Question

Additional information After charging depreciation on the property, plant and equipment Profit from operations is of $449. plant and machinery costing $79 and with accumulated

Additional information After charging depreciation on the property, plant and equipment Profit from operations is of $449. plant and machinery costing $79 and with accumulated depreciation of $59, was sold for $19 during the year ended 31 March 20X1, During the year ended 31 March 20X1, the company acquired property, plant and equipment costing $1899, of which $899 was acquired by means of lease. Cash payments of $999 were made to purchase property, plant and equipment. $89 was paid under lease. The receivables at the end of 20X1 includes $99 of interest receivable. There was no balance at the beginning of the year. Investment income of $679 is made up of $299 interest receivable and $380 dividendsreceived. Dividends paid during the year were $1199 Required: Prepare a statement of cash flows for Maria Ltd for the year ended 31 March 20X1 in compliance with IAS 7 Statement of Cash Flows using the indirect method.

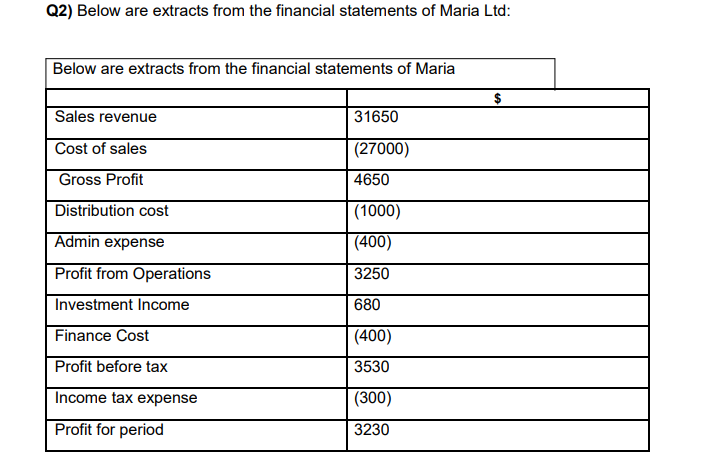

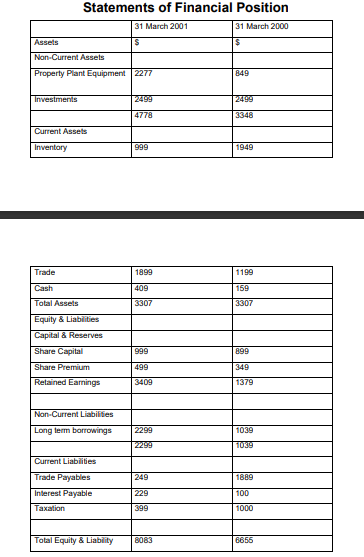

Q2) Below are extracts from the financial statements of Maria Ltd: Below are extracts from the financial statements of Maria $ Sales revenue 31650 Cost of sales (27000) Gross Profit 4650 Distribution cost (1000) (400) Admin expense Profit from Operations 3250 Investment Income 680 Finance Cost (400) Profit before tax 3530 Income tax expense (300) Profit for period 3230 Statements of Financial Position 31 March 2001 31 March 2000 Assets $ Non-Current Assets Property Plant Equipment 2277 849 Investments 2499 2499 4778 3348 Current Assets Inventory 999 1949 Trade 1899 1199 Cash 409 159 Total Assets 3307 3307 Equity & Liabilities Capital & Reserves Share Capital Share Premium Retained Earnings 999 899 499 349 3409 1379 Non-Current Liabilities Long term borrowings 2299 1039 2299 10319 Current Liabilities 249 1889 Trade Payables Interest Payable Taxation 229 100 399 1000 Total Equity & Liability 8083 6656Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started