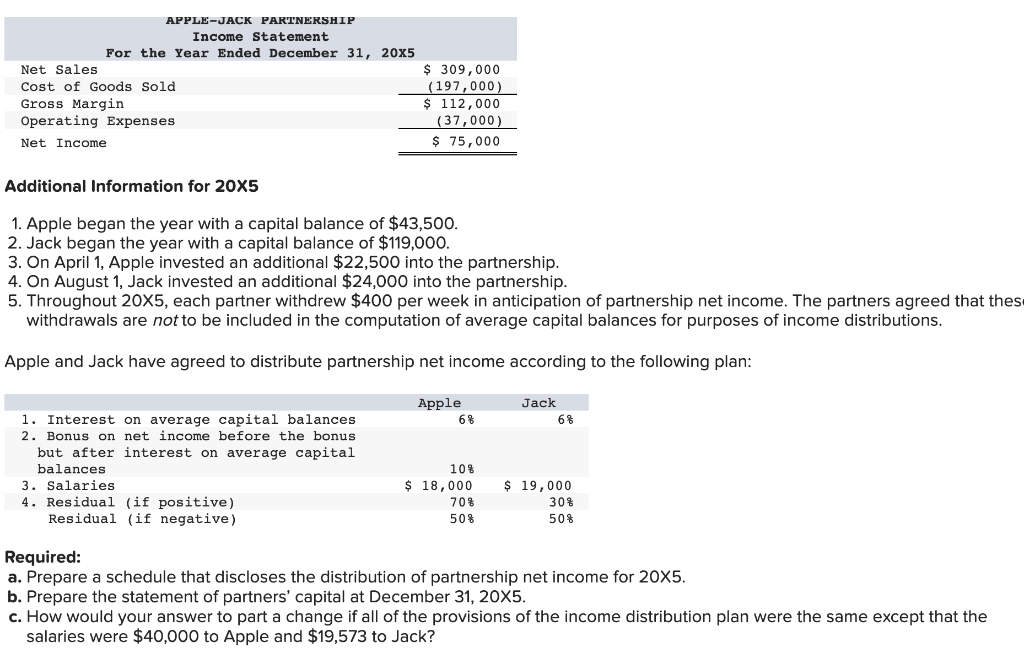

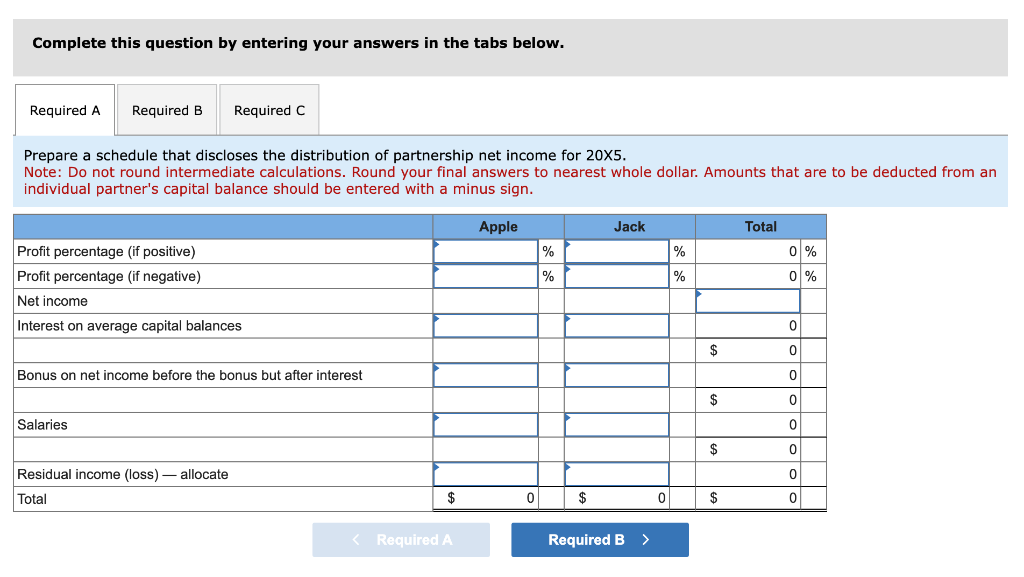

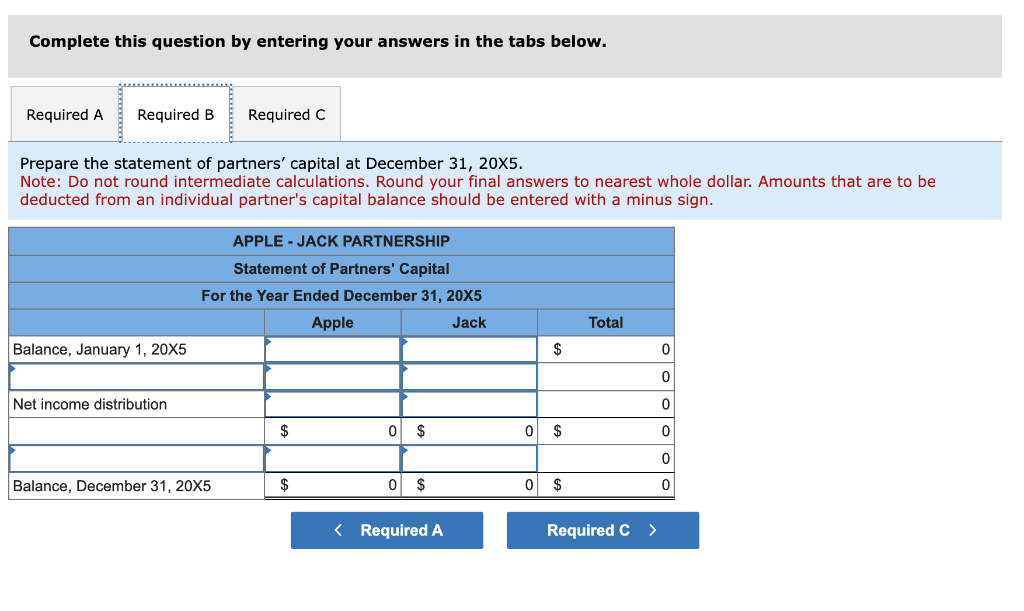

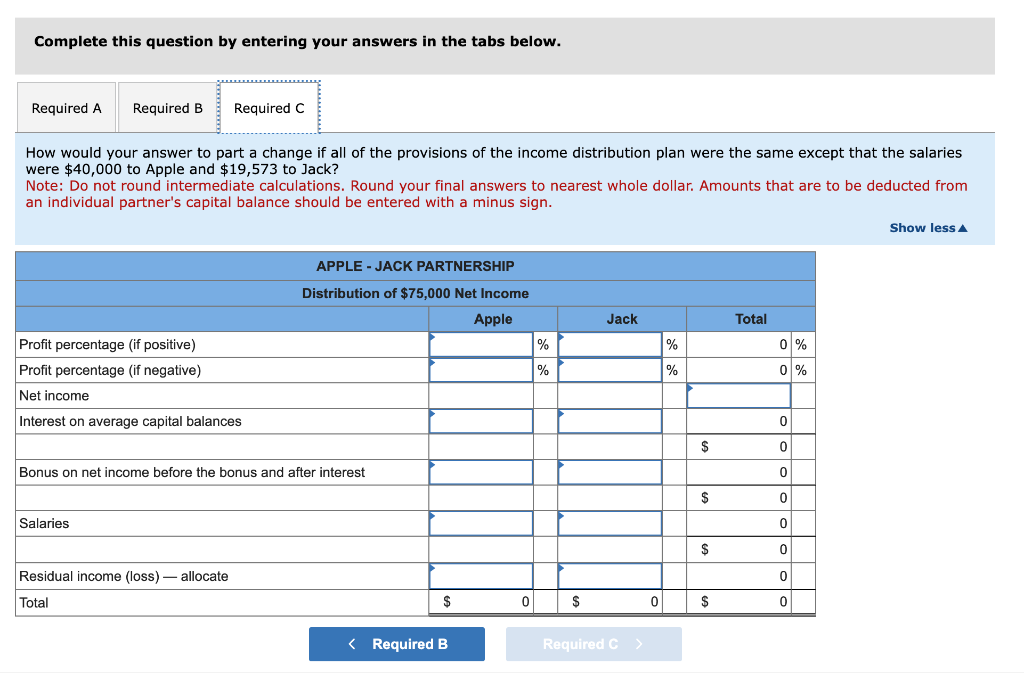

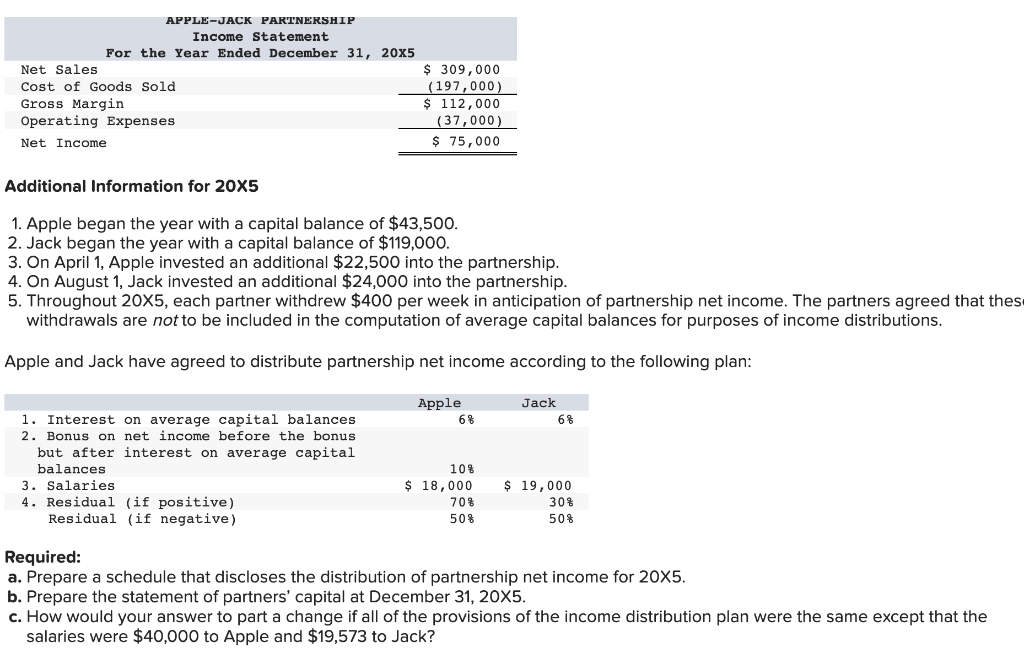

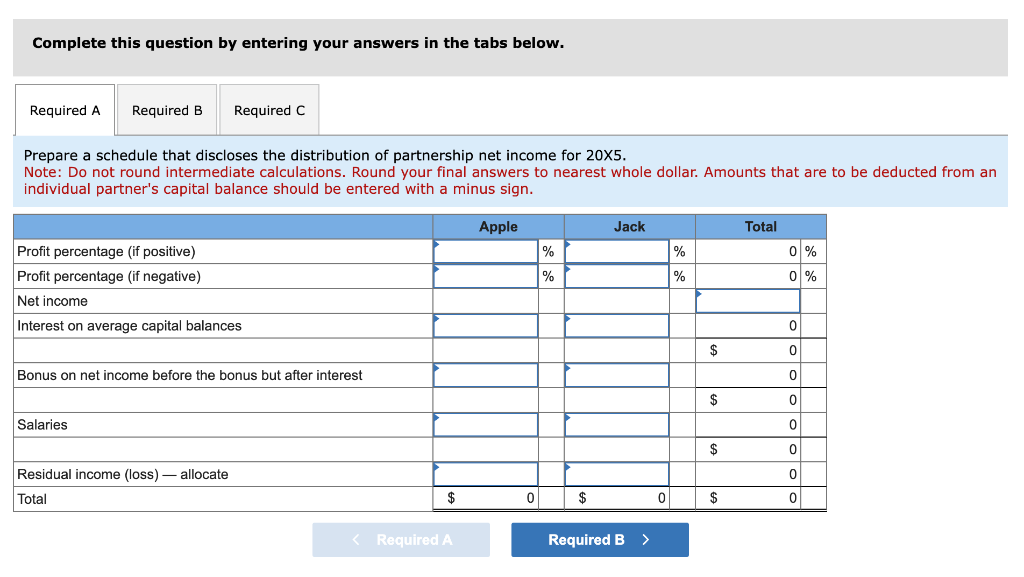

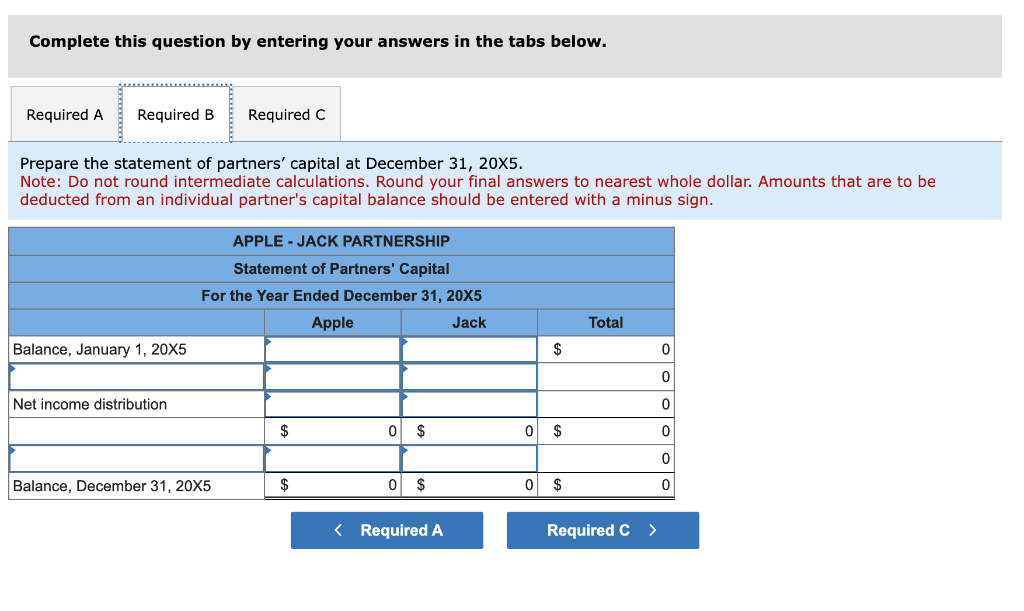

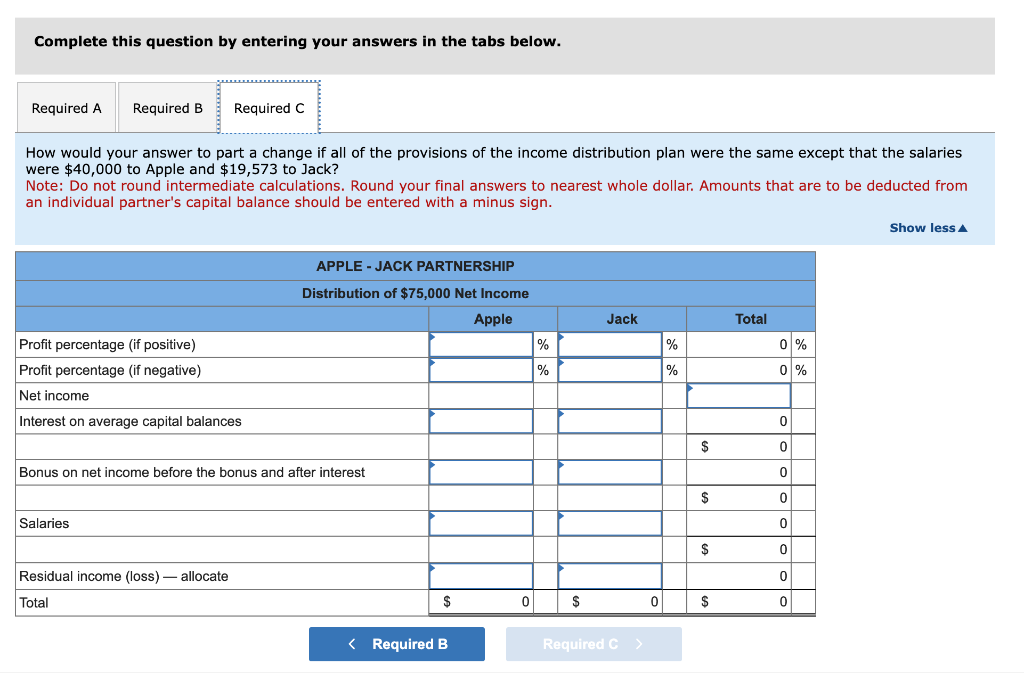

Additional Information for 205 1. Apple began the year with a capital balance of $43,500. 2. Jack began the year with a capital balance of $119,000. 3. On April 1, Apple invested an additional $22,500 into the partnership. 4. On August 1, Jack invested an additional $24,000 into the partnership. 5. Throughout 205, each partner withdrew $400 per week in anticipation of partnership net income. The partners agreed that thes withdrawals are not to be included in the computation of average capital balances for purposes of income distributions. Apple and Jack have agreed to distribute partnership net income according to the following plan: Required: a. Prepare a schedule that discloses the distribution of partnership net income for 205. b. Prepare the statement of partners' capital at December 31, 205. c. How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $40,000 to Apple and \$19,573 to Jack? Complete this question by entering your answers in the tabs below. Prepare a schedule that discloses the distribution of partnership net income for 205. individual partner's capital balance should be entered with a minus sign. Complete this question by entering your answers in the tabs below. Prepare the statement of partners' capital at December 31,205. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign. Complete this question by entering your answers in the tabs below. How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $40,000 to Apple and $19,573 to Jack? Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign. Additional Information for 205 1. Apple began the year with a capital balance of $43,500. 2. Jack began the year with a capital balance of $119,000. 3. On April 1, Apple invested an additional $22,500 into the partnership. 4. On August 1, Jack invested an additional $24,000 into the partnership. 5. Throughout 205, each partner withdrew $400 per week in anticipation of partnership net income. The partners agreed that thes withdrawals are not to be included in the computation of average capital balances for purposes of income distributions. Apple and Jack have agreed to distribute partnership net income according to the following plan: Required: a. Prepare a schedule that discloses the distribution of partnership net income for 205. b. Prepare the statement of partners' capital at December 31, 205. c. How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $40,000 to Apple and \$19,573 to Jack? Complete this question by entering your answers in the tabs below. Prepare a schedule that discloses the distribution of partnership net income for 205. individual partner's capital balance should be entered with a minus sign. Complete this question by entering your answers in the tabs below. Prepare the statement of partners' capital at December 31,205. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign. Complete this question by entering your answers in the tabs below. How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $40,000 to Apple and $19,573 to Jack? Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign