Answered step by step

Verified Expert Solution

Question

1 Approved Answer

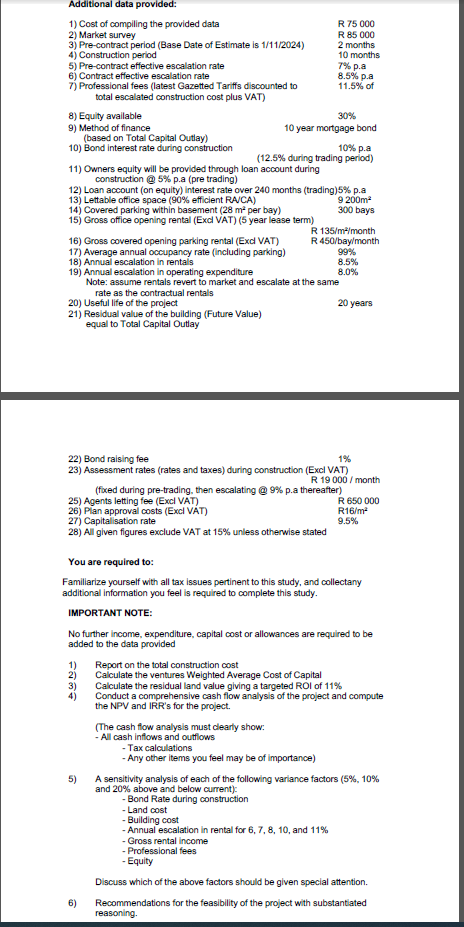

Additional data provided: 1 ) Cost of compiling the provided data 2 ) Market survey 3 ) Pre - contract period ( Base Date of

Additional data provided:

Cost of compiling the provided data

Market survey

Precontract period Base Date of Estimate is

Construction period

Precontract effective escalation rate

Contract effective escalation rate

Professional fees latest Gazetted Tariffs discounted to

total escalated construction cost plus VAT

Equity available

Method of finance based on Total Capital Outlay

Bond interest rate during construction

Owners equity will be provided through loan account during construction & pa pre trading

Loan account on equity interest rate over months trading pa

Lettable office space efficient RACAmathrm~m

Covered parking within basement mathrm~m per bay bays

Gross office opening rental Excl VAT year lease term

mathrmm month

Gross covered opening parking rental Excl VAT

R mathrmm month

R mathrmbay month

Average annual occupancy rate including parking

Annual escalation in rentals

Annual escalation in operating expenditure

Note: assume rentals revert to market and escalate at the same rate as the contractual rentals

Useful life of the project

years

Residual value of the building Future Value equal to Total Capital Outlay

Bond raising fee

Assessment rates rates and taxes during construction Excl VAT R month foxed during pretrading, then escalating & pa thereafter

Agents letting fee Excl VAT

Plan approval costs Excl VAT

Capitalisation rate

All given figures exclude VAT at unless otherwise stated

You are required to:

Familiarize yourself with all tax issues pertinent to this study, and collectany additional information you feel is required to complete this study.

IMPORTANT NOTE:

No further income, expenditure, capital cost or allowances are required to be added to the data provided

Report on the total construction cost

Calculate the ventures Weighted Average Cost of Capital

Calculate the residual land value giving a targeted ROI of

Conduct a comprehensive cash flow analysis of the project and compute the NPV and IRR's for the project.

The cash flow analysis must clearly show:

All cash inflows and outflows

Tax calculations

Any other items you feel may be of importance

A sensitivity analysis of each of the following variance factors and above and below current:

Bond Rate during construction

Land cost

Building cost

Annual escalation in rental for and

Gross rental income

Professional fees

Equity

Discuss which of the above factors should be given special attention.

Recommendations for the feasibility of the project with substantiated reasoning.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started