Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ADDITIONAL INFORMATION: The Class A shares have voting rights and Adidas Ltd has no obligation to repay the capital on these shares. Class A shareholders

ADDITIONAL INFORMATION: The Class A shares have voting rights and Adidas Ltd has no obligation to repay the capital on these shares. Class A

shareholders will only be entitled to a dividend once declared by the directors of Adidas Ltd

The Class B shares are nonredeemable shares. Shareholders of Class B shares are entitled to a dividend on issue

price before Class A shareholders.

The Class C shares are noncumulative nonredeemable shares. Shareholders of Class shares have a right to receive a

dividend of of the issue price at December every year, but only once declared by the Board of directors.

The Class D shares are redeemable preference shares that are entitled to a dividend. The Class D shares were

issued on April and are redeemable at the option of the holders on April

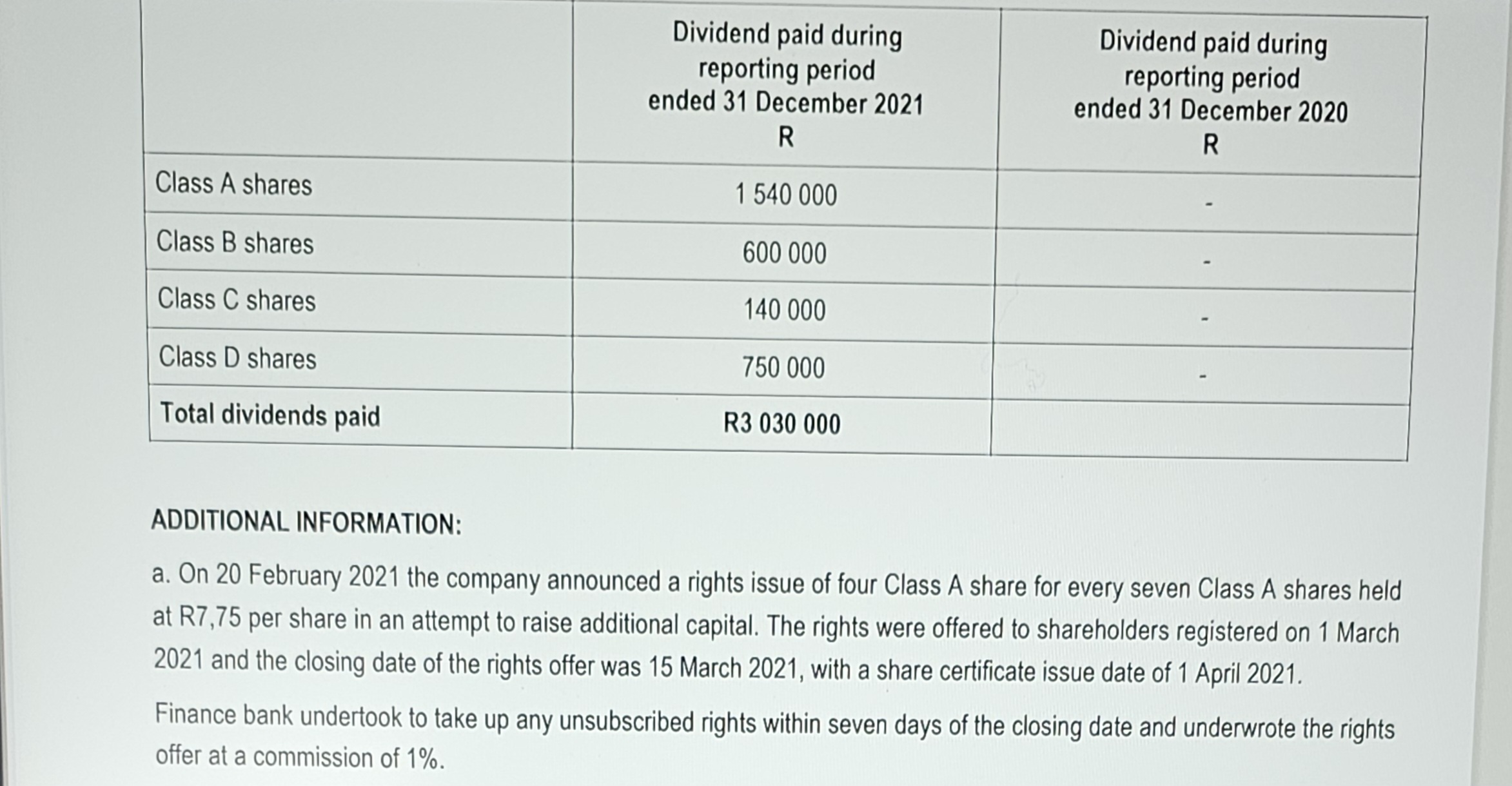

Adidas Ltd experienced liquidity problems during the reporting period ended December even though the company

made a profit, therefore no dividends were paid for that period. The following dividends were paid during the year ended

December : ADDITIONAL INFORMATION:

a On February the company announced a rights issue of four Class A share for every seven Class A shares held

at R per share in an attempt to raise additional capital. The rights were offered to shareholders registered on March

and the closing date of the rights offer was March with a share certificate issue date of April

Finance bank undertook to take up any unsubscribed rights within seven days of the closing date and underwrote the rights

offer at a commission of Adidas Ltd received applications amounting to Rfor shares Share issue costs excluding

underwriter's commission totalled R

The directors have concluded that this offer does not include a bonuselement for IAS Earnings per share purposes.

b An extract of the retained earnings as presented in the Statement of changes of equity of A Ltd for the year ended

December is as follows:REQUIRED:

QUESTION

Which classes of shares doesdo not represent equity in the records of Adidas Ltd Explain why you

are of this opinion.

Prepare the journals to recognise the rights issue of the Class A shares for the year ended December

as it should have been done in the books of Adidas Ltd Short journal narrations are required.

a On February the company announced a rights issue of four Class A share for every seven Class A shares held

at R per share in an attempt to raise additional capital. The rights were offered to shareholders registered on March

and the closing date of the rights offer was March with a share certificate issue date of April

Finance bank undertook to take up any unsubscribed rights within seven days of the closing date and underwrote the rights

offer at a commission of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started