Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional Information: Data: Only requirement 2 needs an answer: Digiprint Corporation owns a small printing press that prints leaflets, brochures, and advertising materials. Digiprint classifies

Additional Information:

Data:

Only requirement 2 needs an answer:

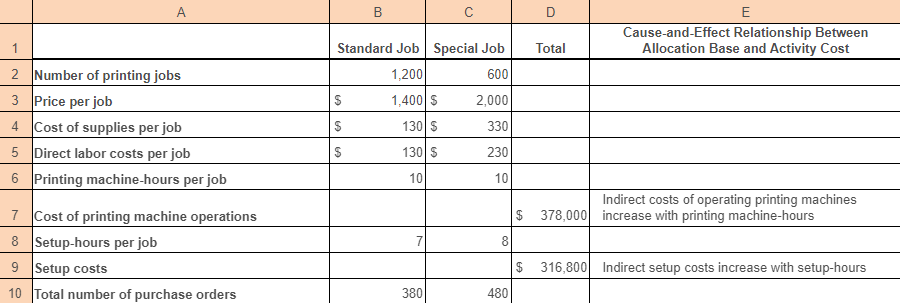

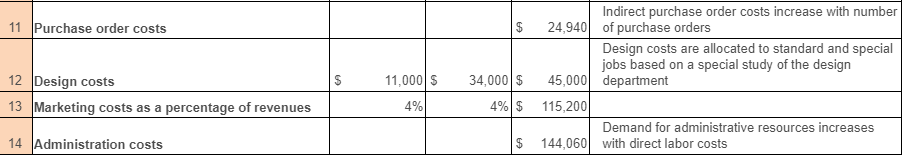

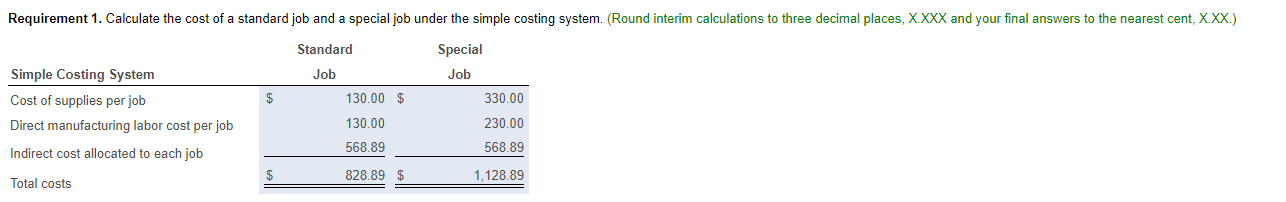

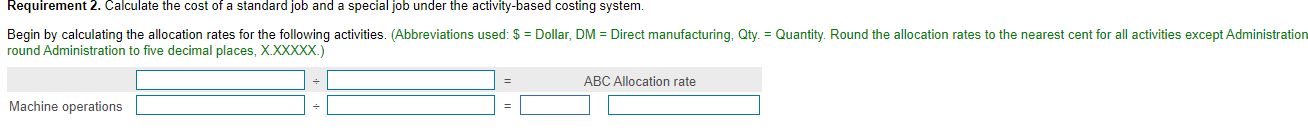

Digiprint Corporation owns a small printing press that prints leaflets, brochures, and advertising materials. Digiprint classifies its various printing jobs as standard jobs or special jobs. (Click the icon to view additional information.) Digiprint's simple job-costing system has two direct-cost categories (direct materials and direct labor) and a single indirect-cost pool. Digiprint operates at capacity and allocates all indirect costs using printing machine-hours as the allocation base. Digiprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Digiprint's ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity-based costing would affect the costs of standard and special jobs, Digiprint collects the following information for the fiscal year 2017 that just ended. (Click the icon to view the information.) A B D E Cause-and-Effect Relationship Between Allocation Base and Activity Cost 1 Total 2 Number of printing jobs 3 Price per job 4 Cost of supplies per job 5 Direct labor costs per job 6 Printing machine-hours per job Standard Job Special Job 1,200 600 1,400 $ 2,000 $ 130$ 330 $ 130$ 230 10 10 Indirect costs of operating printing machines $ 378,000 increase with printing machine-hours 7 8 7 Cost of printing machine operations 8 Setup-hours per job 9 Setup costs 10 Total number of purchase orders $ 316,800 Indirect setup costs increase with setup-hours 380 480 11 Purchase order costs $ 09 11,000 $ 34,000 $ 12 Design costs 13 Marketing costs as a percentage of revenues Indirect purchase order costs increase with number 24,940 of purchase orders Design costs are allocated to standard and special jobs based on a special study of the design 45,000 department 115,200 Demand for administrative resources increases 144,060 with direct labor costs 4% 4%$ 14 Administration costs $ Requirement 1. Calculate the cost of a standard job and a special job under the simple costing system. (Round interim calculations to three decimal places, X.XXX and your final answers to the nearest cent, X.XX.) Standard Special Job Job $ 130.00 $ 330.00 Simple Costing System Cost of supplies per job Direct manufacturing labor cost per job Indirect cost allocated to each job 130.00 230.00 568.89 568.89 $ 828.89 1,128.89 Total costs Requirement 2. Calculate the cost of a standard job and a special job under the activity-based costing system. Begin by calculating the allocation rates for the following activities. (Abbreviations used: $ = Dollar, DM = Direct manufacturing, Qty. = Quantity. Round the allocation rates to the nearest cent for all activities except Administration round Administration to five decimal places, X.XXXXX.) ABC Allocation rate Machine operationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started