Answered step by step

Verified Expert Solution

Question

1 Approved Answer

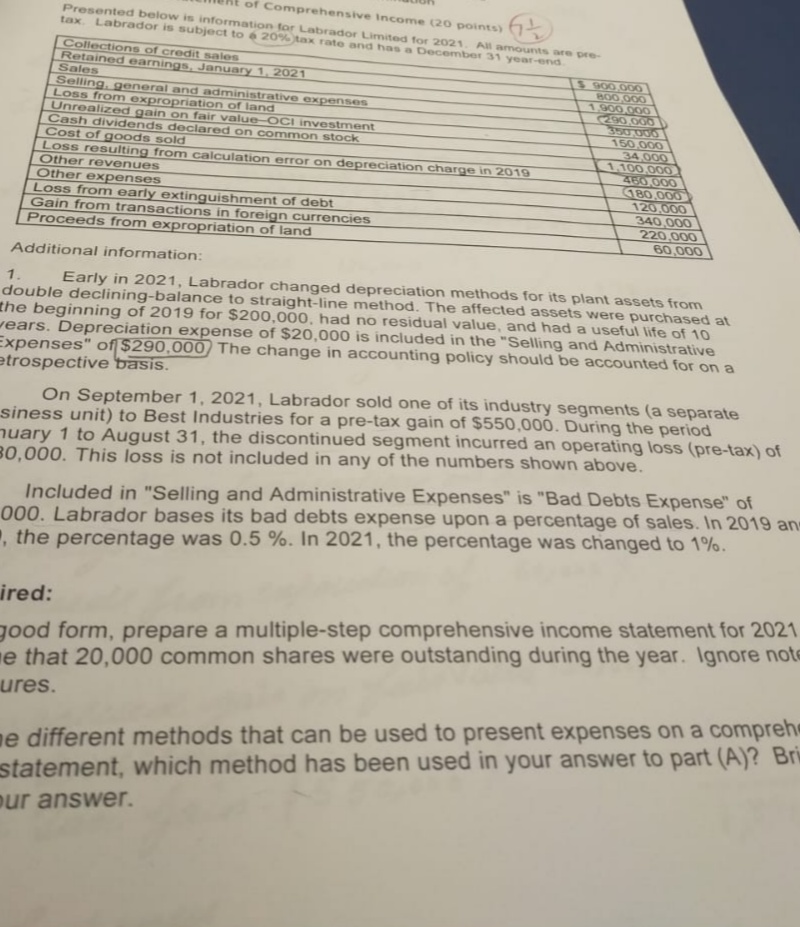

Additional information Early in 2021 Labradoer changed depreciation method for plants and assets from double ddeclining method to straight line method. The affected assets were

- Additional information

- Early in 2021 Labradoer changed depreciation method for plants and assets from double ddeclining method to straight line method. The affected assets were purchased at the beginning of 2019 f0r $200,000 had no residual value and and had a useful life of 10 years . Depreciation expense of $20,000 is included in the selling and administration expense of $290,000. The change in accounting policy should be accounted for an retrospective basis.

- On september 1,2021 labrador sold one ofits industry segment to best industries for a pre tax gain of $550,000. During the period january 1 to August 31, the discontinued segment incuured an operating loss pre tax of $480,000. Thisw loss is not inclued in any of the number shown above.

- Included in selling and Administrative expense is bad debt expense of $19,000. LAbrador based its bad debts expense upon a percentage of sales in 2019 and 2020. The percentage was 0.5%in 2021. The percentage was changed to 1 %.

- Required

In good form prepare a multiple step comprehensive income statement for 2021. Assume 20,000 common shares were outstanding during the year. Ignore note of disclouser.

Of the different method that can be used to present expense on a comprehensive income statement, which method has been used in your answer to part (A)Briefly explain your answer

1. Early in 2021, Labrador changed depreciation methods for its plant assets from double declining-balance to straight-line method. The affected assets were purchased at tears. Depreciation expense of $20,000 is included in the "Selling and Administrative Expenses" of \$290,000) The change in accounting policy should be accounted for on a trospective basis. On September 1, 2021, Labrador sold one of its industry segments (a separate siness unit) to Best Industries for a pre-tax gain of $550,000. During the period huary 1 to August 31, the discontinued segment incurred an operating loss (pre-tax) of 0,000 . This loss is not included in any of the numbers shown above. Included in "Selling and Administrative Expenses" is "Bad Debts Expense" of 000. Labrador bases its bad debts expense upon a percentage of sales. In 2019 a the percentage was 0.5%. In 2021 , the percentage was changed to 1%. ired: good form, prepare a multiple-step comprehensive income statement for 2022 e that 20,000 common shares were outstanding during the year. Ignore no ures. e different methods that can be used to present expenses on a compret statement, which method has been used in your answer to part (A) ? ur answer. 1. Early in 2021, Labrador changed depreciation methods for its plant assets from double declining-balance to straight-line method. The affected assets were purchased at tears. Depreciation expense of $20,000 is included in the "Selling and Administrative Expenses" of \$290,000) The change in accounting policy should be accounted for on a trospective basis. On September 1, 2021, Labrador sold one of its industry segments (a separate siness unit) to Best Industries for a pre-tax gain of $550,000. During the period huary 1 to August 31, the discontinued segment incurred an operating loss (pre-tax) of 0,000 . This loss is not included in any of the numbers shown above. Included in "Selling and Administrative Expenses" is "Bad Debts Expense" of 000. Labrador bases its bad debts expense upon a percentage of sales. In 2019 a the percentage was 0.5%. In 2021 , the percentage was changed to 1%. ired: good form, prepare a multiple-step comprehensive income statement for 2022 e that 20,000 common shares were outstanding during the year. Ignore no ures. e different methods that can be used to present expenses on a compret statement, which method has been used in your answer to part (A) ? urStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started