Answered step by step

Verified Expert Solution

Question

1 Approved Answer

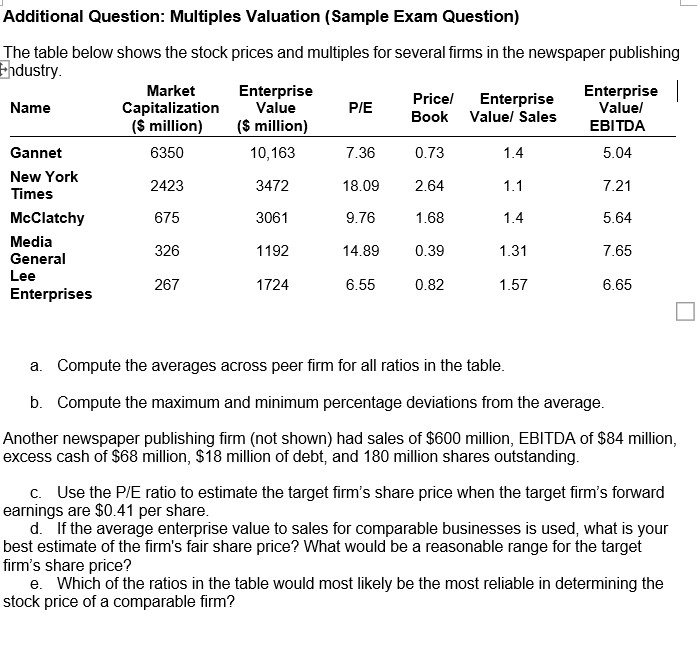

Additional Question Multiples Valuation ( Sample Exam Question ) The table below shows the stock prices and multiples for several firms in the newspaper publishingEnterprisEnterpriseCapitalizationValueEnterprise

Additional Question Multiples Valuation Sample Exam Question The table below shows the stock prices and multiples for several firms in the newspaper publishingEnterprisEnterpriseCapitalizationValueEnterprise sValue Sales EBITDAGannetew YorkltimesmclatchyMediaeneralEnterprisesa Compute the averages across peer firm for all ratios in the tableb Compute the maximum and minimum percentage deviations from the averageAnother newspaper publishing firm not shown had sales of $ million EBITDA of $ milionexcessof $ million S million of debt and million shares outstandingC Use the P E ratio to estimate the target firms share price when the target firms forwardearnings are $ per shareAs d If the average enterprise value to sales for comparable businesses is used what is yourst estimate of the firms fair share price What would be a reasonable range for the targfirm's share price e Which of the ratios in the table would most likely be the most reliable in determining thestock price of a comparable firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started