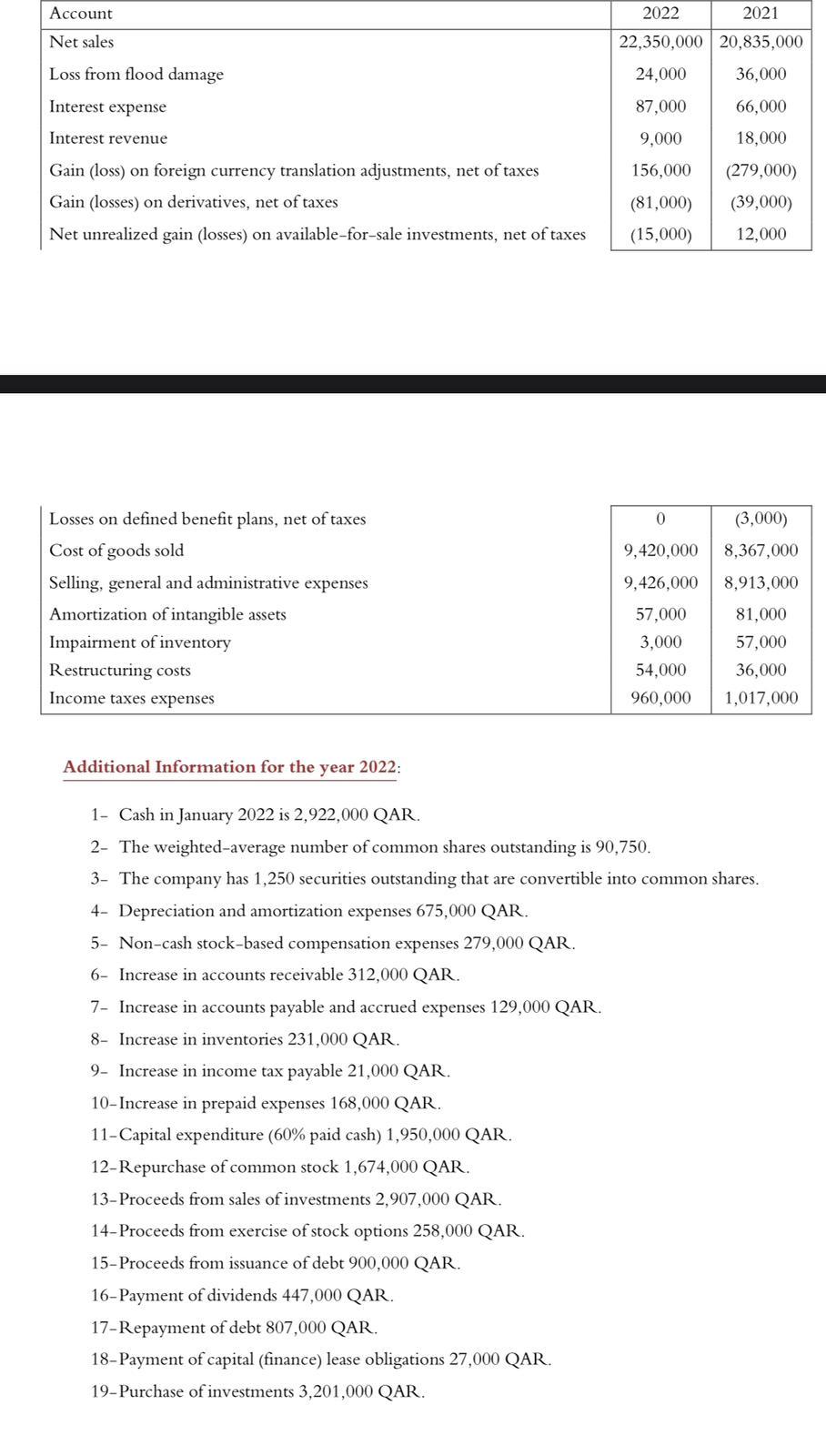

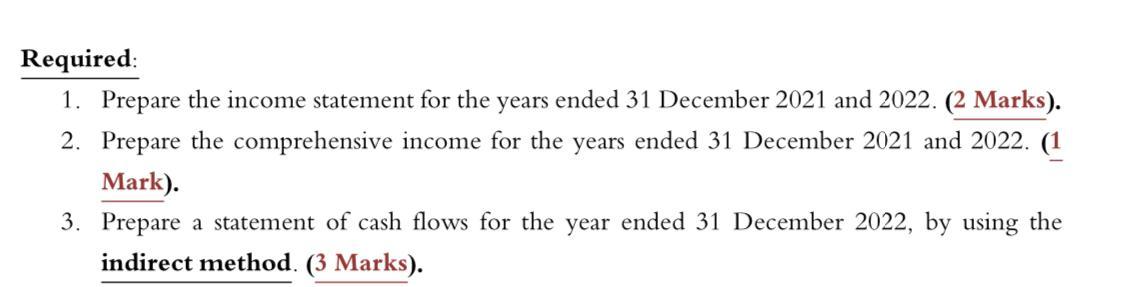

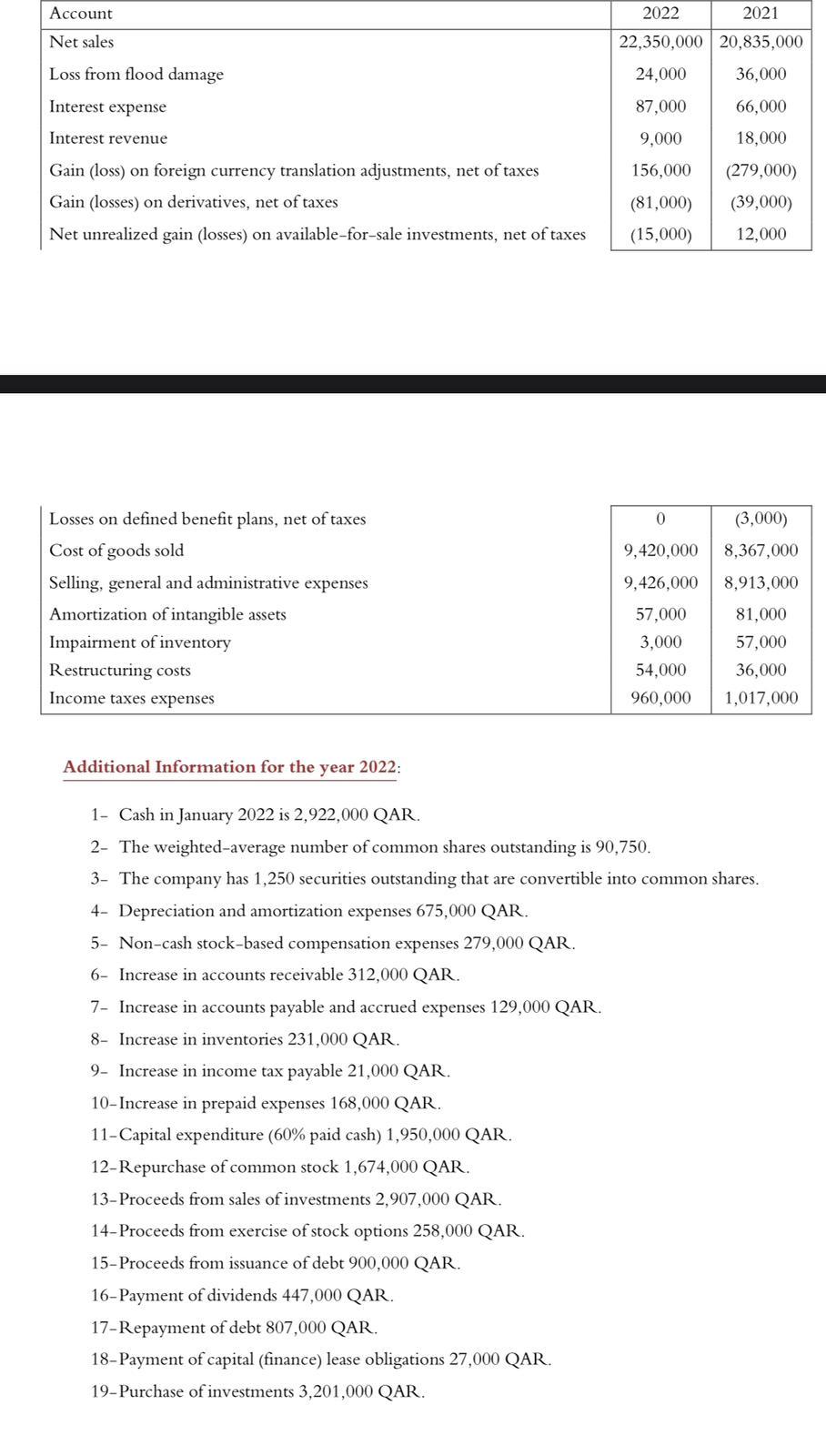

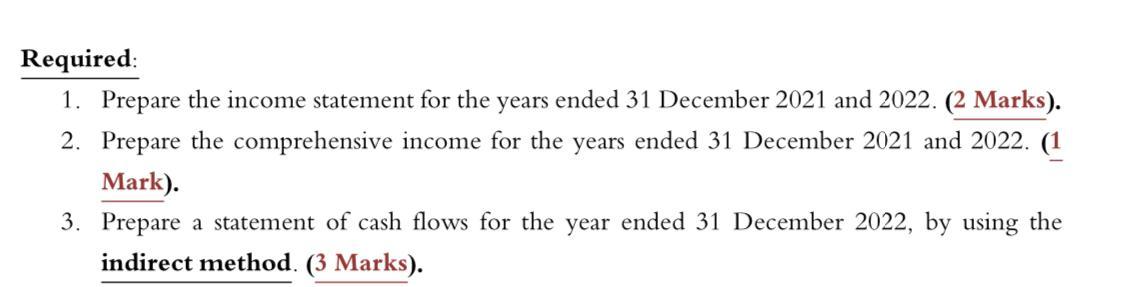

Additional Information for the year 2022: 1- Cash in January 2022 is 2,922,000 QAR. 2- The weighted-average number of common shares outstanding is 90,750 . 3- The company has 1,250 securities outstanding that are convertible into common shares. 4- Depreciation and amortization expenses 675,000 QAR. 5- Non-cash stock-based compensation expenses 279,000 QAR. 6- Increase in accounts receivable 312,000 QAR. 7- Increase in accounts payable and accrued expenses 129,000 QAR. 8- Increase in inventories 231,000 QAR. 9- Increase in income tax payable 21,000 QAR. 10-Increase in prepaid expenses 168,000 QAR. 11-Capital expenditure (60\% paid cash) 1,950,000 QAR. 12-Repurchase of common stock 1,674,000 QAR. 13-Proceeds from sales of investments 2,907,000 QAR. 14-Proceeds from exercise of stock options 258,000 QAR. 15-Proceeds from issuance of debt 900,000 QAR. 16-Payment of dividends 447,000 QAR. 17-Repayment of debt 807,000 QAR. 18-Payment of capital (finance) lease obligations 27,000 QAR. 19-Purchase of investments 3,201,000 QAR. Required: 1. Prepare the income statement for the years ended 31 December 2021 and 2022. (2 Marks). 2. Prepare the comprehensive income for the years ended 31 December 2021 and 2022. (1 Mark). 3. Prepare a statement of cash flows for the year ended 31 December 2022, by using the indirect method. (3 Marks). Additional Information for the year 2022: 1- Cash in January 2022 is 2,922,000 QAR. 2- The weighted-average number of common shares outstanding is 90,750 . 3- The company has 1,250 securities outstanding that are convertible into common shares. 4- Depreciation and amortization expenses 675,000 QAR. 5- Non-cash stock-based compensation expenses 279,000 QAR. 6- Increase in accounts receivable 312,000 QAR. 7- Increase in accounts payable and accrued expenses 129,000 QAR. 8- Increase in inventories 231,000 QAR. 9- Increase in income tax payable 21,000 QAR. 10-Increase in prepaid expenses 168,000 QAR. 11-Capital expenditure (60\% paid cash) 1,950,000 QAR. 12-Repurchase of common stock 1,674,000 QAR. 13-Proceeds from sales of investments 2,907,000 QAR. 14-Proceeds from exercise of stock options 258,000 QAR. 15-Proceeds from issuance of debt 900,000 QAR. 16-Payment of dividends 447,000 QAR. 17-Repayment of debt 807,000 QAR. 18-Payment of capital (finance) lease obligations 27,000 QAR. 19-Purchase of investments 3,201,000 QAR. Required: 1. Prepare the income statement for the years ended 31 December 2021 and 2022. (2 Marks). 2. Prepare the comprehensive income for the years ended 31 December 2021 and 2022. (1 Mark). 3. Prepare a statement of cash flows for the year ended 31 December 2022, by using the indirect method