Question

Additional details: Assume that no intra-entity inventory or land sales occurred between Parent and Sub. Instead, on January 1, 2021, Sub sold equipment to Parent

Additional details:

Assume that no intra-entity inventory or land sales occurred between Parent and Sub. Instead, on January 1, 2021, Sub sold equipment to Parent for $71,000 cash. The equipments original cost to Sub was $95,000 and the book value was $65,000 on date of sale. At the time of sale, the equipment had a remaining useful life of five years.

QUESTION

a. Prepare the worksheet entries for a December 31, 2021, consolidation of these two companies to eliminate the impact of the intra-entity transfer.

b. How much of the gain on sale of equipment has been recognized by the consolidated entity as of 12/31/2022?

b. How much of the gain on sale of equipment has been recognized by the consolidated entity as of 12/31/2022?

c. Determine the noncontrolling interests share of Subs net income for the year ended 12/31/2021.

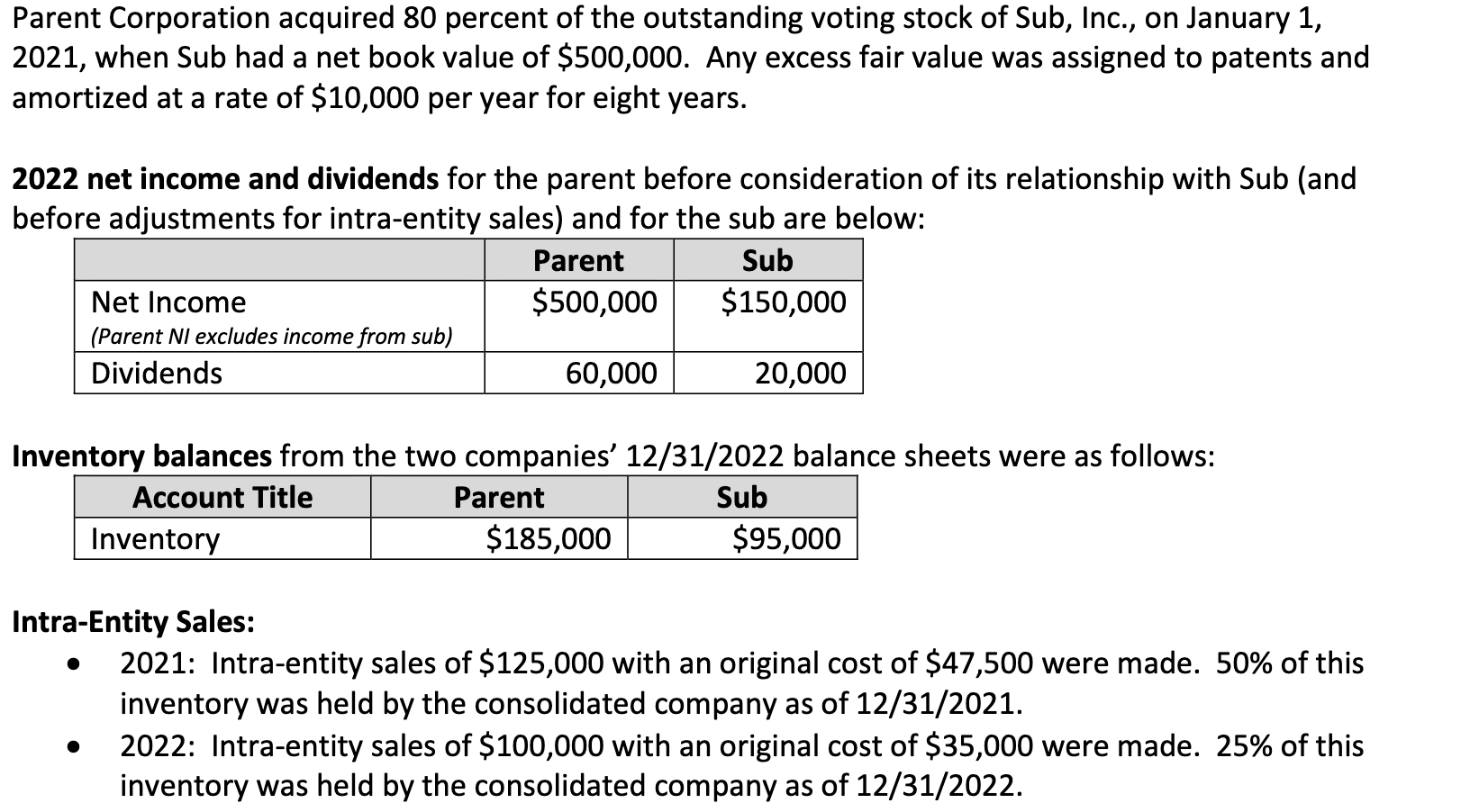

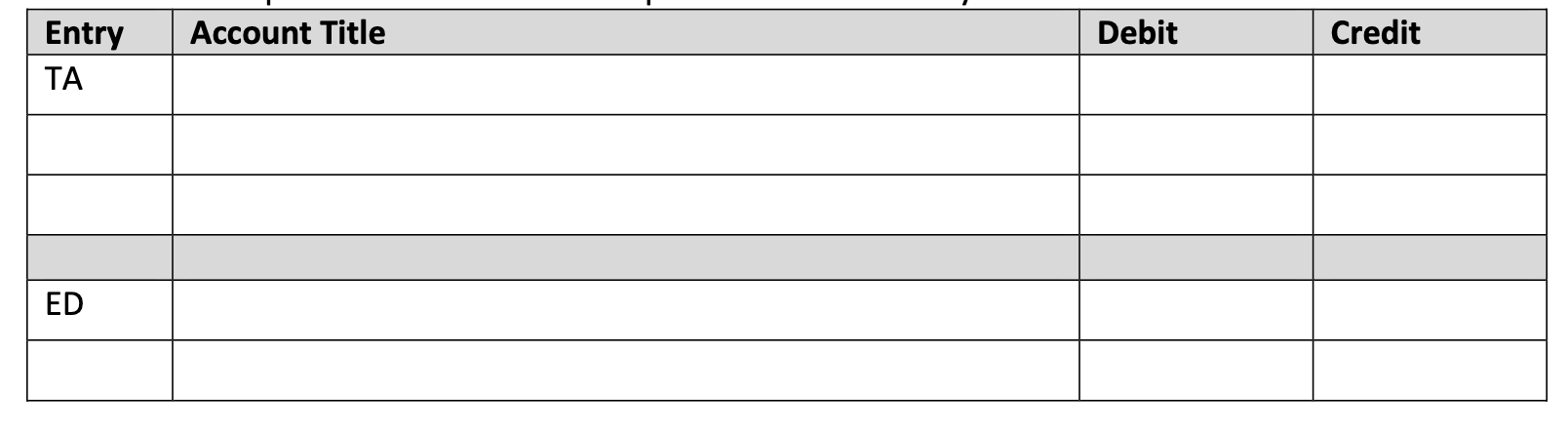

Parent Corporation acquired 80 percent of the outstanding voting stock of Sub, Inc., on January 1 , 2021 , when Sub had a net book value of $500,000. Any excess fair value was assigned to patents and amortized at a rate of $10,000 per year for eight years. 2022 net income and dividends for the parent before consideration of its relationship with Sub (and before adjustments for intra-entity sales) and for the sub are below: Inventory balances from the two companies' 12/31/2022 balance sheets were as follows: Intra-Entity Sales: - 2021: Intra-entity sales of $125,000 with an original cost of $47,500 were made. 50% of this inventory was held by the consolidated company as of 12/31/2021. - 2022: Intra-entity sales of $100,000 with an original cost of $35,000 were made. 25% of this inventory was held by the consolidated company as of 12/31/2022. \begin{tabular}{|l|l|l|l|} \hline Entry & Account Title & Debit & Credit \\ \hline TA & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline ED & & & \\ \hline & & & \\ \hline \end{tabular} Parent Corporation acquired 80 percent of the outstanding voting stock of Sub, Inc., on January 1 , 2021 , when Sub had a net book value of $500,000. Any excess fair value was assigned to patents and amortized at a rate of $10,000 per year for eight years. 2022 net income and dividends for the parent before consideration of its relationship with Sub (and before adjustments for intra-entity sales) and for the sub are below: Inventory balances from the two companies' 12/31/2022 balance sheets were as follows: Intra-Entity Sales: - 2021: Intra-entity sales of $125,000 with an original cost of $47,500 were made. 50% of this inventory was held by the consolidated company as of 12/31/2021. - 2022: Intra-entity sales of $100,000 with an original cost of $35,000 were made. 25% of this inventory was held by the consolidated company as of 12/31/2022. \begin{tabular}{|l|l|l|l|} \hline Entry & Account Title & Debit & Credit \\ \hline TA & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline ED & & & \\ \hline & & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started