Answered step by step

Verified Expert Solution

Question

1 Approved Answer

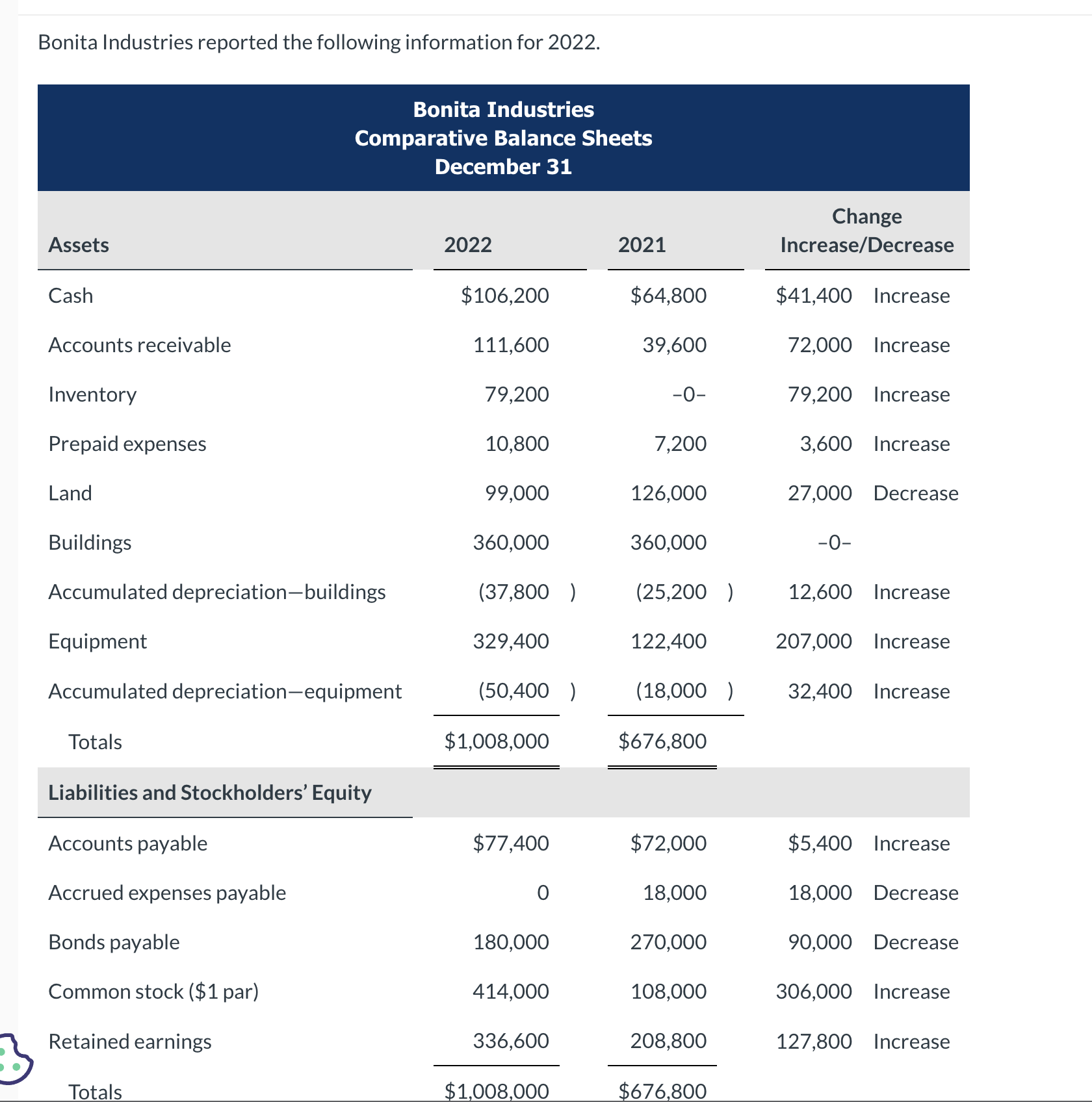

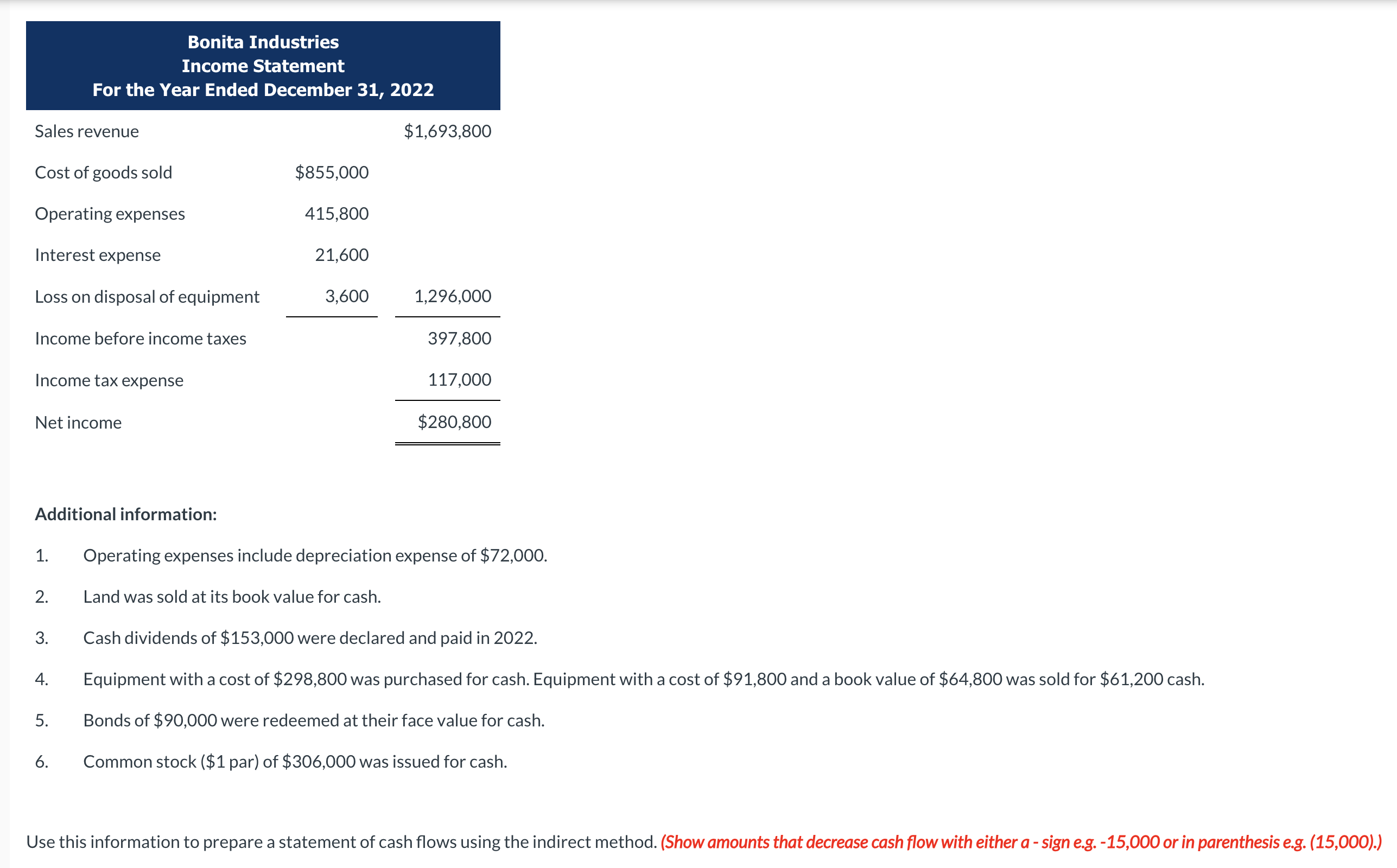

Additional information: 1. Operating expenses include depreciation expense of $72,000. 2. Land was sold at its book value for cash. 3. Cash dividends of $153,000

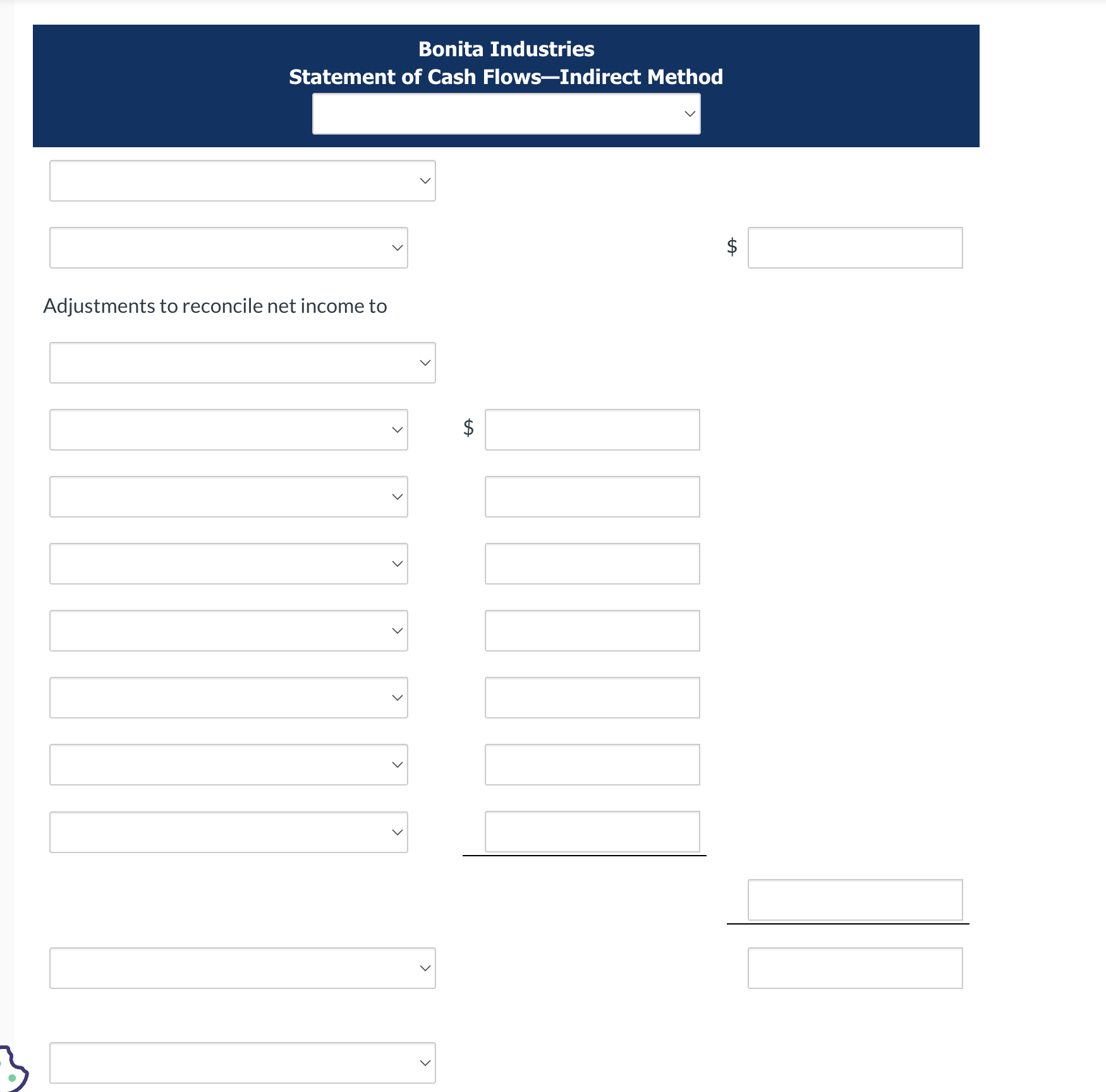

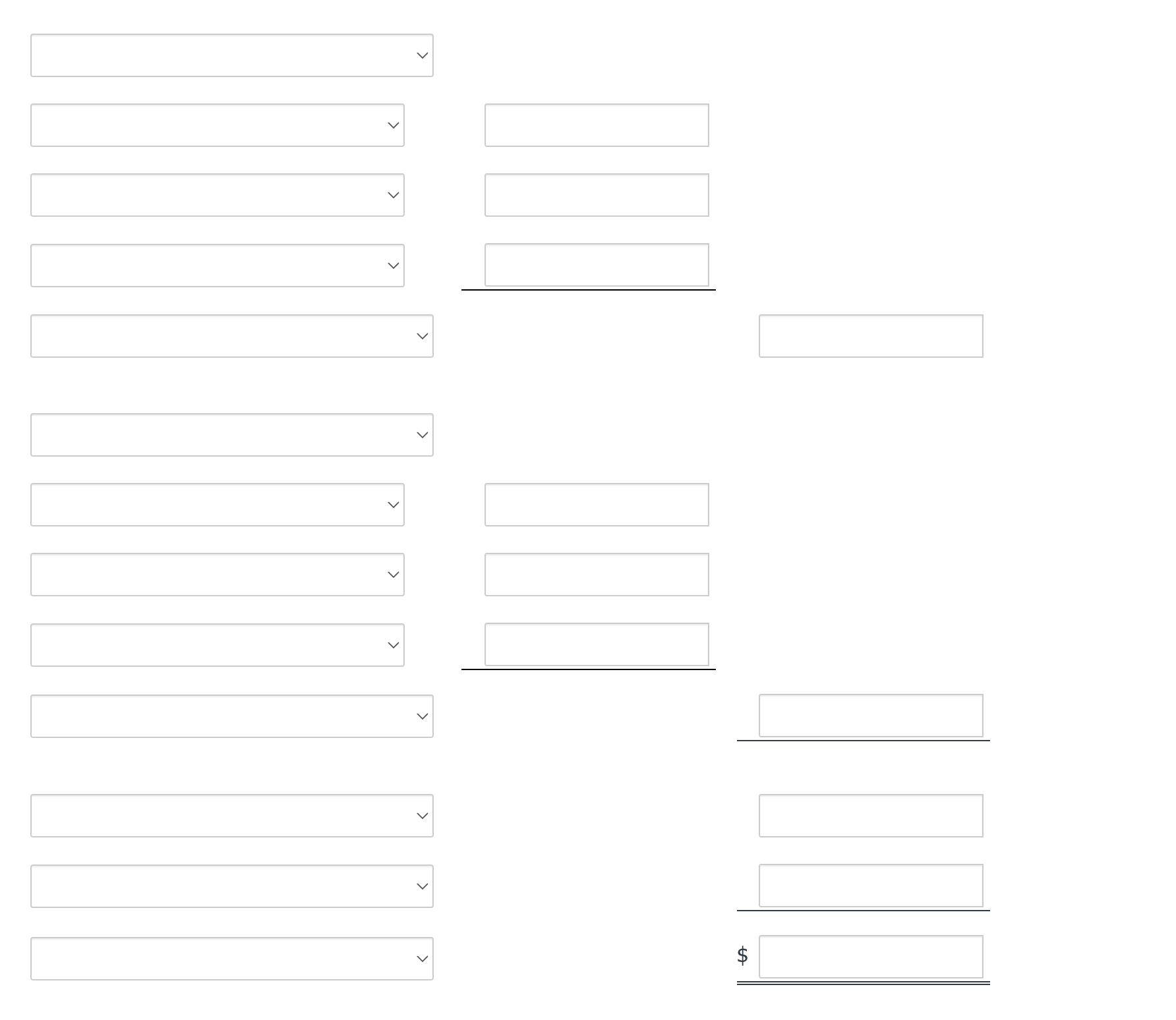

Additional information: 1. Operating expenses include depreciation expense of $72,000. 2. Land was sold at its book value for cash. 3. Cash dividends of $153,000 were declared and paid in 2022. 4. Equipment with a cost of $298,800 was purchased for cash. Equipment with a cost of $91,800 and a book value of $64,800 was sold for $61,200 cash. 5. Bonds of $90,000 were redeemed at their face value for cash. 6. Common stock ( $1 par) of $306,000 was issued for cash. Use this information to prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e. Bonita Industries Statement of Cash Flows-Indirect Method $ Adjustments to reconcile net income to $ ^ ^ ^ ^ ^

Additional information: 1. Operating expenses include depreciation expense of $72,000. 2. Land was sold at its book value for cash. 3. Cash dividends of $153,000 were declared and paid in 2022. 4. Equipment with a cost of $298,800 was purchased for cash. Equipment with a cost of $91,800 and a book value of $64,800 was sold for $61,200 cash. 5. Bonds of $90,000 were redeemed at their face value for cash. 6. Common stock ( $1 par) of $306,000 was issued for cash. Use this information to prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e. Bonita Industries Statement of Cash Flows-Indirect Method $ Adjustments to reconcile net income to $ ^ ^ ^ ^ ^ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started