Question

Additional information: Accounts payable pertain to the purchase of inventory. Plant assets were sold for $40,000. The cost of the plant assets was $40,000. All

Additional information:

Accounts payable pertain to the purchase of inventory.

Plant assets were sold for $40,000. The cost of the plant assets was $40,000.

All dividends are cash.

Cash received/collected from customers is:

Purchases for the year is:

Cash paid to suppliers is:

Depreciation expense is:

Cash paid for operating expenses is:

Cash paid for interest is:

Cash paid for income taxes is:

Cash provided by/(used in)* operating activities is:

Cash provided by/(used in)* investing activities is:

Cash paid for dividends is:

Cash provided by/(used in)* financing activities is:

If Rent Expense for the period was $20,000, the Cash paid for Prepaid Rent is:

If your answer is cash used in, you must indicate this by writing your answer in parenthesis. For example, ($10,000). If your answer is cash provided by, you must write your answer without parentheses.

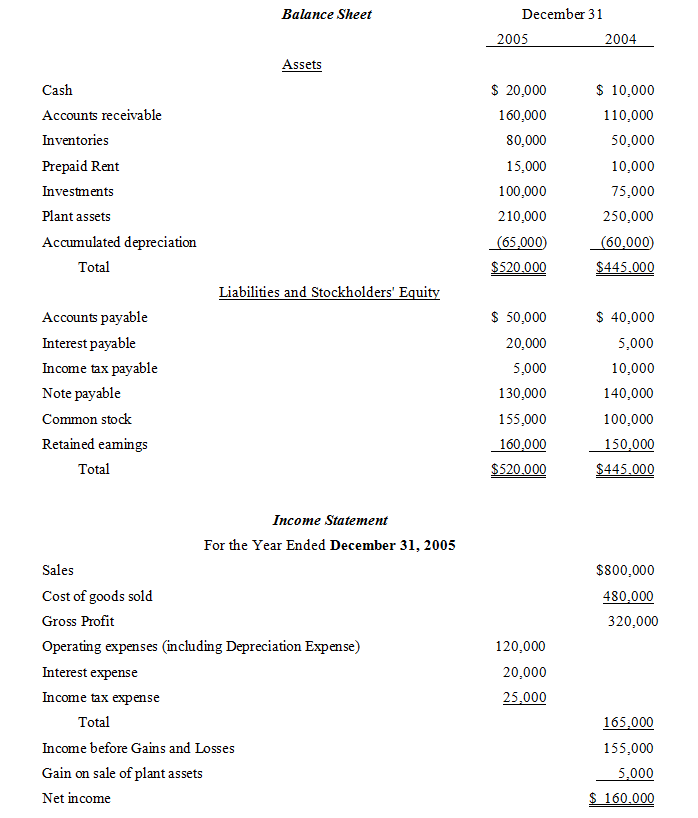

Balance Sheet December 31 2005 Assets Cash Accounts receivable Inventories Prepaid Rent Investments Plant assets Accumulated depreciation $ 20,000 160,000 80,000 15,000 100,000 210,000 $ 10,000 110,000 50,000 10,000 75,000 250,000 (65.000) 60,000 Total 000 $445,000 Liabilities and Stockholders' Equi Accounts payable Interest payable Income tax payable Note payable Common stock Retained eamings $ 50,000 20,000 5,000 130,000 155,000 160,000 $ 40,000 5,000 10,000 140,000 100,000 150,000 $445.000 Total Income Statenent For the Year Ended December 31, 2005 Sales Cost of goods sold Gross Profit Operating expenses (including Depreciation Expense) Interest expense Income tax expense $800,000 480,000 320,000 120,000 20,000 25.000 Total 165,000 155,000 5,000 S 160.000 Income before Gains and Losses ai n on sale of plant asset Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started