Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional Information 1) Stock at the end of the years was as follows. 2) It is company policy not to depreciate land and buildings and

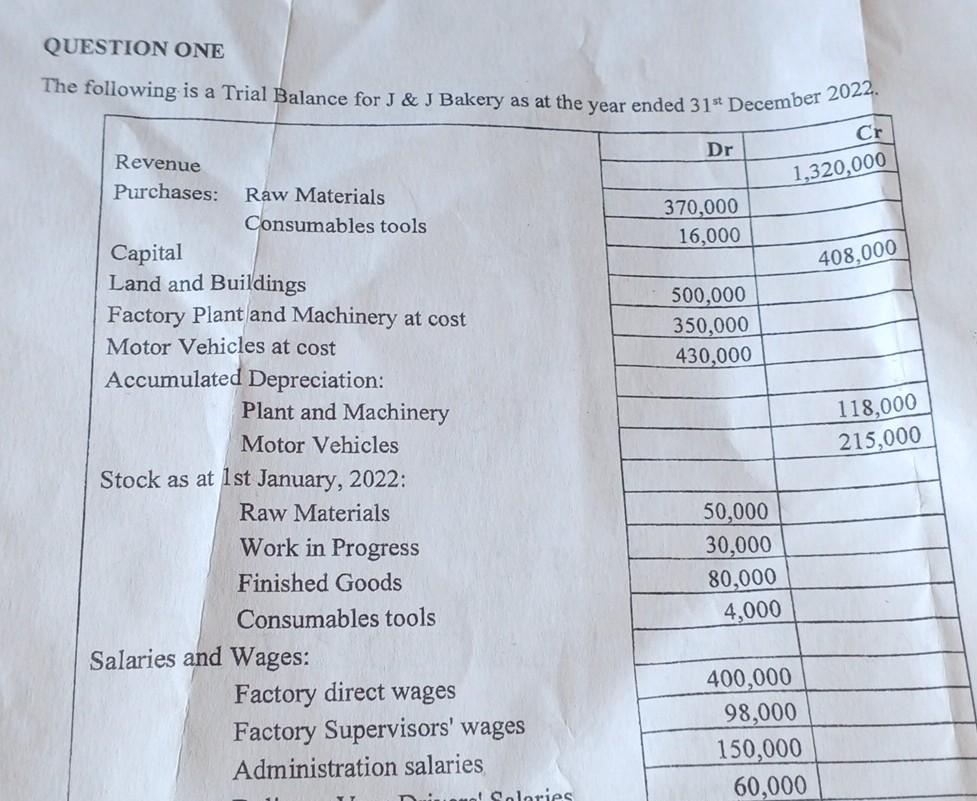

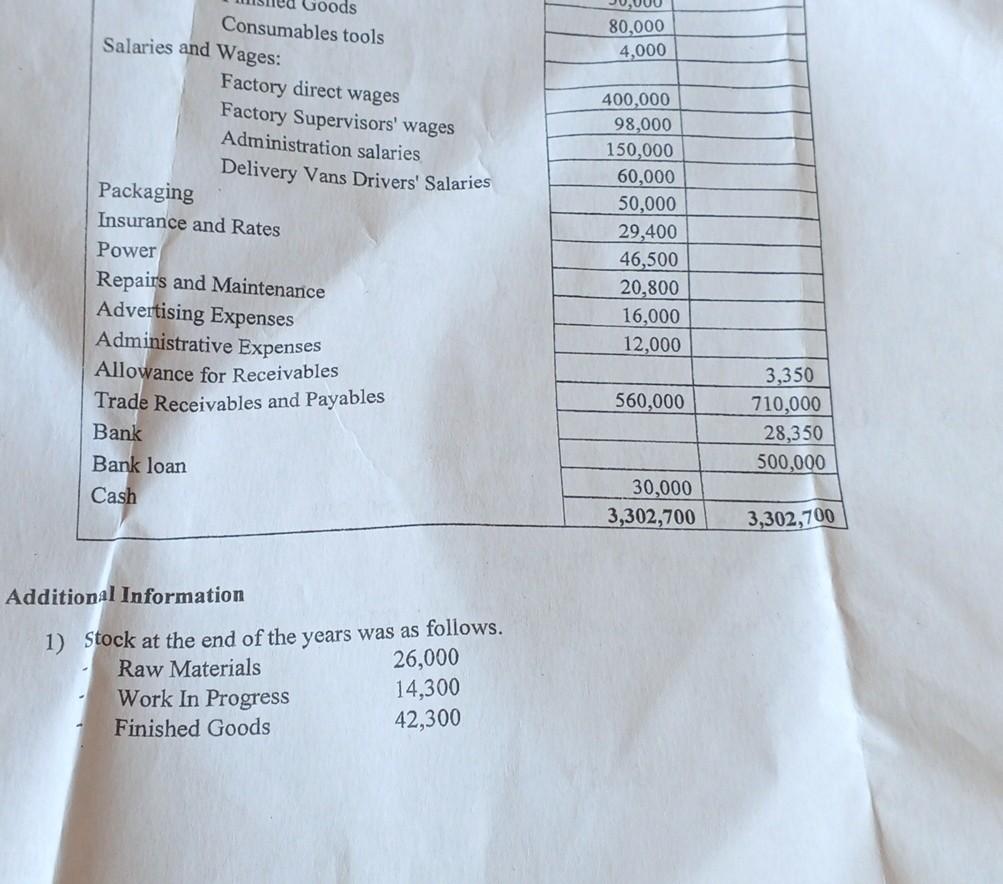

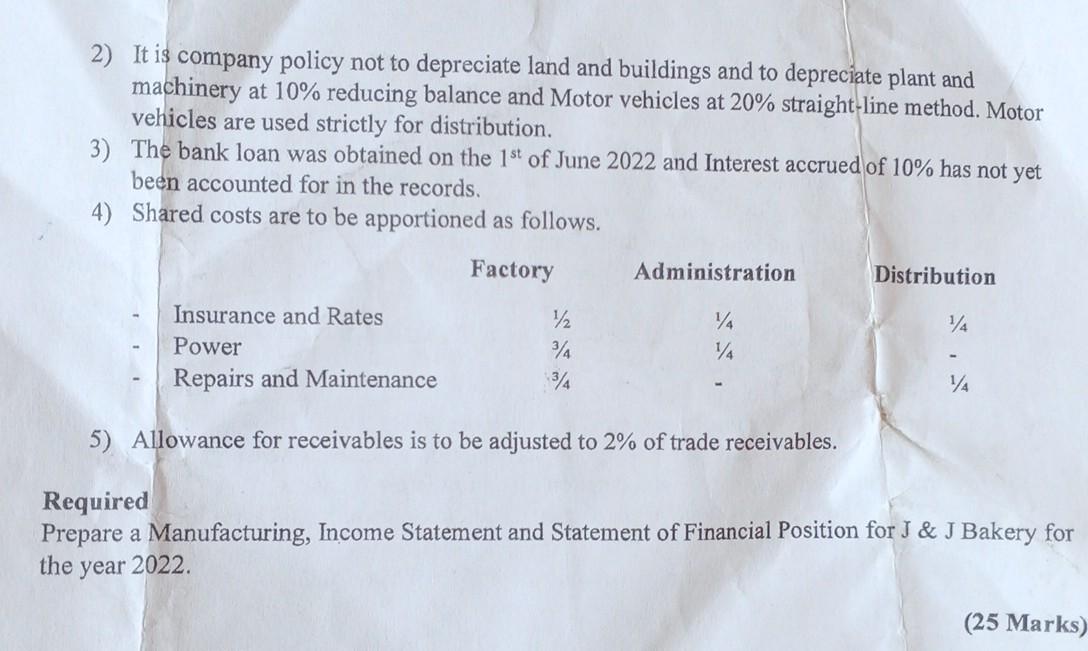

Additional Information 1) Stock at the end of the years was as follows. 2) It is company policy not to depreciate land and buildings and to depreciate plant and machinery at 10\% reducing balance and Motor vehicles at 20% straight-line method. Motor vehicles are used strictly for distribution. 3) The bank loan was obtained on the 1st of June 2022 and Interest accrued of 10% has not yet been accounted for in the records. 4) Shared costs are to be apportioned as follows. 5) Allowance for receivables is to be adjusted to 2% of trade receivables. Required Prepare a Manufacturing, Income Statement and Statement of Financial Position for J \& J Bakery for the year 2022 . The following is a Trial Balance for I \& I Rakerv ac at the Additional Information 1) Stock at the end of the years was as follows. 2) It is company policy not to depreciate land and buildings and to depreciate plant and machinery at 10\% reducing balance and Motor vehicles at 20% straight-line method. Motor vehicles are used strictly for distribution. 3) The bank loan was obtained on the 1st of June 2022 and Interest accrued of 10% has not yet been accounted for in the records. 4) Shared costs are to be apportioned as follows. 5) Allowance for receivables is to be adjusted to 2% of trade receivables. Required Prepare a Manufacturing, Income Statement and Statement of Financial Position for J \& J Bakery for the year 2022 . The following is a Trial Balance for I \& I Rakerv ac at the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started