Answered step by step

Verified Expert Solution

Question

1 Approved Answer

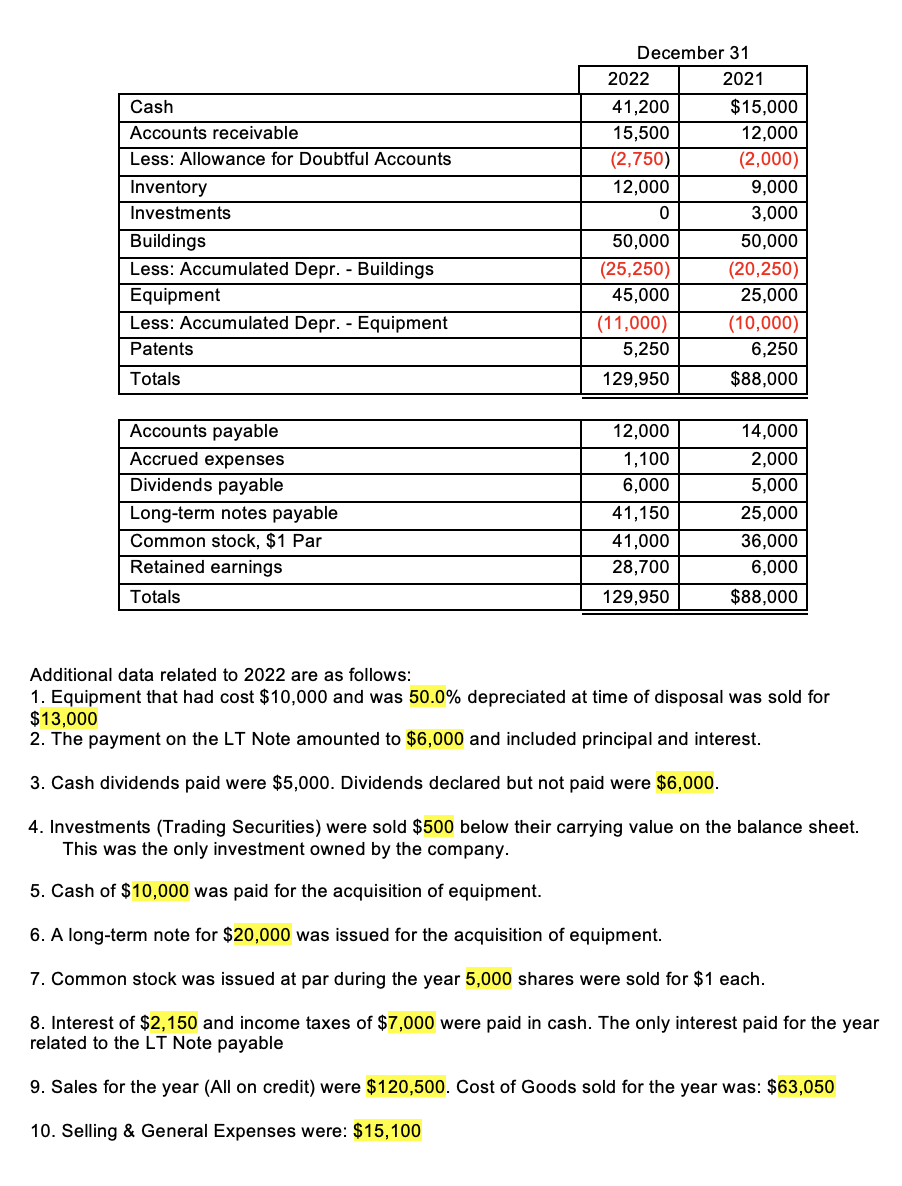

Additional data related to 2022 are as follows: 1. Equipment that had cost $10,000 and was 50.0% depreciated at time of disposal was sold for

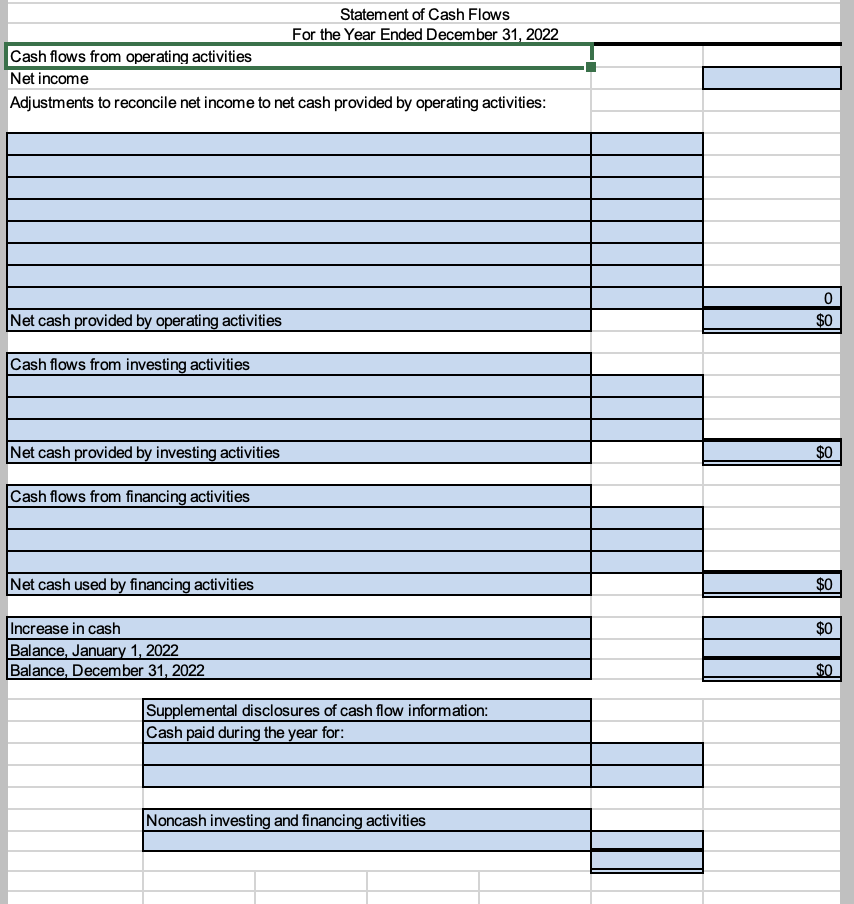

Additional data related to 2022 are as follows: 1. Equipment that had cost $10,000 and was 50.0% depreciated at time of disposal was sold for $13,000 2. The payment on the LT Note amounted to $6,000 and included principal and interest. 3. Cash dividends paid were $5,000. Dividends declared but not paid were $6,000. 4. Investments (Trading Securities) were sold $500 below their carrying value on the balance sheet. This was the only investment owned by the company. 5. Cash of $10,000 was paid for the acquisition of equipment. 6. A long-term note for $20,000 was issued for the acquisition of equipment. 7. Common stock was issued at par during the year 5,000 shares were sold for $1 each. 8. Interest of $2,150 and income taxes of $7,000 were paid in cash. The only interest paid for the year related to the LT Note payable 9. Sales for the year (All on credit) were $120,500. Cost of Goods sold for the year was: $63,050 10. Selling \& General Expenses were: $15,100 Statement of Cash Flows For the Year Ended December 31, 2022 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: \begin{tabular}{|l|l|l|} \hline Cash flows from investing activities & & \\ \hline & & \\ \hline & & \\ \hline Net cash provided by investing activities & & \\ \hline \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline Increase in cash & & \\ \hline Balance, January 1,2022 & & \\ \hline Balance, December 31,2022 & & \\ \hline \hline \end{tabular} \begin{tabular}{|l|l|} \hline Supplemental disclosures of cash flow information: & \\ \hline Cash paid during the year for: & \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Noncash investing and financing activities & \\ \hline & \\ \hline \hline \end{tabular}

Additional data related to 2022 are as follows: 1. Equipment that had cost $10,000 and was 50.0% depreciated at time of disposal was sold for $13,000 2. The payment on the LT Note amounted to $6,000 and included principal and interest. 3. Cash dividends paid were $5,000. Dividends declared but not paid were $6,000. 4. Investments (Trading Securities) were sold $500 below their carrying value on the balance sheet. This was the only investment owned by the company. 5. Cash of $10,000 was paid for the acquisition of equipment. 6. A long-term note for $20,000 was issued for the acquisition of equipment. 7. Common stock was issued at par during the year 5,000 shares were sold for $1 each. 8. Interest of $2,150 and income taxes of $7,000 were paid in cash. The only interest paid for the year related to the LT Note payable 9. Sales for the year (All on credit) were $120,500. Cost of Goods sold for the year was: $63,050 10. Selling \& General Expenses were: $15,100 Statement of Cash Flows For the Year Ended December 31, 2022 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: \begin{tabular}{|l|l|l|} \hline Cash flows from investing activities & & \\ \hline & & \\ \hline & & \\ \hline Net cash provided by investing activities & & \\ \hline \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline Increase in cash & & \\ \hline Balance, January 1,2022 & & \\ \hline Balance, December 31,2022 & & \\ \hline \hline \end{tabular} \begin{tabular}{|l|l|} \hline Supplemental disclosures of cash flow information: & \\ \hline Cash paid during the year for: & \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Noncash investing and financing activities & \\ \hline & \\ \hline \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started