Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional information to answer question 6 is as follows: The investments are currently worth $13,000. It is estimated that $32,000 of the accounts receivable are

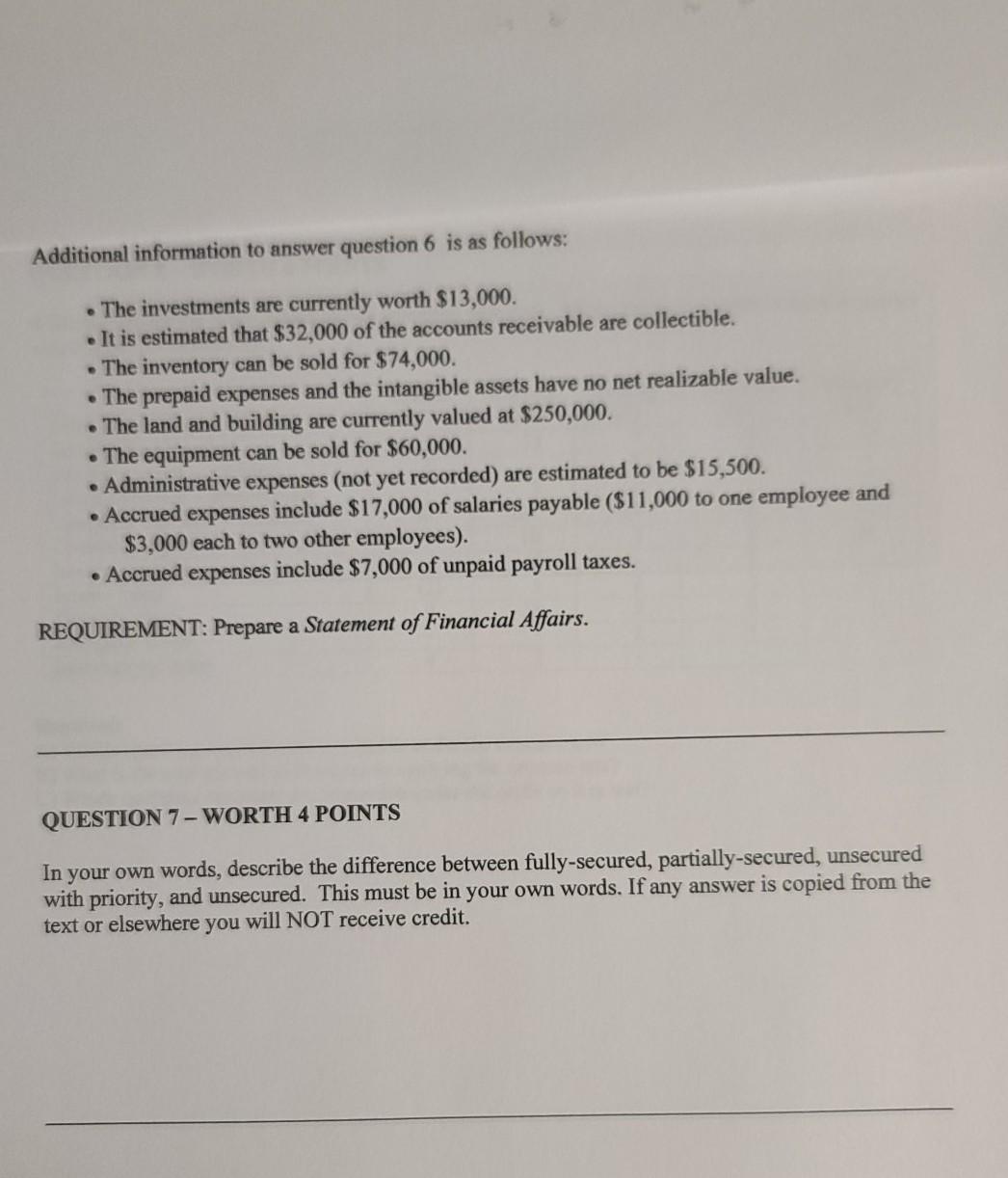

Additional information to answer question 6 is as follows: The investments are currently worth $13,000. It is estimated that $32,000 of the accounts receivable are collectible. The inventory can be sold for $74,000. The prepaid expenses and the intangible assets have no net realizable value. The land and building are currently valued at $250,000. The equipment can be sold for $60,000. Administrative expenses (not yet recorded) are estimated to be $15,500. Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees). Accrued expenses include $7,000 of unpaid payroll taxes. REQUIREMENT: Prepare a Statement of Financial Affairs. QUESTION 7 - WORTH 4 POINTS In your own words, describe the difference between fully-secured, partially-secured, unsecured with priority, and unsecured. This must be in your own words. If any answer is copied from the text or elsewhere you will NOT receive credit. Additional information to answer question 6 is as follows: The investments are currently worth $13,000. It is estimated that $32,000 of the accounts receivable are collectible. The inventory can be sold for $74,000. The prepaid expenses and the intangible assets have no net realizable value. The land and building are currently valued at $250,000. The equipment can be sold for $60,000. Administrative expenses (not yet recorded) are estimated to be $15,500. Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees). Accrued expenses include $7,000 of unpaid payroll taxes. REQUIREMENT: Prepare a Statement of Financial Affairs. QUESTION 7 - WORTH 4 POINTS In your own words, describe the difference between fully-secured, partially-secured, unsecured with priority, and unsecured. This must be in your own words. If any answer is copied from the text or elsewhere you will NOT receive credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started