Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional information: a. The entity uses a single account for its direct material and indirect materials. Indirect material is one fourth of the total

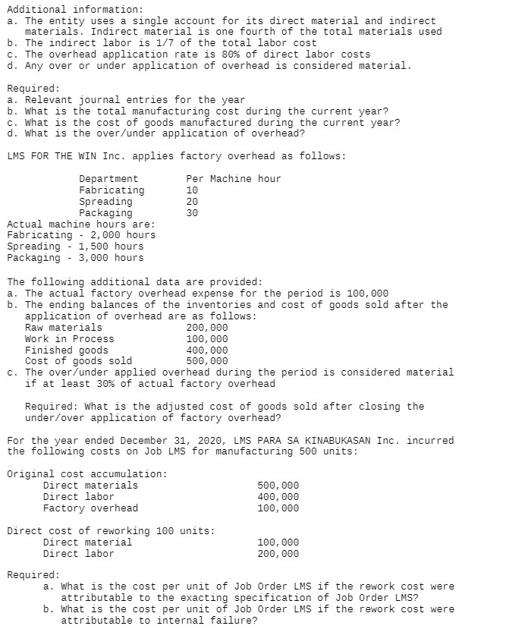

Additional information: a. The entity uses a single account for its direct material and indirect materials. Indirect material is one fourth of the total materials used b. The indirect labor is 1/7 of the total labor cost c. The overhead application rate is 80% of direct labor costs d. Any over or under application of overhead is considered material. Required: a. Relevant journal entries for the year b. What is the total manufacturing cost during the current year? c. What is the cost of goods manufactured during the current year? d. What is the over/under application of overhead? LMS FOR THE WIN Inc. applies factory overhead as follows: Per Machine hour Department Fabricating 10 Spreading Packaging Actual machine hours are: Fabricating 2,000 hours Spreading 1,500 hours Packaging 3,000 hours 20 30 The following additional data are provided: a. The actual factory overhead expense for the period is 100,000 b. The ending balances of the inventories and cost of goods sold after the application of overhead are as follows: Raw materials Work in Process Finished goods Cost of goods sold c. The over/under applied overhead during the period is considered material if at least 30% of actual factory overhead 200,000 100,000 Original cost accumulation: Direct materials Direct labor Factory overhead 400,000 500,000 Required: What is the adjusted cost of goods sold after closing the under/over application of factory overhead? For the year ended December 31, 2020, LMS PARA SA KINABUKASAN Inc. incurred the following costs on Job LMS for manufacturing 500 units: Direct cost of reworking 100 units: Direct material Direct labor 500,000 400,000 100, 000 100, 000 200,000 Required: a. What is the cost per unit of Job Order LMS if the rework cost were attributable to the exacting specification of Job Order LMS? b. What is the cost per unit of Job Order LMS if the rework cost were attributable to internal failure?

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer a a Relevant journal entries for the year Date Account Name Debit RM Credit RM Direct Materia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started