Answered step by step

Verified Expert Solution

Question

1 Approved Answer

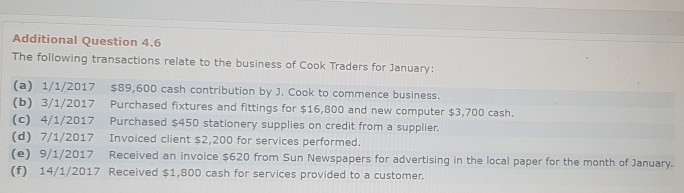

Additional Question 4.6 The following transactions relate to the business of Cook Traders for January: (a) 1/1/2017 $89,600 cash contribution by J. Cook to commence

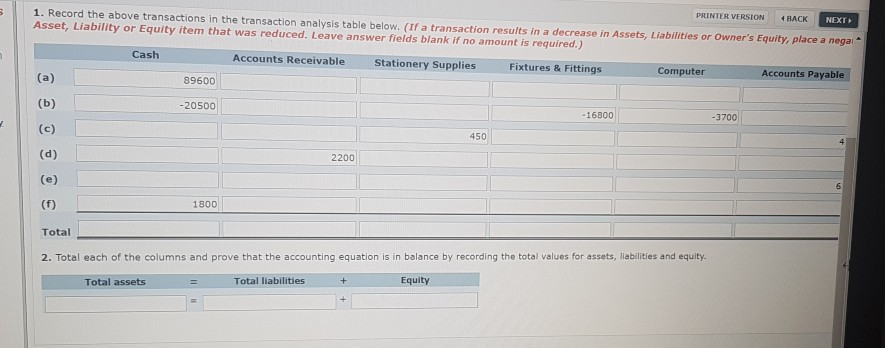

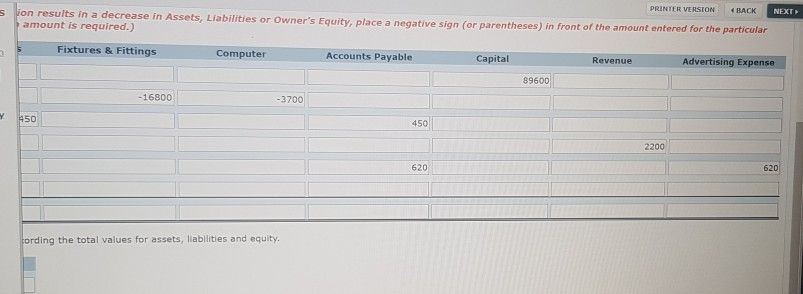

Additional Question 4.6 The following transactions relate to the business of Cook Traders for January: (a) 1/1/2017 $89,600 cash contribution by J. Cook to commence business. (b) 3/1/2017 Purchased fixtures and fittings for $16,800 and new computer $3,700 cash. (c) 4/1/2017 Purchased $450 stationery supplies on credit from a supplier. (d) 7/1/2017 Invoiced client $2,200 for services performed. (e) 9/1/2017 Received an invoice $620 from Sun Newspapers for advertising in the local paper for the month of January. (f) 14/1/2017 Received $1,800 cash for services provided to a customer. PRINTER VERSION 1. Record the above transactions in the transaction analysis table below. (If a transaction results in a decrease in Assets, Liabilities or Owner's Equity, place a negal Asset, Liability or Equity item that was reduced. Leave answer fields blank if no amount is required.) BACK NEXT Cash Accounts Receivable Stationery Supplies Fixtures & Fittings Computer Accounts Payable 89600 -20500 - 16800 -3700 @ @ OSO 2200 1800 Total 2. Total each of the columns and prove that the accounting equation is in balance by recording the total values for assets, liabilities and equity. Total assets Total liabilities Equity PRINTER VERSION BACK s Von results in a decrease in Assets, Liabilities or Owner's Equity, place a negative sign (or parentheses) in front of the amount entered for the particular amount is required.) NEXT Fixtures & Fittings Computer Accounts Payable Capital Revenue Advertising Expense 89600 -16800 -3700 450 2200 620 620 cording the total values for assets, liabilities and equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started