Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ADDITIONAL INFORMATION Net Income for 2019 21,632 Depreciation expense 5,000 Cash dividends declared and paid 8,600 Cash received for equipment sold 2,000 Original cost of

| ADDITIONAL INFORMATION | |

| Net Income for 2019 | 21,632 |

| Depreciation expense | 5,000 |

| Cash dividends declared and paid | 8,600 |

| Cash received for equipment sold | 2,000 |

| Original cost of equipment | 7,200 |

| Loss on sale of equipment | 1,000 |

| Additional equipment purchased for cash | 29,800 |

| Investments were sold at cost. |

1. Prepare a statement of cash flow effect

2. Prepare a statement of cash flow

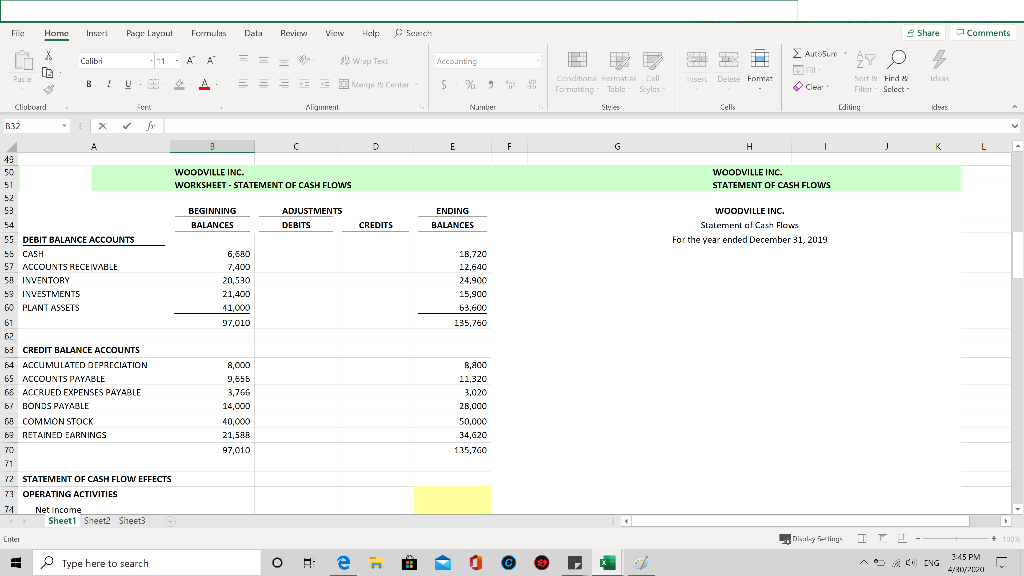

Filet Home Page Layout View Share Comments Insteet Calibri B ! Formulas A A A Data = = 3 Revies = Help Search Wrap Text Meme Center - Auto5077 Accounting Pase Ideas U. 3. $ % 9 8 Conditions Formatas Call Formatting Table Styles - Delete Font Clear Sort Filter Fird Select- Clipboard Polignment Number Styles Editing Ideas 6:32 WOODVILLE INC. WORKSHEET - STATEMENT OF CASH FLOWS WOODVILLE INC. STATEMENT OF CASH FLOWS BEGINNING BALANCES ADJUSTMENTS DEBITS ENDING BALANCES CREDITS WOODVILLE INC. Statement of Cash Flows For the year ended December 31, 2019 55 DEBIT BALANCE ACCOUNTS CASH 57 ACCOUNTS RECEIVABLE 50 INVENTORY 59 INVESTMENTS GO PLANT ASSETS 61 6,680 7,400 20,580 21,400 41,000 97,010 18,720 12,640 24,900 15,900 63,600 135,760 63 63 CREDIT BALANCE ACCOUNTS 64 ACCUMULATED DEPRECIATION 65 ACCOUNTS PAYABLE 65 ACCRUED EXPENSES PAYABLE 67 BONDS PAYABLE 60 COMMON STOCK 89 RETAINED EARNINGS 8,000 9,655 3,766 14,000 40,000 21,588 97,010 8,200 11,320 3,020 28,000 50,000 34,620 135,760 71 72 STATEMENT OF CASH FLOW EFFECTS 73 OPERATING ACTIVITIES 74 Net Income Sheet1 Sheet2 Sheet3 + Criter Duy tiny IT -- ING 345PM 4:20/2020 Type here to search A - - XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started