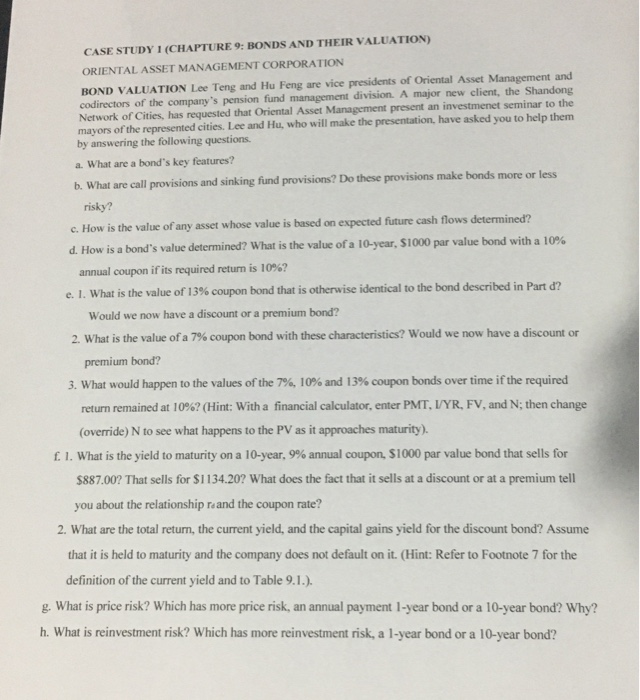

CASE STUDY I (CHAPTURE 9: BONDS AND THEIR VALUATION) ORIENTAL ASSET MANAGEMENT CORPORATION BOND VALUATION Lee Teng and Hu Feng are vice presidents of Oriental Asset Management and codirectors of the company's pension fund management division. A major new client, the Shandong Network of Cities, has requested that Oriental Asset Management present an investmenet seminar to the mayors of the represented cities. Lee and Hu, who will make the presentation, have asked you to help them by answering the following questions. a. What are a bond's key features? b. What are call provisions and sinking fund provisions? Do these provisions make bonds more or less risky? c. How is the value of any asset whose value is based on expected future cash flows determined? d. How is a bond's value determined? What is the value of a 10-year, 51000 par value bond with a 10% annual coupon if its required return is 10%? e. 1. What is the value of 13% coupon bond that is otherwise identical to the bond described in Part d? Would we now have a discount or a premium bond? 2. What is the value of a 7% coupon bond with these characteristics? Would we now have a discount or premium bond? 3. What would happen to the values of the 7%, 10% and 13% coupon bonds over time if the required return remained at 10%? (Hint: With a financial calculator, enter PMT, I/YR, FV, and N; then change (override) N to see what happens to the PV as it approaches maturity). f. 1. What is the yield to maturity on a 10-year, 9% annual coupon, 51000 par value bond that sells for $887.00? That sells for $1134.20? What does the fact that it sells at a discount or at a premium tell you about the relationship re and the coupon rate? 2. What are the total return, the current yield, and the capital gains yield for the discount bond? Assume that it is held to maturity and the company does not default on it. (Hint: Refer to Footnote 7 for the definition of the current yield and to Table 9.1.). g. What is price risk? Which has more price risk, an annual payment 1-year bond or a 10-year bond? Why? h. What is reinvestment risk? Which has more reinvestment risk, a 1-year bond or a 10-year bond