Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional information 1. Closing inventory at 31 st December 2019 was OMR 900,000 2. Depreciation will be provided as follows a) On Plant and Machinery

Additional information

1. Closing inventory at 31st December 2019 was OMR 900,000

2. Depreciation will be provided as follows

a) On Plant and Machinery @ 30% reducing balance method

b) On office equipment @ 15% straight line method

3. Both the depreciation will be charged into administration expenses.

4. During the year the company issued 5,000,000 redeemable preference shares of OMR 1 each.

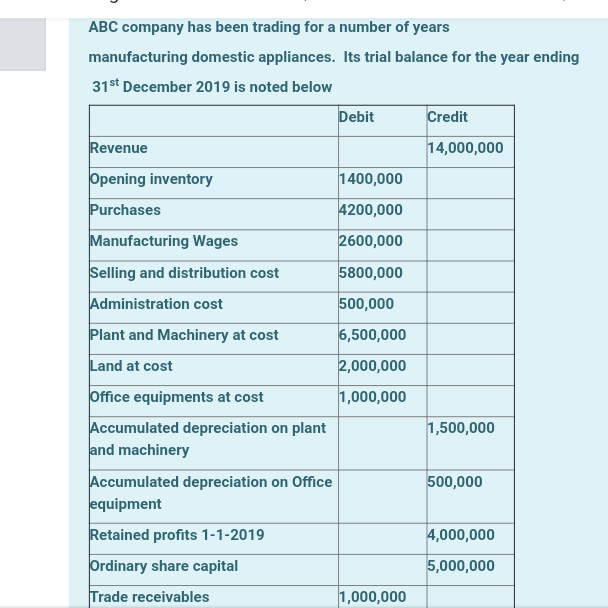

ABC company has been trading for a number of years manufacturing domestic appliances. Its trial balance for the year ending 31st December 2019 is noted below Debit Credit Revenue 14,000,000 Opening inventory 1400,000 Purchases 4200,000 Manufacturing Wages 2600,000 Selling and distribution cost 5800,000 Administration cost 500,000 Plant and Machinery at cost 6,500,000 Land at cost 2,000,000 Office equipments at cost 1,000,000 Accumulated depreciation on plant and machinery Accumulated depreciation on Office equipment Retained profits 1-1-2019 Ordinary share capital 1,500,000 500,000 4,000,000 5,000,000 Trade receivables 1,000,000 ABC company has been trading for a number of years manufacturing domestic appliances. Its trial balance for the year ending 31st December 2019 is noted below Debit Credit Revenue 14,000,000 Opening inventory 1400,000 Purchases 4200,000 Manufacturing Wages 2600,000 Selling and distribution cost 5800,000 Administration cost 500,000 Plant and Machinery at cost 6,500,000 Land at cost 2,000,000 Office equipments at cost 1,000,000 Accumulated depreciation on plant and machinery Accumulated depreciation on Office equipment Retained profits 1-1-2019 Ordinary share capital 1,500,000 500,000 4,000,000 5,000,000 Trade receivables 1,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started