Question

ADDITIONAL INFORMATION 1. Pen Corporation acquired 13,500 shares of Syn Company stock for $15 per share on January 1, 2011, when Syns stockholders equity consisted

ADDITIONAL INFORMATION 1. Pen Corporation acquired 13,500 shares of Syn Company stock for $15 per share on January 1, 2011, when Syns stockholders equity consisted of $150,000 capital stock and $15,000 retained earnings. 2. Syn Companys land was undervalued when Pen acquired its interest, and accordingly, $20,000 of the fair value/book value differential was assigned to land. Any remaining differential is assigned to unrecorded patents with a 10-year remaining life. 3. Syn Company owes Pen $5,000 on account, and Pen owes Syn $5,000 on a note payable.

REQUIRED: Prepare consolidated workpapers for Pen Corporation and Subsidiary for the year ended December 31,2012.

Prepare all necessay entries.

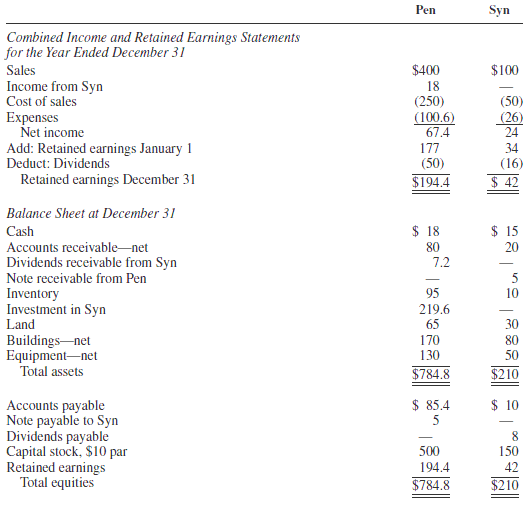

Pen Combined Income and Retained Earnings Statements for the Year Ended December 3l Sales Income from Syn Cost of sales Expenses $100 18 (250) (50) 100.6 (26 34 (16 $194.4 S42 Net income 67.4 Add: Retained earnings January1 Deduct: Dividends (50) Retained earnings December 31 Balance Sheet at December 31 Cash Accounts receivable-net Dividends receivable from Syn Note receivable from Pen Inventory Investment in Syn Land Buildings-net Equipment net $ 18 80 $ 15 20 95 219.6 10 30 50 170 130 $784.8 Total assets $210 $85.4 Accounts payable Note payable to Syn Dividends payable 150 42 $210 Capital stock, $10 par Retained earnings Total equities 500 194.4 $784.8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started