Question

Additional information: Third wave of the pandemic had a severe effect on global economy. This has caused the following to the business: Inventory as at

Additional information:

- Third wave of the pandemic had a severe effect on global economy. This has caused the following to the business:

- Inventory as at 31 March 2021 has a net realizable value at 70% of the cost

- 40% of credit customers have been declared bankrupt resulting in these debts being written off. This situation has forced the company to increase its allowance for doubtful debts to additional $25,000.

- Due to significant fall in the value of property, plant & equipment, company has decided to depreciate them at 20% per annum on cost.

- Following apportionment was decided by the company as following.

|

| Selling & Distribution Cost | General & Administrative Cost |

| Building (total 10,000 square feet) | 2,500 square feet | 7,500 square feet |

| Vehicle | 75% usage | 25% usage |

| Utilities | 50% usage | 50% usage |

| Insurance | 30% usage | 70% usage |

- Company made a final call for ordinary shares on 1 Jan 2021 and received all call cash by 28 February 2021.

- Company declared its final dividend. Due to the pandemic, company decided to declare a dividend of $0.02 per fully paid ordinary share held.

Company also decided to issue bonus issue of shares to ordinary shareholders to cushion a lower final dividend declared. Bonus issue of shares was made at 10 ordinary shares for 100 ordinary shares held valued at $2.00 each. Asset revaluation reserve was used to issue bonus shares. Bonus issue of share will not be entitled for divided.

- Company also issued a 6%, 4 year-Debenture for $200,000 on 1 October 2020 with cash received was banked in. This transaction has not been recorded in the books of account yet.

- Corporate tax is charged at 20%.

Required:

- Prepare notes to account for cost of sales, selling & distribution cost, general & administrative cost, finance cost and property plant and equipment.

- Prepare Statement of comprehensive income for the year ended 31 March 2021.

- Prepare Statement of changes in equity for the year ended 31 March 2021.

d. Prepare Statement of financial position as at 31 March 2021.

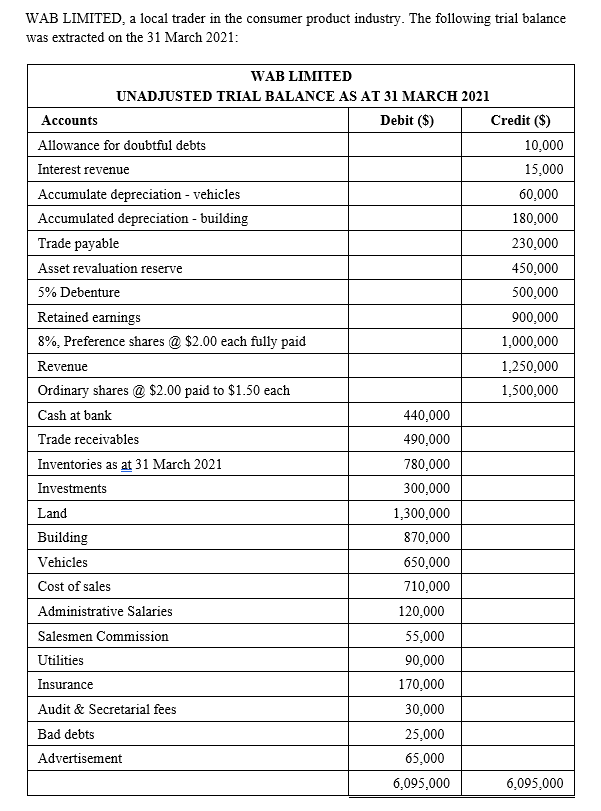

WAB LIMITED, a local trader in the consumer product industry. The following trial balance was extracted on the 31 March 2021: WAB LIMITED UNADJUSTED TRIAL BALANCE AS AT 31 MARCH 2021 Accounts Debit ($) Credit ($) Allowance for doubtful debts 10,000 Interest revenue 15,000 Accumulate depreciation - vehicles 60,000 Accumulated depreciation - building 180.000 Trade payable 230,000 Asset revaluation reserve 450,000 5% Debenture 500.000 Retained earnings 900,000 8%. Preference shares @ $2.00 each fully paid 1,000,000 Revenue 1,250,000 Ordinary shares @ $2.00 paid to $1.50 each 1,500,000 Cash at bank 440,000 Trade receivables 490,000 Inventories as at 31 March 2021 780,000 Investments 300,000 Land 1,300,000 Building 870,000 Vehicles 650,000 Cost of sales 710,000 Administrative Salaries 120,000 Salesmen Commission 55,000 Utilities 90,000 Insurance 170,000 Audit & Secretarial fees 30,000 Bad debts 25,000 Advertisement 65,000 6,095,000 6,095,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started