ADDITIONAL INFORMATION TO ANSWER QUESTIONS:

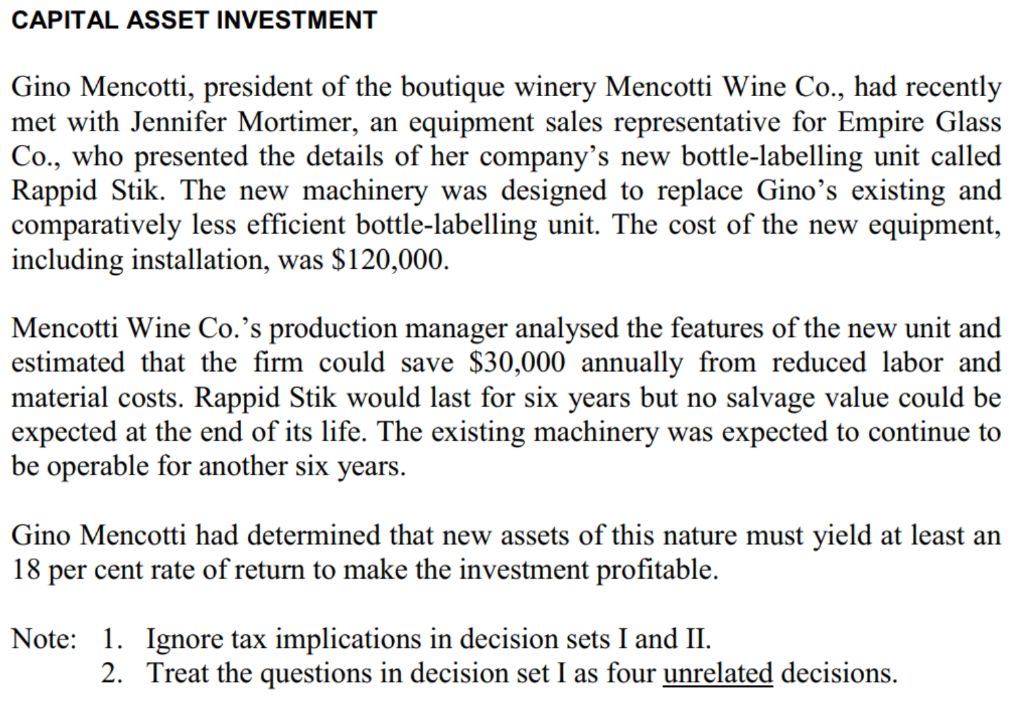

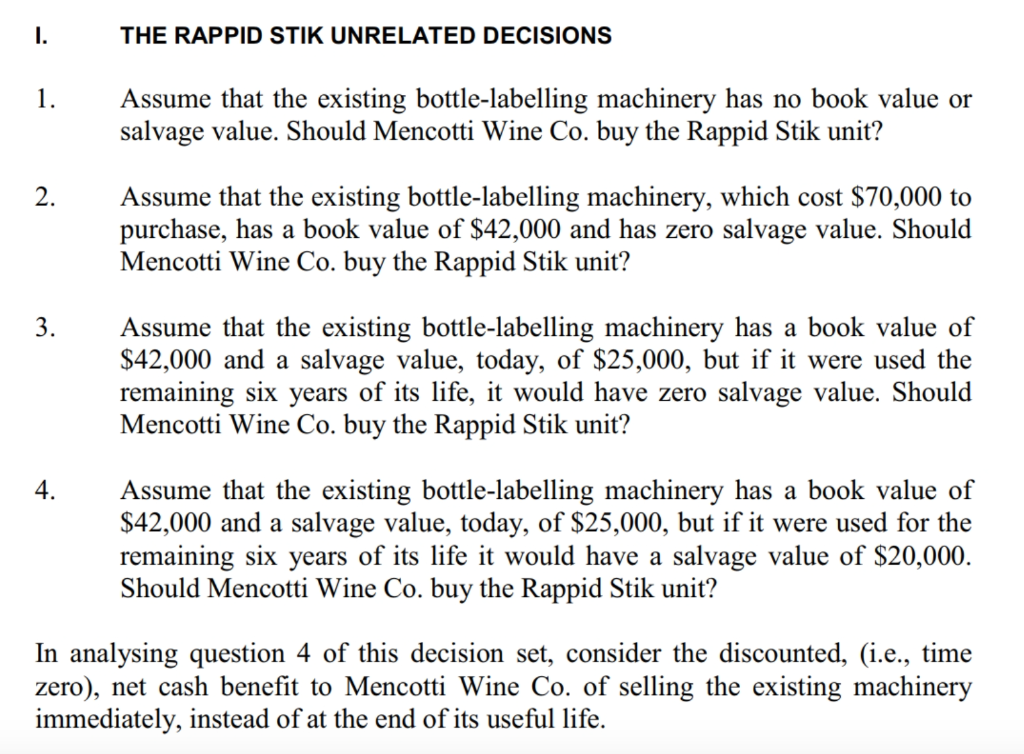

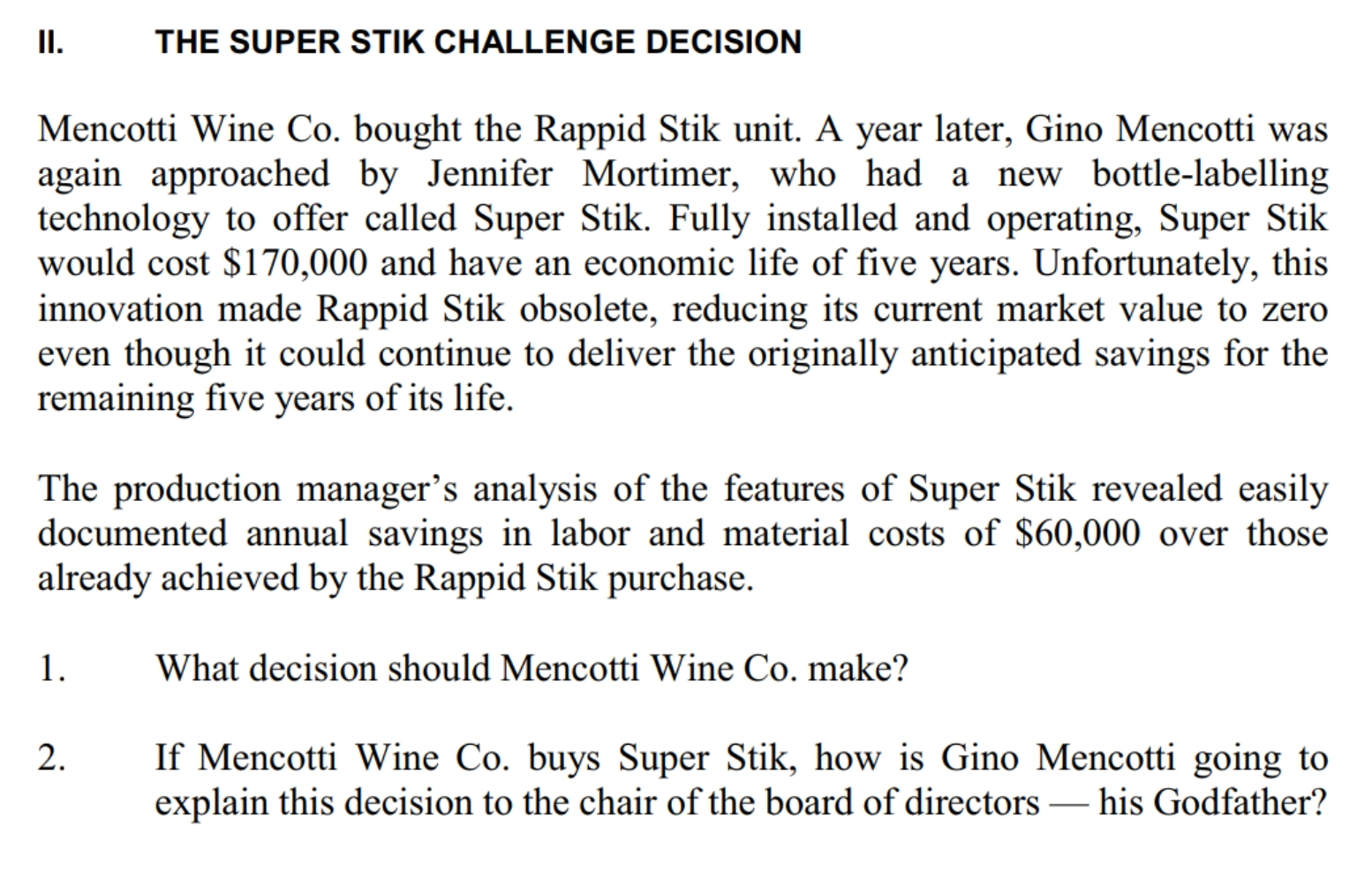

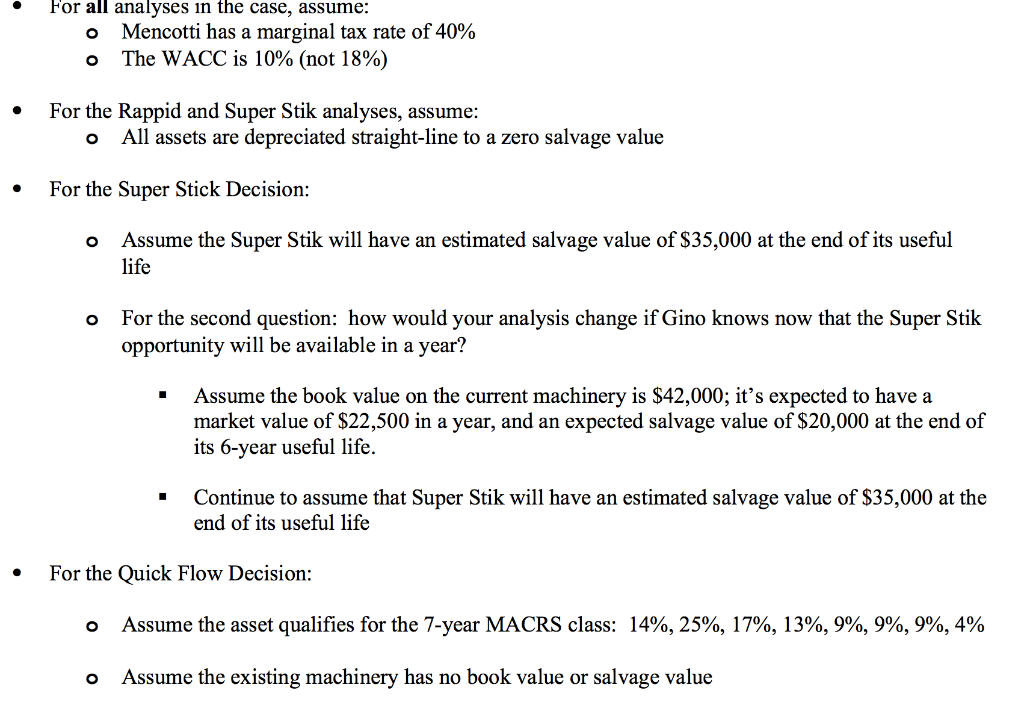

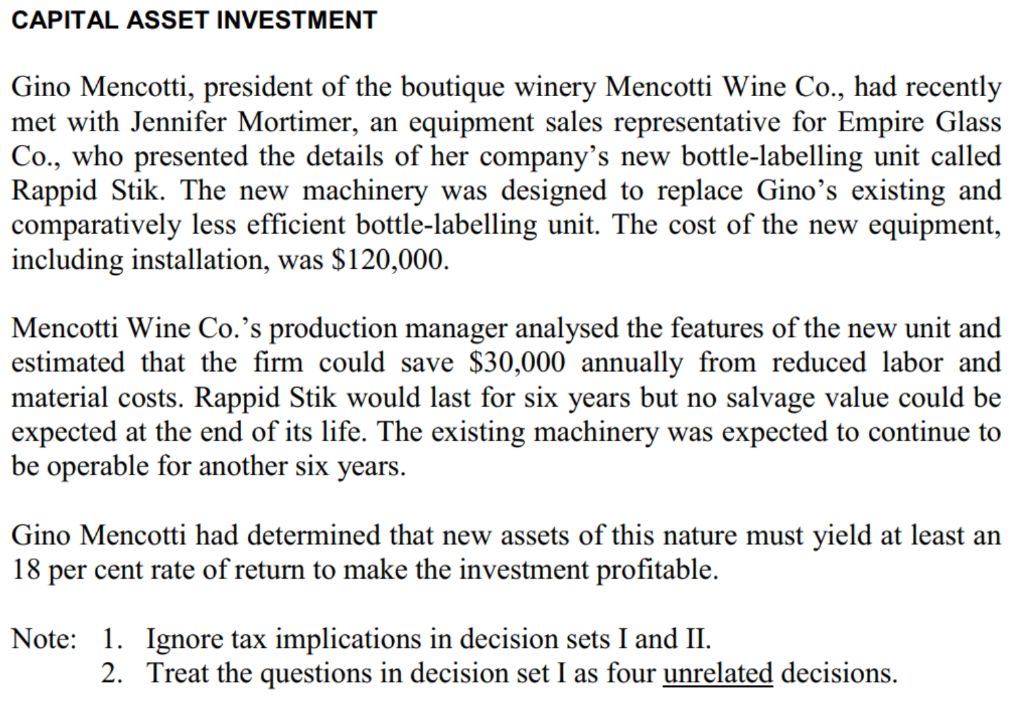

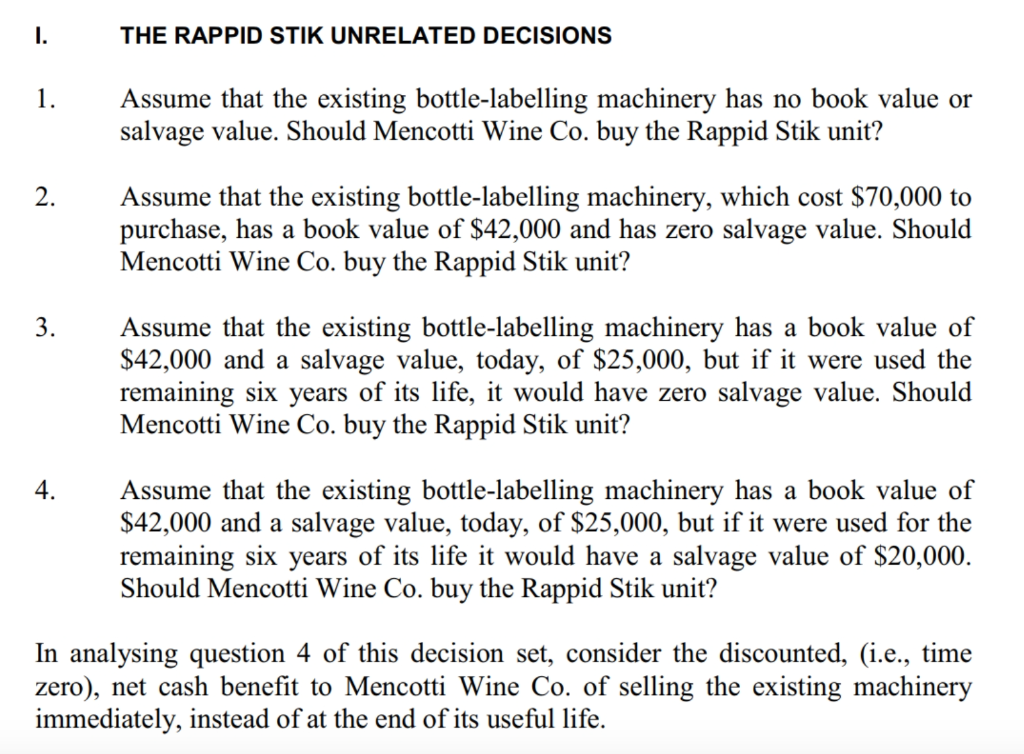

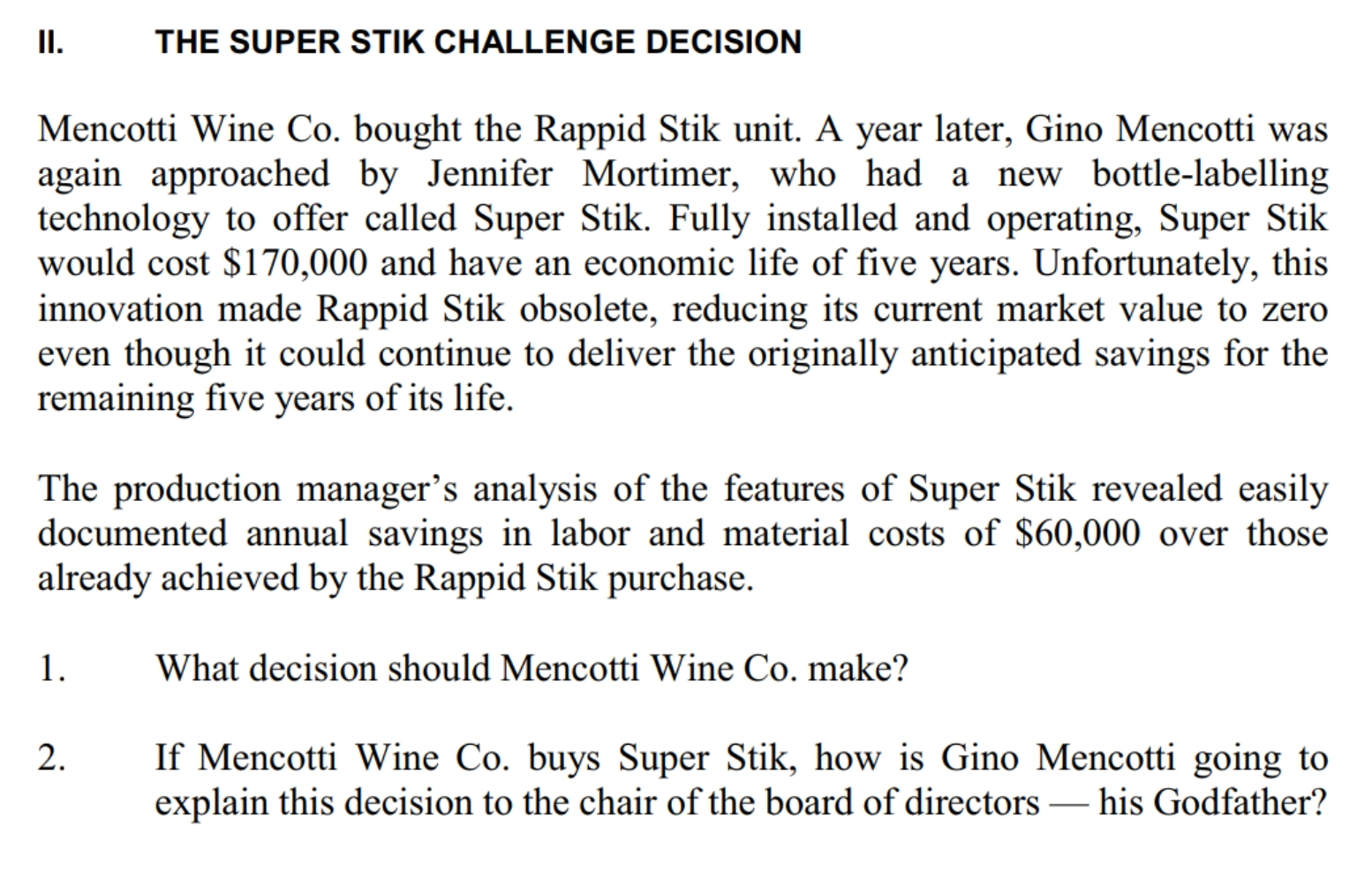

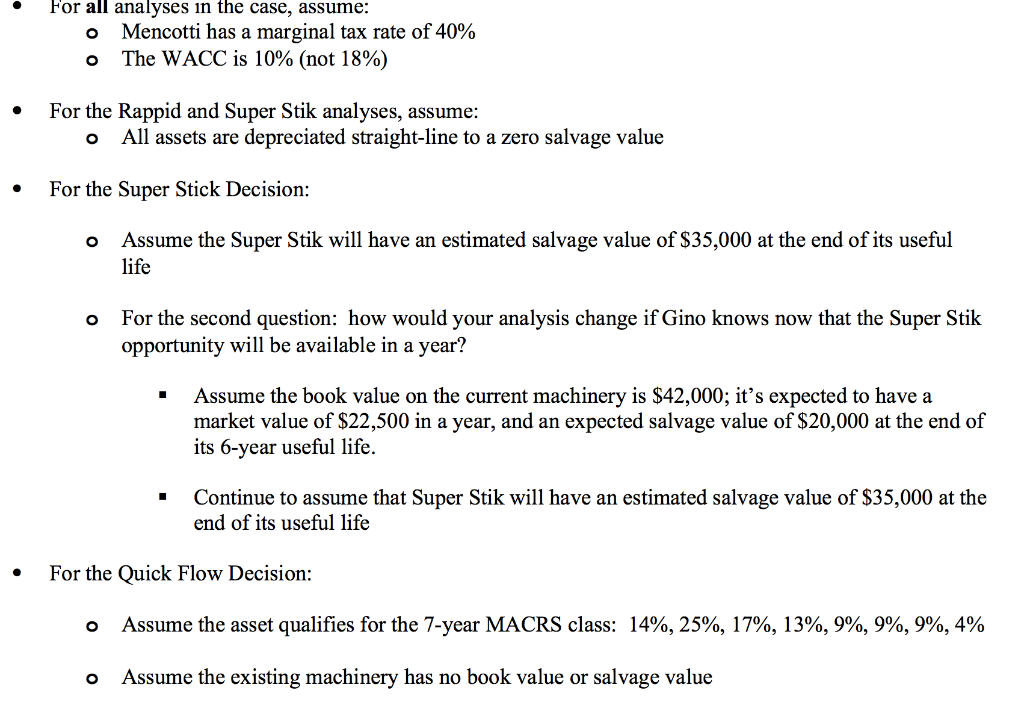

CAPITAL ASSET INVESTMENT Gino Mencotti, president of the boutique winery Mencotti Wine Co., had recently met with Jennifer Mortimer, an equipment sales representative for Empire Glass Co., who presented the details of her company's new bottle-labelling unit called Rappid Stik. The new machinery was designed to replace Gino's existing and comparatively less efficient bottle-labelling unit. The cost of the new equipment, including installation, was $120,000. Mencotti Wine Co.'s production manager analysed the features of the new unit and estimated that the firm could save $30,000 annually from reduced labor and material costs. Rappid Stik would last for six years but no salvage value could be expected at the end of its life. The existing machinery was expected to continue to be operable for another six years. Gino Mencotti had determined that new assets of this nature must yield at least an 18 per cent rate of return to make the investment profitable. Note: 1. Ignore tax implications in decision sets I and II. 2. Treat the questions in decision set I as four unrelated decisions. THE RAPPID STIK UNRELATED DECISIONS Assume that the existing bottle-labelling machinery has no book value or salvage value. Should Mencotti Wine Co. buy the Rappid Stik unit? Assume that the existing bottle-labelling machinery, which cost $70,000 to purchase, has a book value of $42,000 and has zero salvage value. Should Mencotti Wine Co. buy the Rappid Stik unit? 3. Assume that the existing bottle-labelling machinery has a book value of $42,000 and a salvage value, today, of $25,000, but if it were used the remaining six years of its life, it would have zero salvage value. Should Mencotti Wine Co. buy the Rappid Stik unit? 4. Assume that the existing bottle-labelling machinery has a book value of $42,000 and a salvage value, today, of $25,000, but if it were used for the remaining six years of its life it would have a salvage value of $20,000. Should Mencotti Wine Co. buy the Rappid Stik unit? In analysing question 4 of this decision set, consider the discounted, (i.e., time zero), net cash benefit to Mencotti Wine Co. of selling the existing machinery immediately, instead of at the end of its useful life. II. THE SUPER STIK CHALLENGE DECISION Mencotti Wine Co. bought the Rappid Stik unit. A year later, Gino Mencotti was again approached by Jennifer Mortimer, who had a new bottle-labelling technology to offer called Super Stik. Fully installed and operating, Super Stik would cost $170,000 and have an economic life of five years. Unfortunately, this innovation made Rappid Stik obsolete, reducing its current market value to zero even though it could continue to deliver the originally anticipated savings for the remaining five years of its life. The production manager's analysis of the features of Super Stik revealed easily documented annual savings in labor and material costs of $60,000 over those already achieved by the Rappid Stik purchase. 1. What decision should Mencotti Wine Co. make? 1. 2. If Mencotti Wine Co. buys Super Stik, how is Gino Mencotti going to explain this decision to the chair of the board of directors his Godfather? For all analyses in the case, assume: O Mencotti has a marginal tax rate of 40% o The WACC is 10% (not 18%) For the Rappid and Super Stik analyses, assume: o All assets are depreciated straight-line to a zero salvage value For the Super Stick Decision: o Assume the Super Stik will have an estimated salvage value of $35,000 at the end of its useful life O For the second question: how would your analysis change if Gino knows now that the Super Stik opportunity will be available in a year? Assume the book value on the current machinery is $42,000; it's expected to have a market value of $22,500 in a year, and an expected salvage value of $20,000 at the end of its 6-year useful life. Continue to assume that Super Stik will have an estimated salvage value of $35,000 at the end of its useful life For the Quick Flow Decision: o Assume the asset qualifies for the 7-year MACRS class: 14%, 25%, 17%, 13%, 9%, 9%, 9%, 4% o Assume the existing machinery has no book value or salvage value