Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Cole receives $7,040 in Old Age Security payments and $5,500 in Canada Pension Plan payments over 12 months. There was no tax shown

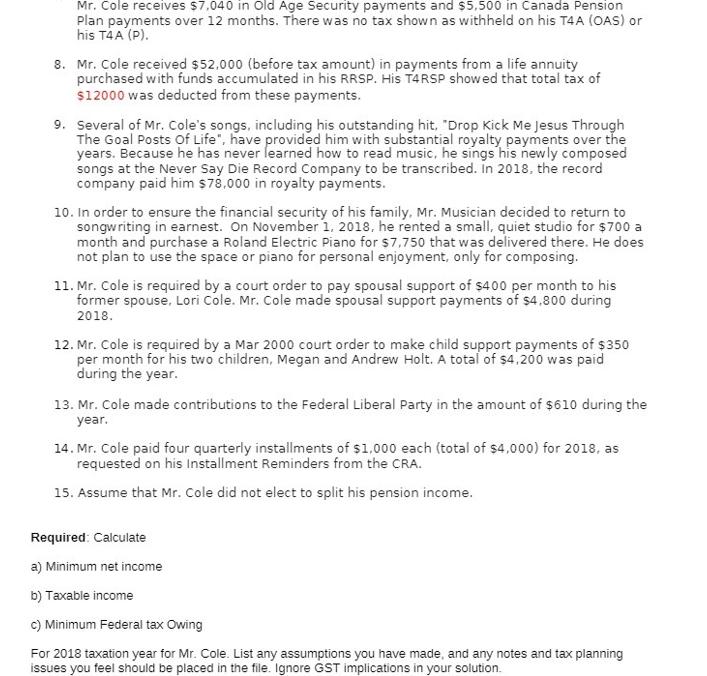

Mr. Cole receives $7,040 in Old Age Security payments and $5,500 in Canada Pension Plan payments over 12 months. There was no tax shown as withheld on his T4A (OAS) or his T4A (P). 8. Mr. Cole received $52.000 (before tax amount) in payments from a life annuity purchased with funds accumulated in his RRSP. His T4RSP showed that total tax of $12000 was deducted from these payments. 9. Several of Mr. Cole's songs, including his outstanding hit, "Drop Kick Me Jesus Through The Goal Posts Of Life", have provided him with substantial royalty payments over the years. Because he has never learned how to read music, he sings his newly composed songs at the Never Say Die Record Company to be transcribed. In 2018, the record company paid him $78,000 in royalty payments. 10. In order to ensure the financial security of his family. Mr. Musician decided to return to songwriting in earnest. On November 1, 2018, he rented a small, quiet studio for $700 a month and purchase a Roland Electric Piano for $7,750 that was delivered there. He does not plan to use the space or piano for personal enjoyment, only for composing. 11. Mr. Cole is required by a court order to pay spousal support of $400 per month to his former spouse, Lori Cole. Mr. Cole made spousal support payments of $4.800 during 2018. 12. Mr. Cole is required by a Mar 2000 court order to make child support payments of $350 per month for his two children, Megan and Andrew Holt. A total of $4,200 was paid during the year. 13. Mr. Cole made contributions to the Federal Liberal Party in the amount of $610 during the year. 14. Mr. Cole paid four quarterly installments of $1,000 each (total of $4,000) for 2018, as requested on his Installment Reminders from the CRA. 15. Assume that Mr. Cole did not elect to split his pension income. Required: Calculate a) Minimum net income b) Taxable income c) Minimum Federal tax Owing For 2018 taxation year for Mr. Cole. List any assumptions you have made, and any notes and tax planning issues you feel should be placed in the file. Ignore GST implications in your solution.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Mr Coles minimum net income we need to first calculate his total income and deductions for the year Here are the calculations Total Income Old Age Security payments 7040 Canada Pension Pl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started