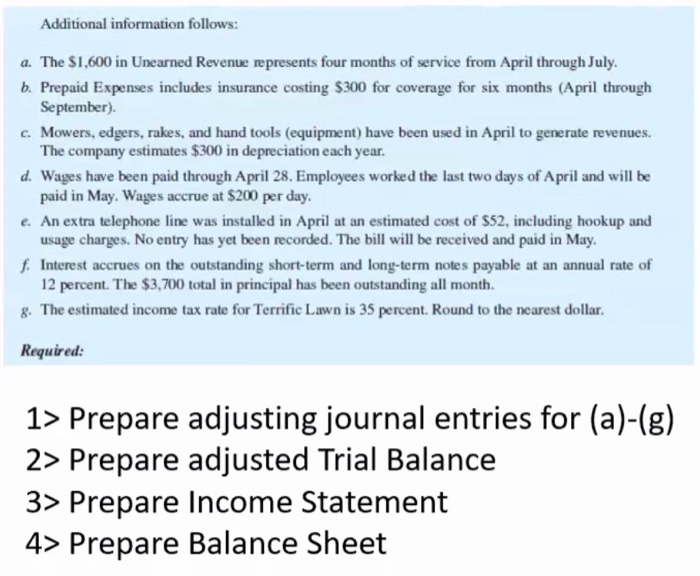

Additional information follows: a. The $1,600 in Unearned Revenue represents four months of service from April through July. b. Prepaid Expenses includes insurance costing $300 for coverage for six months (April through September). c. Mowers, edgers, rakes, and hand tools (equipment) have been used in April to generate revenues. The company estimates $300 in depreciation each year. d. Wages have been paid through April 28. Employees worked the last two days of April and will be paid in May. Wages accrue at $200 per day. e. An extra telephone line was installed in April at an estimated cost of $52, including hookup and usage charges. No entry has yet been recorded. The bill will be received and paid in May. f. Interest accrues on the outstanding short-term and long-term notes payable at an annual rate of 12 percent. The $3,700 total in principal has been outstanding all month. 8. The estimated income tax rate for Terrific Lawn is 35 percent. Round to the nearest dollar. Required: 1> Prepare adjusting journal entries for (a)-(g) 2> Prepare adjusted Trial Balance 3> Prepare Income Statement 4> Prepare Balance Sheet Additional information follows: a. The $1,600 in Unearned Revenue represents four months of service from April through July. b. Prepaid Expenses includes insurance costing $300 for coverage for six months (April through September). c. Mowers, edgers, rakes, and hand tools (equipment) have been used in April to generate revenues. The company estimates $300 in depreciation each year. d. Wages have been paid through April 28. Employees worked the last two days of April and will be paid in May. Wages accrue at $200 per day. e. An extra telephone line was installed in April at an estimated cost of $52, including hookup and usage charges. No entry has yet been recorded. The bill will be received and paid in May. f. Interest accrues on the outstanding short-term and long-term notes payable at an annual rate of 12 percent. The $3,700 total in principal has been outstanding all month. 8. The estimated income tax rate for Terrific Lawn is 35 percent. Round to the nearest dollar. Required: 1> Prepare adjusting journal entries for (a)-(g) 2> Prepare adjusted Trial Balance 3> Prepare Income Statement 4> Prepare Balance Sheet