Question

Additional information: (i) The physical inventory-take revealed that the value of inventory at 30 April 2020 was RM350,000. However, its net realizable value was estimated

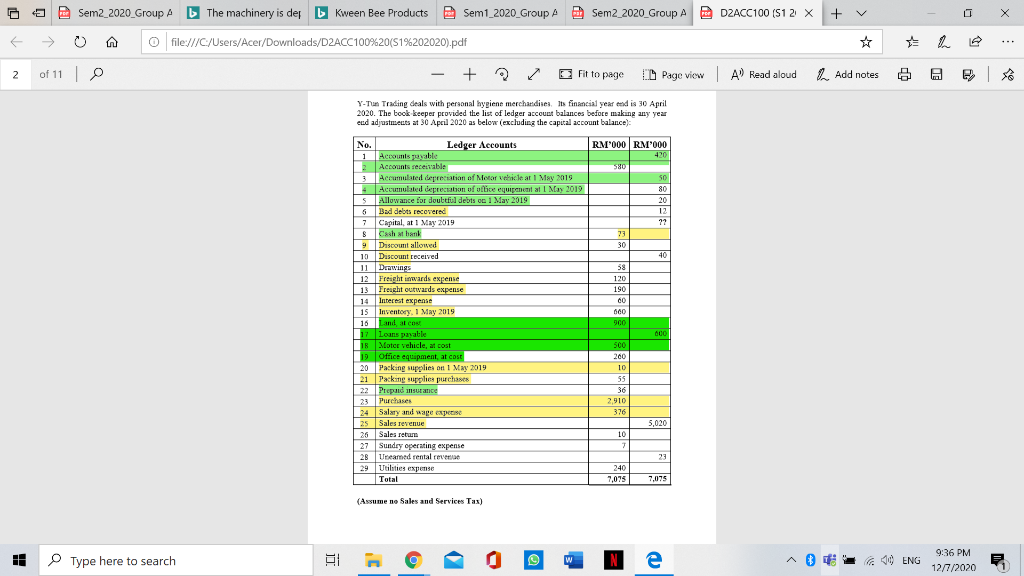

Additional information: (i) The physical inventory-take revealed that the value of inventory at 30 April 2020 was RM350,000. However, its net realizable value was estimated at RM345,000. (ii) There was packing supplies worth of RM15,000 was in hand at 30 April 2020. (iii) The depreciation charge for the year is to be provided as follows: Office equipment at 15% per annum using straight line method and Motor vehicles at 20% per annum using reducing balance method. (iv) The prepaid insurance expired during the year ended April 2020 amounted to RM30,000. Salaries and wages for the month of April 2020 amounting to RM24,000 was due and unpaid. (v) Purchases returns of RM10,000 for merchandise was credited to sales revenue account in error. (vi) The allowance for doubtful debts is to be adjusted to 5% of accounts receivable. (vii) 20% of the loan payable is due for repayment by 30 April 2021. REQUIRED: (a) What inventory system is used by Y-Tun Trading? Justify your answer. (b) Prepare a detailed income statement for the year ended 30 April 2020. (c) Prepare a statement of changes in owners equity for the year ended 30 April 2020.

Additional information: (i) The physical inventory-take revealed that the value of inventory at 30 April 2020 was RM350,000. However, its net realizable value was estimated at RM345,000. (ii) There was packing supplies worth of RM15,000 was in hand at 30 April 2020. (iii) The depreciation charge for the year is to be provided as follows: Office equipment at 15% per annum using straight line method and Motor vehicles at 20% per annum using reducing balance method. (iv) The prepaid insurance expired during the year ended April 2020 amounted to RM30,000. Salaries and wages for the month of April 2020 amounting to RM24,000 was due and unpaid. (v) Purchases returns of RM10,000 for merchandise was credited to sales revenue account in error. (vi) The allowance for doubtful debts is to be adjusted to 5% of accounts receivable. (vii) 20% of the loan payable is due for repayment by 30 April 2021. REQUIRED: (a) What inventory system is used by Y-Tun Trading? Justify your answer. (b) Prepare a detailed income statement for the year ended 30 April 2020. (c) Prepare a statement of changes in owners equity for the year ended 30 April 2020.

(d) Prepare a balance sheet as at 30 April 2020.

Sem2_2020_Group A The machinery is der Kween Bee Products Sem1_2020_Group A Sem2_2020_Group A DZACC100 (S1 2 X + 0 file:///C:/Users/Acer/Downloads/D2ACC100%20(51%202020).pdf * 2 of 11 + Fit to page Page view A Read aloud 1. Add notes 0 m Y-Tun Trading deals with personal hygiene merchandises. Its financial year end is 30 April 2020. The book keeper provided the list of ledger account balances before making any year end adjustments at 30 April 2020 as below (excluding the capital account balance) RM'000 RM'000 420 580 50 80 12 12 73 30 9 40 40 No. Ledger Accounts 1 Accounts guyable 2 Accounts receivable 3 Accumulated depreciation of Motor vehiclear 1 May 2015 4 Accumulated depreciation of uitive equipament at 1 May 2019 5 Allowance for doubtful debts op 1 May 2019 5 Bad debts recovered 7 Capital, at 1 May 2019 S Csah at bank Discount allowed 10 Discount received 11 Drawings 12 Freight inwards expense 13 Freight outwards expense 14 Interest expense 15 Inventory. 1 May 2019 16 Land, al cost 17 Loans payable IR Motor vehicle, al cost 19 Office equipment, at cost 20 Packing supplies on 1 May 2019 21 Packing supplies purchases Prepaid insurance 23 Purchases 24 Salary and we expetise 25 Sales revenue 25 Sales retur 27 Sundry operating expense 28 Ureamed rental reverse 29 Utilities expense Total 58 120 190 co 600 900 000 500 200 10 55 36 2,910 376 5,020 10 7 23 240 7,075 7,075 (Assume ne Sales and Services Tax) H Type here to search J' w Ne ENG 9:36 PM 12/7/2020 Sem2_2020_Group A The machinery is der Kween Bee Products Sem1_2020_Group A Sem2_2020_Group A DZACC100 (S1 2 X + 0 file:///C:/Users/Acer/Downloads/D2ACC100%20(51%202020).pdf * 2 of 11 + Fit to page Page view A Read aloud 1. Add notes 0 m Y-Tun Trading deals with personal hygiene merchandises. Its financial year end is 30 April 2020. The book keeper provided the list of ledger account balances before making any year end adjustments at 30 April 2020 as below (excluding the capital account balance) RM'000 RM'000 420 580 50 80 12 12 73 30 9 40 40 No. Ledger Accounts 1 Accounts guyable 2 Accounts receivable 3 Accumulated depreciation of Motor vehiclear 1 May 2015 4 Accumulated depreciation of uitive equipament at 1 May 2019 5 Allowance for doubtful debts op 1 May 2019 5 Bad debts recovered 7 Capital, at 1 May 2019 S Csah at bank Discount allowed 10 Discount received 11 Drawings 12 Freight inwards expense 13 Freight outwards expense 14 Interest expense 15 Inventory. 1 May 2019 16 Land, al cost 17 Loans payable IR Motor vehicle, al cost 19 Office equipment, at cost 20 Packing supplies on 1 May 2019 21 Packing supplies purchases Prepaid insurance 23 Purchases 24 Salary and we expetise 25 Sales revenue 25 Sales retur 27 Sundry operating expense 28 Ureamed rental reverse 29 Utilities expense Total 58 120 190 co 600 900 000 500 200 10 55 36 2,910 376 5,020 10 7 23 240 7,075 7,075 (Assume ne Sales and Services Tax) H Type here to search J' w Ne ENG 9:36 PM 12/7/2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started