Question

Additional information: a) On 1 July 2014, A Ltd acquired 75% of the contributed equity of Z Ltd. At that date the equity of Z

Additional information:

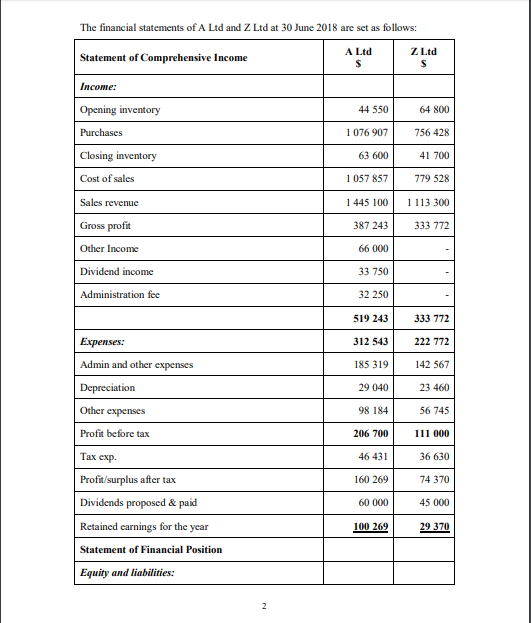

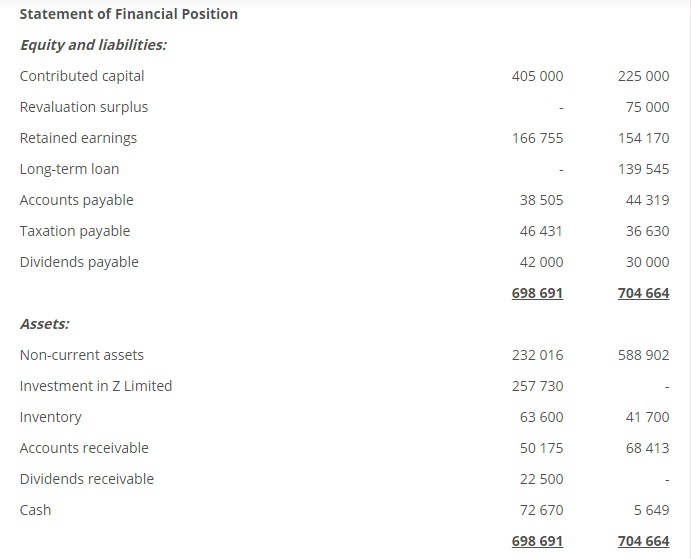

a) On 1 July 2014, A Ltd acquired 75% of the contributed equity of Z Ltd. At that date the equity of Z Ltd comprised: Contributed equity $225 000 Retained earnings $55 140 Revaluation reserve $43 500

b) At the time acquisition, all assets were considered to be fairly valued.

c) During the year, Z Ltd made sales to A Ltd amounting to $126 750; Z Ltd had always sold goods to A Ltd at a mark-up of 25% on cost.

d) Inventory at 30 June 2018 was as follows: A Ltd $63 600 Z Ltd $41 700

e) Of the inventory A Ltd had on hand at 30 June 2017, $18 900 was purchased from Z Ltd.

f) Of the inventory A Ltd had on hand at 30 June 2018, $23 100 was purchased from Z Ltd.

g) Z Ltds administrative expenses include $32 250 paid to A Ltd for providing management and administrative service for the year.

h) On 30 June 2018, the directors decided that goodwill arising on the acquisition on A Ltd had been impaired by 40%.

i) On 30 June 2018, a final dividend amounting to $42 000 was provided by A Ltd, while $30 000 was provided by Z Ltd, and the decision to pay the dividend communicated to shareholders on that date. A Ltd has recognised its share of the dividend receivable from Z Ltd in its financial statements on 30 June 2018.

j) Tax is charged at a rate of 40%.

Required: (a) Complete the acquisition analysis on 1 July 2014 for A Ltds investment in Z Ltd as required by AASB3 and AASB10 and determine the amount of goodwill or gain on bargain purchase following the partial/proportional goodwill method.

(b) Prepare the acquisition journal entries on 1 July 2014.

(c) Prepare all consolidated journal entries including non-controlling interest and their posting to consolidated worksheet for the year ended 30 June 2018 for consolidation purpose of A Ltd and Z Ltd.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started