Question

Additional Information: (1) Land and buildings were revalued by the directors on 31 December 20x0 based on an independent valuation performed by I. Countit (a

Additional Information:

(1) Land and buildings were revalued by the directors on 31 December 20x0 based on an independent valuation performed by I. Countit (a member of the Australian Institute of Valuers) on 12 December, 20x0. This resulted in $140,000 being recorded in the Asset Revaluation Reserve during the year.

The Asset Revaluation Reserve balance at 1 July 20x0 was nil.

(2) Investments consist of 20,000 shares in a listed public company with a market value of $35,000 at the Balance Date. These shares were purchased on July 1 20x0 at a cost of $25,000. Note: the Trial Balance currently shows the investments at historical cost. They are considered to be available for sale but not intended to be sold before 20x5. In accordance with accounting standards - the shares are to be listed in the accounts at market value. The Gain (net of tax) will be recorded in the Available-for-Sale Investment Revaluation Reserve. Tax rate is 30%. The tax applicable to the gain is expected to be payable in the future when the gain is realised.

The Available-for-Sale Investment Revaluation Reserve balance at 1 July 20x0 was nil

(3) The loan from the finance company was received on the 31st March 20x1 and $20,000 is to be repaid in the next 12 months the balance being due for repayment after that date. The Finance Company loan is secured by a registered mortgage over the companys land & buildings.

(4) Anticipated liability for long service leave payable within the next twelve months is $10,000

(5) During the year $3,000 was transferred to the general reserve from retained earnings. The General Reserve balance at 1 July 20x0 was $12,000

(6) Challenge Ltd has a law suit pending against it with damages estimated at $300,000. The case is due to be heard in January 20x2 and the outcome is uncertain at the present time.

(7) A contract for $500,000 has been signed for the extension of the operating plant. The work is to commence October 20x1 with $50,000 payable in November 20x1 and the balance $450,000 payable in April 20x2.

(8) Inventory comprises all Finished Goods (i.e. there is no Raw materials or Work in Progress inventories)

(9) Net Profit after tax for the Period $20,000. The Retained Earnings balance at 1 July 20x0 was $15,000

(10) As per AASB 112 the Deferred Tax Asset is to be offset against the Deferred Tax Liability with the offset shown in the Notes

REQUIRED:

Prepare the balance sheet and accompanying notes for the year ended 30 June 20x1.

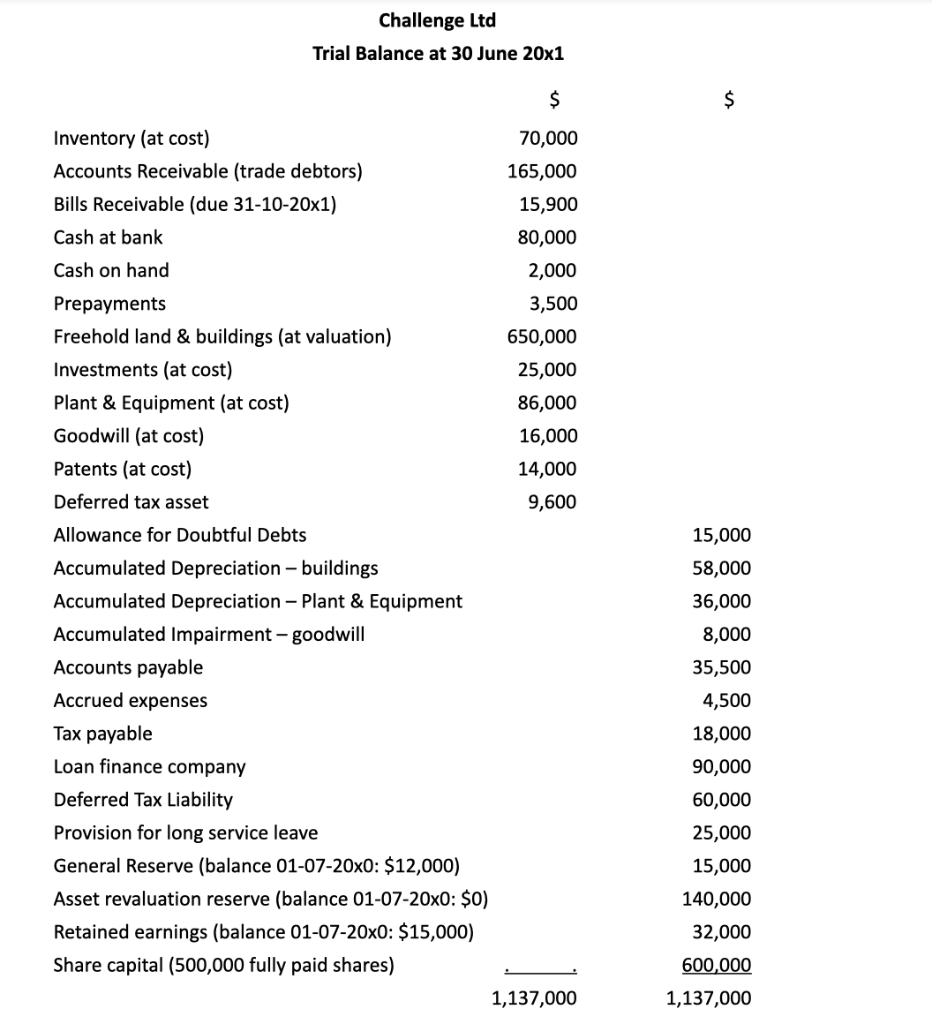

Challenge Ltd Trial Balance at 30 June 20x1 Inventory (at cost) Accounts Receivable (trade debtors) Bills Receivable (due 31-10-20x1) Cash at bank Cash on hand Prepayments Freehold land & buildings (at valuation) Investments (at cost) Plant & Equipment (at cost) Goodwill (at cost) Patents (at cost) Deferred tax asset Allowance for Doubtful Debts Accumulated Depreciation - buildings Accumulated Depreciation Plant & Equipment Accumulated Impairment-goodwill Accounts payable Accrued expenses Tax payable Loan finance company Deferred Tax Liability Provision for long service leave General Reserve (balance 01-07-20x0: $12,000) Asset revaluation reserve (balance 01-07-20x0: $0) Retained earnings (balance 01-07-20x0: $15,000) Share capital (500,000 fully paid shares) 70,000 165,000 15,900 80,000 2,000 3,500 650,000 25,000 86,000 16,000 14,000 9,600 15,000 58,000 36,000 8,000 35,500 4,500 18,000 90,000 60,000 25,000 15,000 140,000 32,000 600,000 1,137,000 1,137,000 Challenge Ltd Trial Balance at 30 June 20x1 Inventory (at cost) Accounts Receivable (trade debtors) Bills Receivable (due 31-10-20x1) Cash at bank Cash on hand Prepayments Freehold land & buildings (at valuation) Investments (at cost) Plant & Equipment (at cost) Goodwill (at cost) Patents (at cost) Deferred tax asset Allowance for Doubtful Debts Accumulated Depreciation - buildings Accumulated Depreciation Plant & Equipment Accumulated Impairment-goodwill Accounts payable Accrued expenses Tax payable Loan finance company Deferred Tax Liability Provision for long service leave General Reserve (balance 01-07-20x0: $12,000) Asset revaluation reserve (balance 01-07-20x0: $0) Retained earnings (balance 01-07-20x0: $15,000) Share capital (500,000 fully paid shares) 70,000 165,000 15,900 80,000 2,000 3,500 650,000 25,000 86,000 16,000 14,000 9,600 15,000 58,000 36,000 8,000 35,500 4,500 18,000 90,000 60,000 25,000 15,000 140,000 32,000 600,000 1,137,000 1,137,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started