Question

Additional Information: a) On 1 July 2017, the owner injected an additional $14,000 cash into the business. b) During the year, equipment costing $12,000 and

Additional Information:

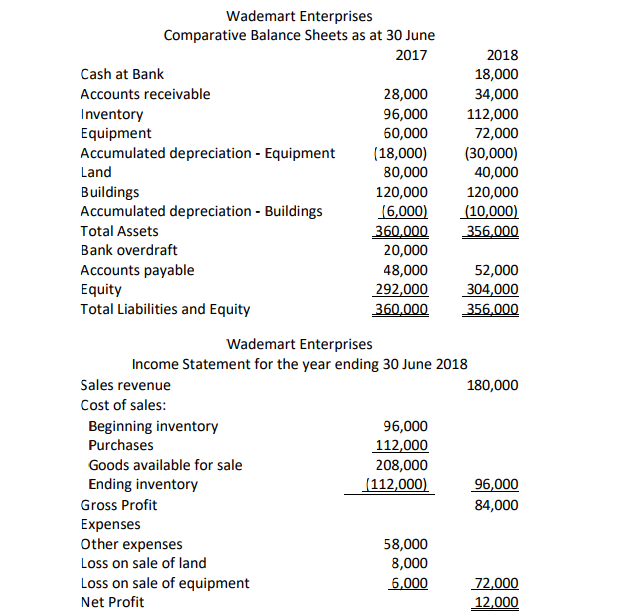

a) On 1 July 2017, the owner injected an additional $14,000 cash into the business.

b) During the year, equipment costing $12,000 and written down to a carrying value of $10,000 was sold for $4,000 cash.

c) Half of the land on hand at the beginning of the year was sold for $32,000 cash.

d) Dividends were paid in cash during the year.

e) Depreciation expense for equipment and buildings have been included in the other expenses. All expenses other than depreciation were paid in cash.

Required: Prepare a Statement of Cash Flows for Wademart Enterprises at the 30 June 2018 using the direct method.

Wademart Enterprises Comparative Balance Sheets as at 30 June 2018 18,000 34,000 112,000 72,000 (30,000) 40,000 120,000 (6,000)(10,000) 2017 Cash at Bank Accounts receivable Inventory Equipment Accumulated depreciation - Equipment Land Buildings Accumulated depreciation Buildings Total Assets Bank overdraft Accounts payable Equity Total Liabilities and Equity 28,000 96,000 50,000 18,000 80,000 120,000 20,000 48,000 292,000 52,000 304,000 Wademart Enterprises Income Statement for the year ending 30 June 2018 Sales revenue Cost of sales 180,000 96,000 112,000 208,000 Beginning inventory Purchases Goods available for sale 112,000)96,000 84,000 Ending inventory Gross Profit Expenses Other expenses Loss on sale of land Loss on sale of equipment Net Profit 58,000 8,000 6,000 72,000 12Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started