Additonal information :

Maintenance on Vehicle is at 3.5%

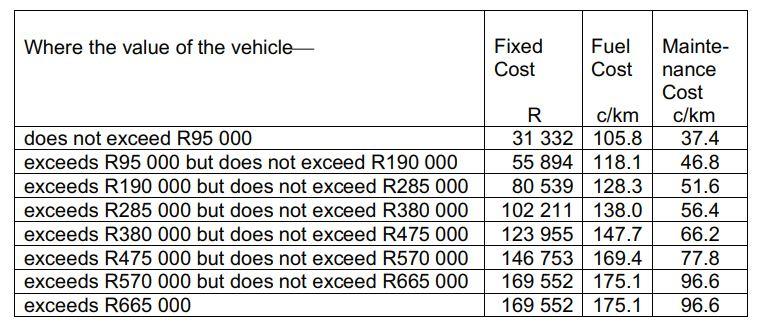

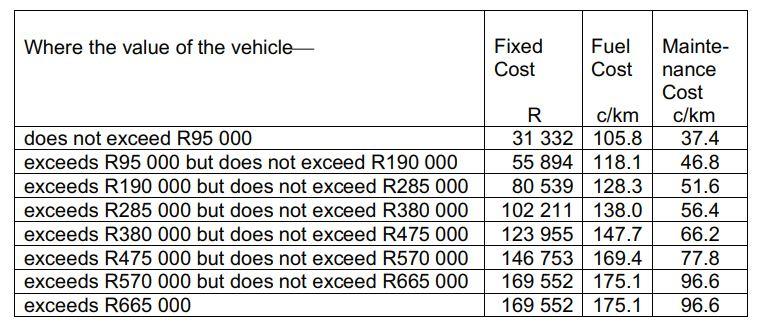

Fuel cost taxable for tax in south africa (RATES)

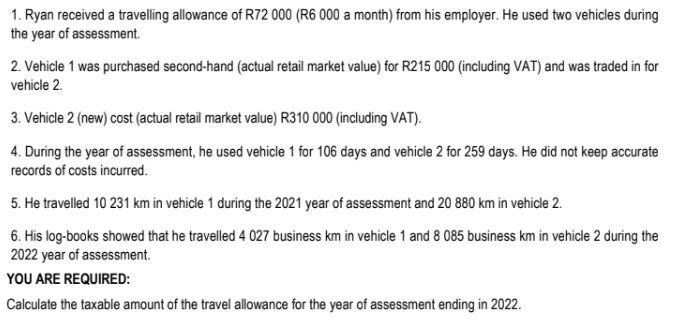

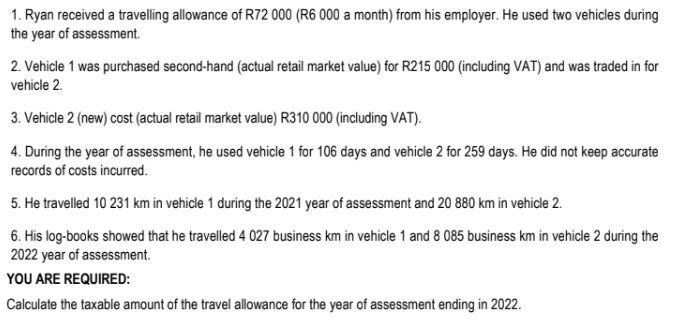

1. Ryan received a travelling allowance of R72 000 (R6 000 a month) from his employer. He used two vehicles during the year of assessment. 2. Vehicle 1 was purchased second-hand (actual retail market value) for R215 000 (including VAT) and was traded in for vehicle 2. 3. Vehicle 2 (new) cost (actual retail market value) R310 000 (including VAT). 4. During the year of assessment, he used vehicle 1 for 106 days and vehicle 2 for 259 days. He did not keep accurate records of costs incurred. 5. He travelled 10 231 km in vehicle 1 during the 2021 year of assessment and 20 880 km in vehicle 2. 6. His log-books showed that he travelled 4 027 business km in vehicle 1 and 8 085 business km in vehicle 2 during the 2022 year of assessment. YOU ARE REQUIRED: Calculate the taxable amount of the travel allowance for the year of assessment ending in 2022. Where the value of the vehicle does not exceed R95 000 exceeds R95 000 but does not exceed R190 000 exceeds R190 000 but does not exceed R285 000 exceeds R285 000 but does not exceed R380 000 exceeds R380 000 but does not exceed R475 000 exceeds R475 000 but does not exceed R570 000 exceeds R570 000 but does not exceed R665 000 exceeds R665 000 Fixed Cost R 31 332 55 894 80 539 102 211 123 955 146 753 169 552 169 552 Fuel Mainte- Cost c/km 105.8 118.1 128.3 138.0 147.7 169.4 175.1 175.1 nance Cost c/km 37.4 46.8 51.6 56.4 66.2 77.8 96.6 96.6 1. Ryan received a travelling allowance of R72 000 (R6 000 a month) from his employer. He used two vehicles during the year of assessment. 2. Vehicle 1 was purchased second-hand (actual retail market value) for R215 000 (including VAT) and was traded in for vehicle 2. 3. Vehicle 2 (new) cost (actual retail market value) R310 000 (including VAT). 4. During the year of assessment, he used vehicle 1 for 106 days and vehicle 2 for 259 days. He did not keep accurate records of costs incurred. 5. He travelled 10 231 km in vehicle 1 during the 2021 year of assessment and 20 880 km in vehicle 2. 6. His log-books showed that he travelled 4 027 business km in vehicle 1 and 8 085 business km in vehicle 2 during the 2022 year of assessment. YOU ARE REQUIRED: Calculate the taxable amount of the travel allowance for the year of assessment ending in 2022. Where the value of the vehicle does not exceed R95 000 exceeds R95 000 but does not exceed R190 000 exceeds R190 000 but does not exceed R285 000 exceeds R285 000 but does not exceed R380 000 exceeds R380 000 but does not exceed R475 000 exceeds R475 000 but does not exceed R570 000 exceeds R570 000 but does not exceed R665 000 exceeds R665 000 Fixed Cost R 31 332 55 894 80 539 102 211 123 955 146 753 169 552 169 552 Fuel Mainte- Cost c/km 105.8 118.1 128.3 138.0 147.7 169.4 175.1 175.1 nance Cost c/km 37.4 46.8 51.6 56.4 66.2 77.8 96.6 96.6