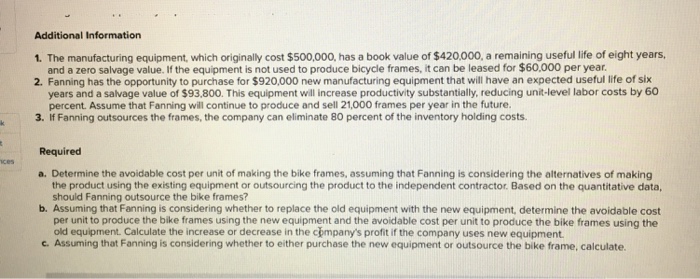

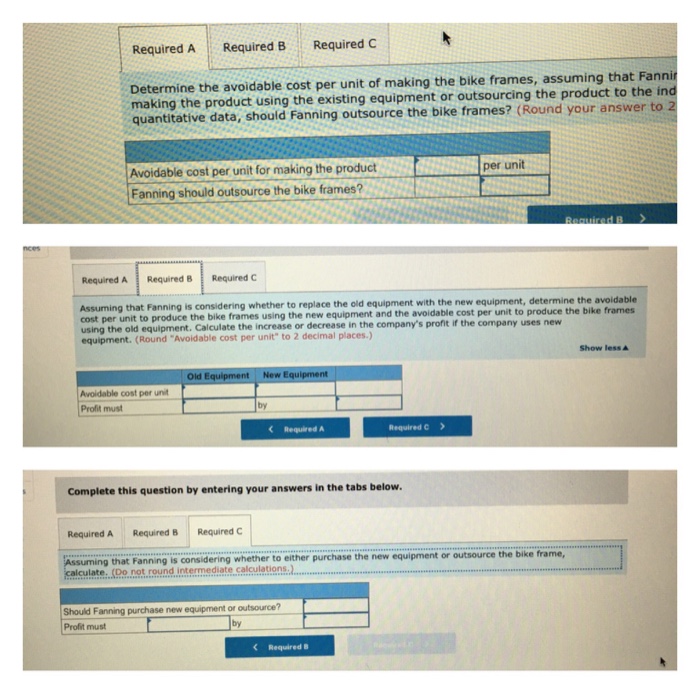

Additional Information 1. The manufacturing equipment, which originally cost $500,000, has a book value of $420,000, a remaining useful life of eight years and a zero salvage value. If the equipment is not used to produce bicycle frames, it can be leased for $60,000 per year 2. Fanning has the opportunity to purchase for $920,000 new manufacturing equipment that will have an expected useful life of six years and a salvage value of $93,800. This equipment will increase productivity substantially, reducing unit-level labor costs by 60 percent. Assume that Fanning will continue to produce and sell 21,000 frames per year in the future. 3. If Fanning outsources the frames, the company can eliminate 80 percent of the inventory holding costs Required a. Determine the avoidable cost per unit of making the bike frames, assuming that Fanning is considering the alternatives of making b. Assuming that Fanning is considering whether to replace the old equipment with the new equipment, determine the avoidable cost c. Assuming that Fanning is considering whether to either purchase the new equipment or outsource the bike frame, calculate. ices the product using the existing equipment or outsourcing the product to the independent contractor. Based on the quantitative data, should Fanning outsource the bike frames? per unit to produce the bike frames using the new equipment and the avoidable cost per unit to produce the bike frames using the old equipment. Calculate the increase or decrease in the company's profit if the company uses new equipment Additional Information 1. The manufacturing equipment, which originally cost $500,000, has a book value of $420,000, a remaining useful life of eight years and a zero salvage value. If the equipment is not used to produce bicycle frames, it can be leased for $60,000 per year 2. Fanning has the opportunity to purchase for $920,000 new manufacturing equipment that will have an expected useful life of six years and a salvage value of $93,800. This equipment will increase productivity substantially, reducing unit-level labor costs by 60 percent. Assume that Fanning will continue to produce and sell 21,000 frames per year in the future. 3. If Fanning outsources the frames, the company can eliminate 80 percent of the inventory holding costs Required a. Determine the avoidable cost per unit of making the bike frames, assuming that Fanning is considering the alternatives of making b. Assuming that Fanning is considering whether to replace the old equipment with the new equipment, determine the avoidable cost c. Assuming that Fanning is considering whether to either purchase the new equipment or outsource the bike frame, calculate. ices the product using the existing equipment or outsourcing the product to the independent contractor. Based on the quantitative data, should Fanning outsource the bike frames? per unit to produce the bike frames using the new equipment and the avoidable cost per unit to produce the bike frames using the old equipment. Calculate the increase or decrease in the company's profit if the company uses new equipment