Answered step by step

Verified Expert Solution

Question

1 Approved Answer

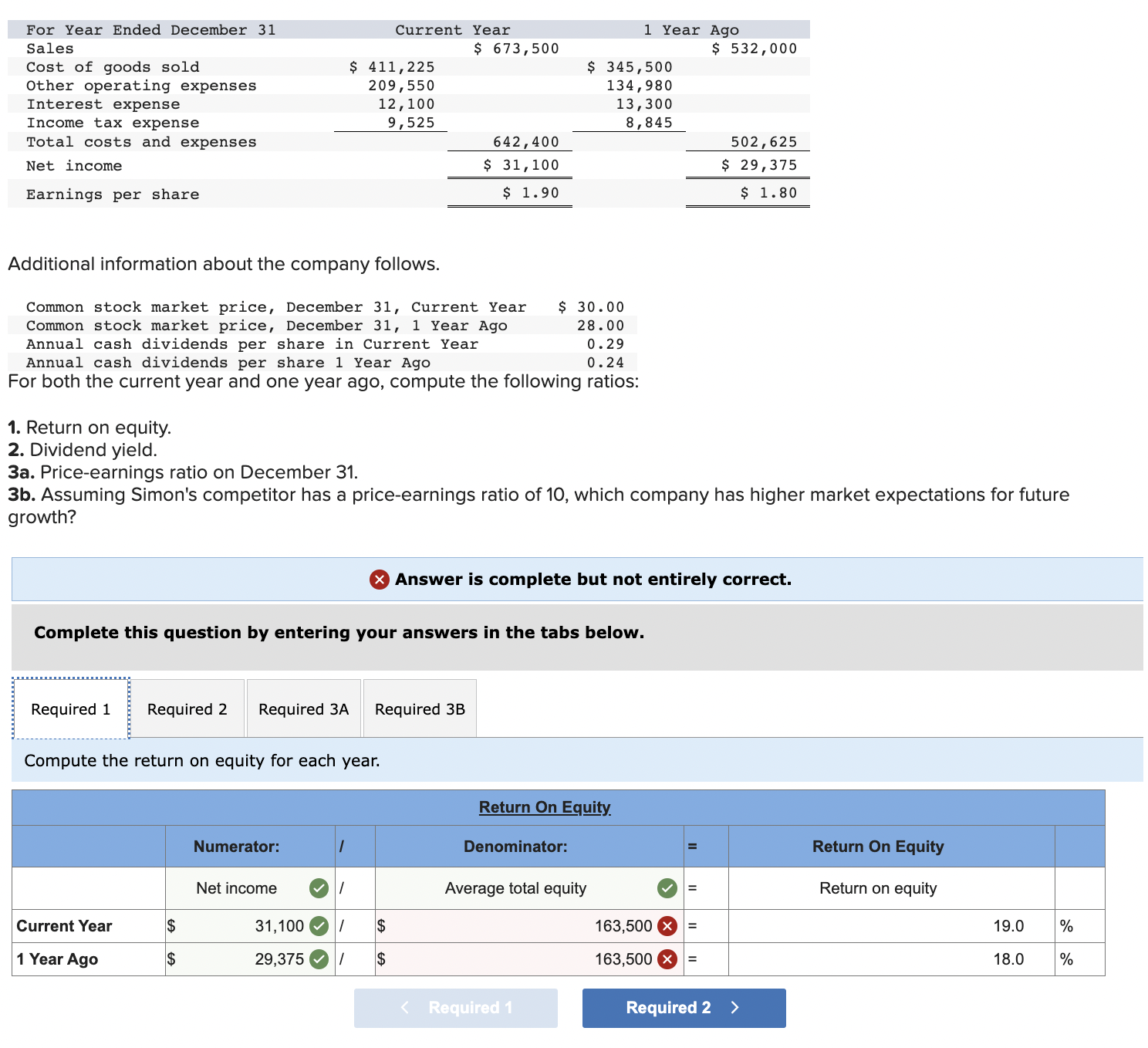

Additional information about the company follows. Common stock market price, December 31, Current Year $30.00 Common stock market price, December 31, 1 Year Ago 28.00

Additional information about the company follows. Common stock market price, December 31, Current Year $30.00 Common stock market price, December 31, 1 Year Ago 28.00 AnnualcashdividendspershareinCurrentYear0.29 Annual cash dividends per share 1 Year Ago 0.24 For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 10, which company has higher market expectations for future growth? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute the return on equity for each year

Additional information about the company follows. Common stock market price, December 31, Current Year $30.00 Common stock market price, December 31, 1 Year Ago 28.00 AnnualcashdividendspershareinCurrentYear0.29 Annual cash dividends per share 1 Year Ago 0.24 For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 10, which company has higher market expectations for future growth? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute the return on equity for each year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started