Question

Additional information: 1. The inventories as at 30 April 2021 had been valued at cost of RM750,000. However, 20% of these inventories were obsolete, with

Additional information:

1. The inventories as at 30 April 2021 had been valued at cost of RM750,000. However, 20% of these inventories were obsolete, with the net realisable value estimated at RM120,000.

2. The company depreciates its equipment at 10% on cost and motor van at 20% per annum using the reducing balance method. Both depreciation charges are to be treated as Administrative expenses.

3. A piece of land was acquired during the year for RM200,000 and this amount had been included in the purchases amount.

4. The Development costs of RM200,000 are to be amortised over 4 years, and the amortisation charge is to be recognised as Administrative expenses.

5. An amount of RM70,000 owing by a customer had been deemed to be uncollectible. Allowance for doubtful debts is to be adjusted at 4% of the remaining receivables after deducting bad debts. It is the companys policy to treat bad debts and allowance for doubtful debts as Distribution costs.

6. Both interest on debenture and dividend for redeemable preference shares for the year have not been recorded in the book as at 30 April 2021. Dividend for redeemable preference shares is to be classified as the Finance costs.

7. The estimated tax expense for the year ended 30 April 2021 is RM160,000.

Required:

Prepare the statement of profit or loss (by function) for Bestari Bhd. for the year ended 30 April 2021. Cost of sales, administrative expenses, distribution costs and finance costs to be prepared as part of your workings. (11 marks)

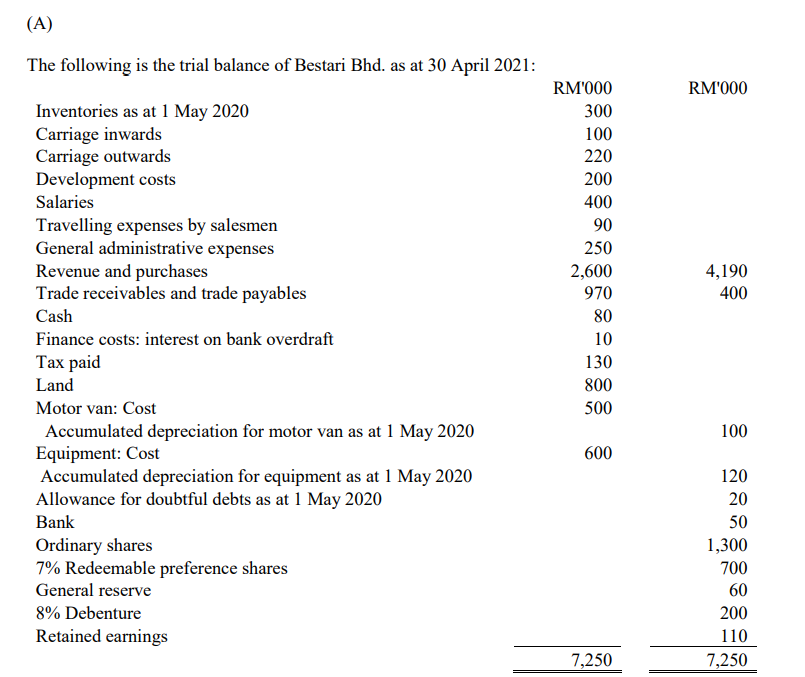

(A) The following is the trial balance of Bestari Bhd. as at 30 April 2021: RM'000 RM'000 300 100 220 200 400 90 250 2,600 970 80 4,190 400 10 Inventories as at 1 May 2020 Carriage inwards Carriage outwards Development costs Salaries Travelling expenses by salesmen General administrative expenses Revenue and purchases Trade receivables and trade payables Cash Finance costs: interest on bank overdraft Tax paid Land Motor van: Cost Accumulated depreciation for motor van as at 1 May 2020 Equipment: Cost Accumulated depreciation for equipment as at 1 May 2020 Allowance for doubtful debts as at 1 May 2020 Bank Ordinary shares 7% Redeemable preference shares General reserve 8% Debenture Retained earnings 130 800 500 100 600 120 20 50 1,300 700 60 200 110 7,250 7,250Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started