Question

Additional information Estimated selling and administrative expenses for the forthcoming year are $12,400,500. Victoria Square Cleaners management accountants allocate manufacturing overhead using a predetermined rate

Additional information

-

Estimated selling and administrative expenses for the forthcoming year are $12,400,500.

-

Victoria Square Cleaners management accountants allocate manufacturing overhead using a predetermined rate based on the number of direct labour hours per unit of product.

-

Victoria Square Cleaners accounts for its inventories (both finished goods and raw materials) on a first in, first out (FIFO) basis.

Required

-

(a) Prepare a sales budget for the forthcoming year.

-

(b) Prepare a production budget for the forthcoming year.

-

(c) Prepare a direct materials budget for the forthcoming year.

-

(d) Prepare a direct materials purchases budget for the forthcoming year.

-

(e) Calculate the direct labour cost per unit for both products.

-

(f) Prepare a direct labour budget for the forthcoming year.

(g) Determine the budgeted cost of manufacturing a unit of both products during the forthcoming year.

(h) Prepare a cost of goods sold budget for the forthcoming year.

(i) Prepare a budgeted statement of profit or loss for the forthcoming year in a generally accepted accounting principles (GAAP) format.

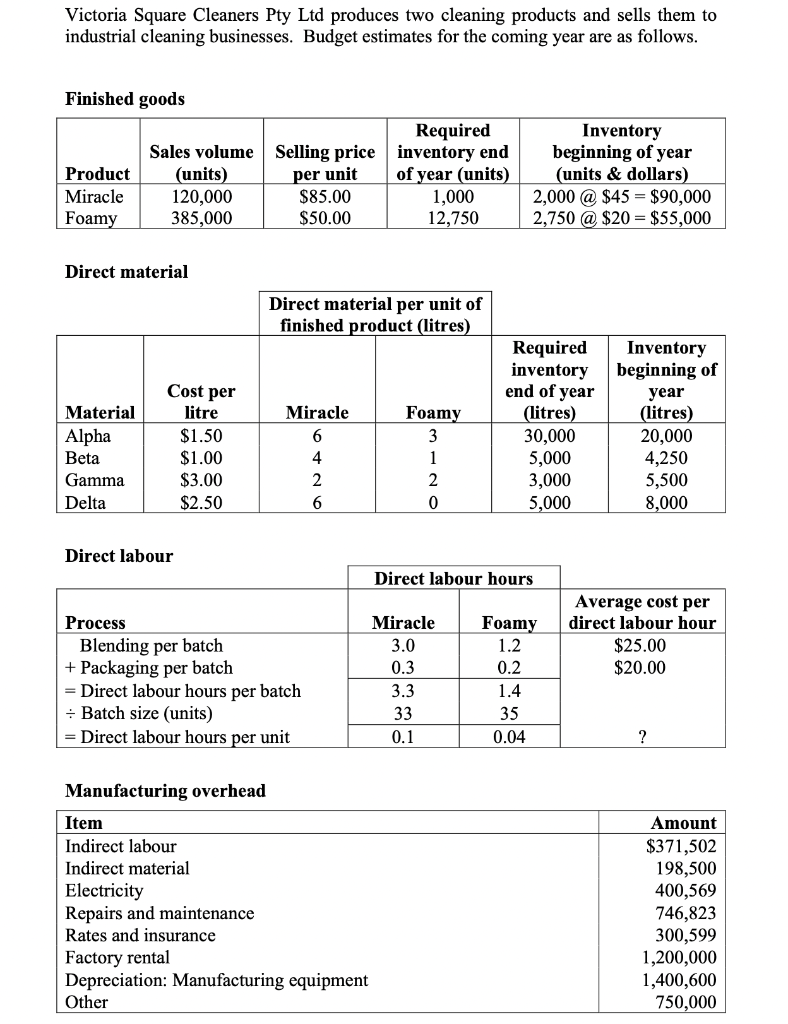

Victoria Square Cleaners Pty Ltd produces two cleaning products and sells them to industrial cleaning businesses. Budget estimates for the coming year are as follows. Finished goods Direct material Manufacturing overheadStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started