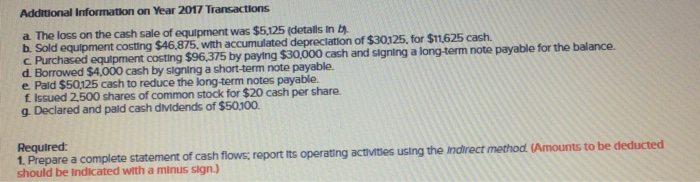

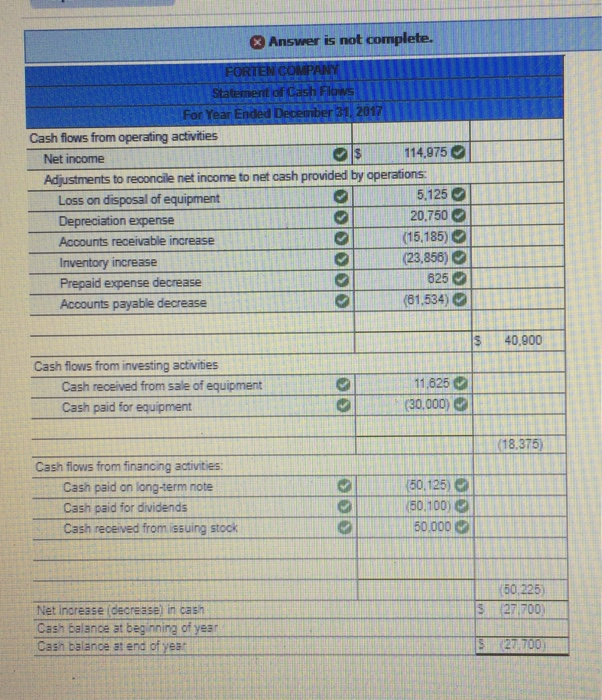

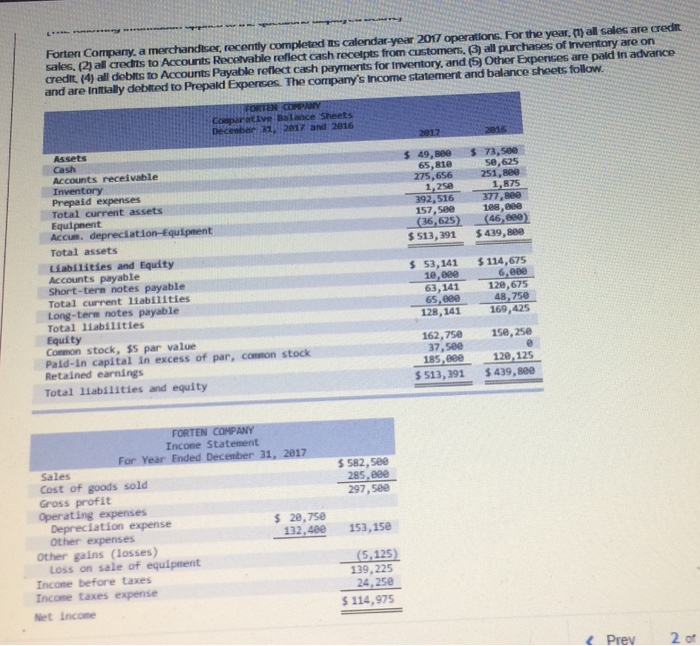

Additional Information on Year 2017 Transactions a The loss on the cash sale of equipment was $525 (detals ln b b. Sold equipment costing $46,875, with accumulated depreciation of $30125, for $1.625 cash. C. Purchased equipment costing $96,375 by paying $30,000 cash and signing a long-term note payable for the balance. d. Borrowed $4,000 cash by signing a short-term note payable e Pald $50125 cash to reduce the long-term notes payable. f Issued 2,500 shares of common stock for $20 cash per share. g. Declared and pald cash dMdends of $50100 Required Preoaure a complete tatement of cash flows: report ts operating actvites using the indtrect methodt UAmounts to be deducted 3 Answer is not complete. Statement of Cash Flows 31. 2017 For Year Ended Cash flows from operating activities 114,975 Net income Adjustments to reconcile net income to net cash provided by operations 5.125 Loss on disposal of equipment Depreciation expense Accounts receivable increase Inventory increase Prepaid expense decrease Accounts payable decrease 20,750 0 (15,185) (23,856) 825 (81.534) S 40,900 Cash flows from investing activites 11,825 (30.000) Cash received from sale of equipment Cash paid for equipment 01 Cash flows from financing activities (50.125) (50.100| 50 000 Cash paid on long-term note Cash paid for dividends Cash received from issuing stock (50,225) S (27 700) Net increase (decrease) in cash Cash balance at beginning of year Cash balance at end of yea Forten Company, a merchendbor, recently completed0alendar year 207 operators. For the year. m all sales are not sales. (2) all credrts to Accounts Recelvable reflect cash recelpts from customers, S) all purchases of Inventory are on credit (4) all deblts to Accounts Payable reflect cash payments for Inventory, and (5) Other Expenses are pald in advance and are Intially debited to Prepald Expenses. The company's Income statement and balance sheets follow Conperative Balance Sheets Decenber 21,2917 and 2816 $ 49,880 65, 810 275,656 1,250 392,516 157, 58e 73,580 e,625 Cash Accounts receivable 251,880 1,875 377,8e0 188,8e0 Inventory Prepaid expenses Total current assets Equipnent Accum. depreciation-Equipment (36,625) (46,80e) 513,391 $439,889 Total assets Liabilities and Equity Accounts payable Short-tern notes payable Total current liabilities s53,141 $114,675 6,800 128,675 48,750 10,888 63,141 65,009 128,141 675 169,425 Total liabilities Equity 162,75015e,250 Conmon stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings 37,see 185,8e0 120,125 513,391 $439,880 Total liabilities and equity Incone Statement For Year Ended 5 582, 5ee 285,88e 297,5ee Sales Cost of goods sold Operating expenses Other expenses Gross profit 2e,75e 132,480 Depreciation expense 153,15e Other gains (losses) (5,125) 139,225 24,250 Loss on sale of equipnent Incone before taxes Income taxes expense 5 114,975 Net Incone Prev 2 of