Question

Additional information 1. Deep Limited acquired its holding in Yellow Limited on 30 June 2014 when the balances in the books of Yellow Ltd were

Additional information 1. Deep Limited acquired its holding in Yellow Limited on 30 June 2014 when the balances in the books of Yellow Ltd were as follows: N$ Issued capital 4 000 Non-current replacement reserve 6 000 Retained earnings 20 000 2. On 01 July 2018, Deep Ltd sold a machine with a carrying amount of N$1 000 to Yellow Ltd for N$6 000. The group provides for depreciation on machinery at 20% per annum on the reducing balance method. 3. The group mutually invoices inventory. The following is applicable: Sales of inventory (for the year) by Deep Ltd to: Yellow Ltd N$60 000 Wholesalers 500 000 Sales of inventory (for the year) by Yellow Ltd to: Deep Ltd N$80 000 Wholesalers 600 000 Inter-company sales take place at 20% on cost. No inter-company inventory was at hand at the beginning of the year. The following inter-company inventory was at hand on 31 December 2018 Deep Ltd purchased from Yellow Ltd N$5 000 Yellow Ltd purchased from Deep Ltd 10 000 4. Normal tax should be provided as follows: Deep Ltd N$8 000 Yellow Ltd 2 000 5. Assume a tax rate of 50% 6. Goodwill should be amortised over a period od 5 years. You are required to prepare:

(a) The consolidated statement of financial position of Deep Ltd and its subsidiary for the year ended 31 December 2018. (b) The consolidated statement of profit or loss for the year ended 31 December 2018. (c) The consolidated statement of changes in equity for the year ended 31 December 2018.

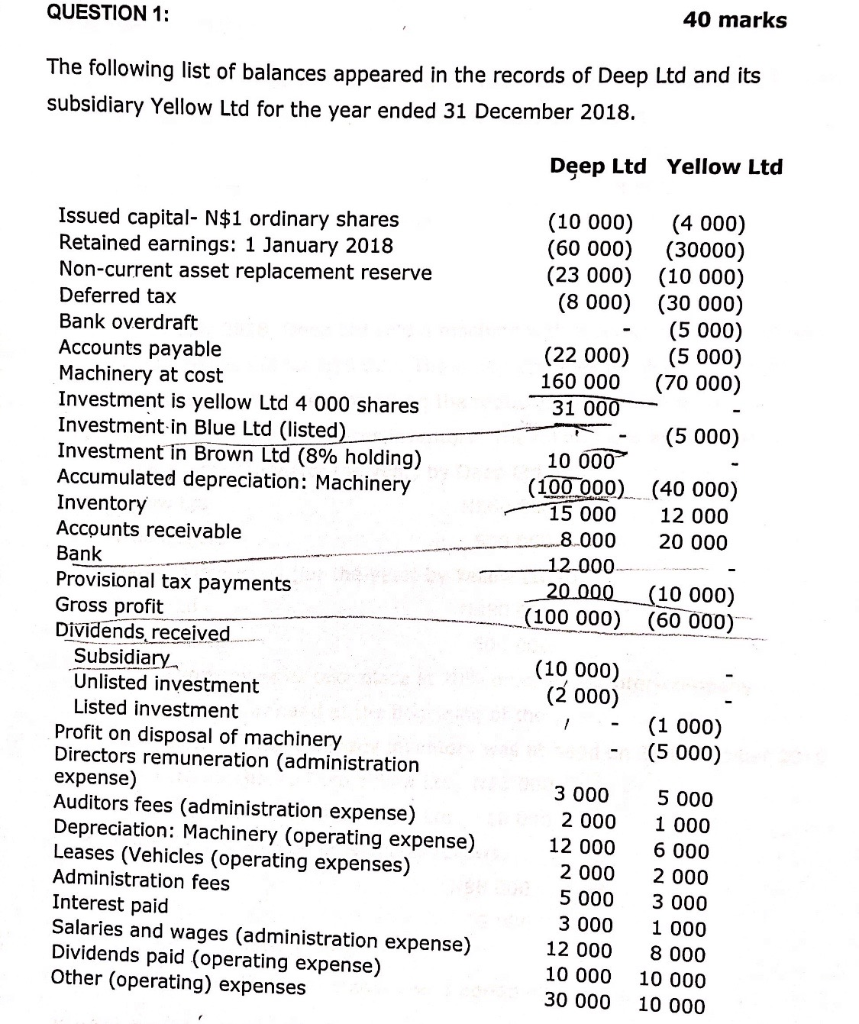

40 marks QUESTION 1: The following list of balances appeared in the records of Deep Ltd and its subsidiary Yellow Ltd for the year ended 31 December 2018. Deep Ltd Yellow Ltd (4 000) (30000) (23 000) (10 000) (8 000) (30 000) (5 000) (5 000) (70 000) (10 000) (60 000) Issued capital- N$1 ordinary shares Retained earnings: 1 January 2018 Non-current asset replacement reserve Deferred tax Bank overdraft (22 000) 160 000 31 000 Accounts payable Machinery at cost Investment is yellow Ltd 4 000 shares Investment in Blue Ltd (listed) Investment in Brown Ltd (8% holding) Accumulated depreciation: Machinery Inventory Accounts receivable Bank Provisional tax payments Gross profit DIvidends received. Subsidiary Unlisted investment (5 000) 10 000 (100 000) (40 000) 15 000 12 000 20 000 8.000 12-000 20.000 (10 000) (60 000) (100 000) (10 000) (2 000) Listed investment (1 000) (5 000) Profit on disposal of machinery Directors remuneration (administration expense) Auditors fees (administration expense) Depreciation: Machinery (operating expense) Leases (Vehicles (operating expenses) Administration fees Interest paid Salaries and wages (administration expense) Dividends paid (operating expense) Other (operating) expenses 3 000 5 000 2 000 1 000 12 000 6 000 2 000 2 000 BA 5 000 3 000 3 000 1 000 12 000 8 000 10 000 10 000 30 000 10 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started