Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AdDOLLS A Heading 5 Normal 1 No Spac.. Heading 1 Heading 2 Heading 6 Paragraph Problem - 1 On March 12, 2013. Admiral Electronics sold

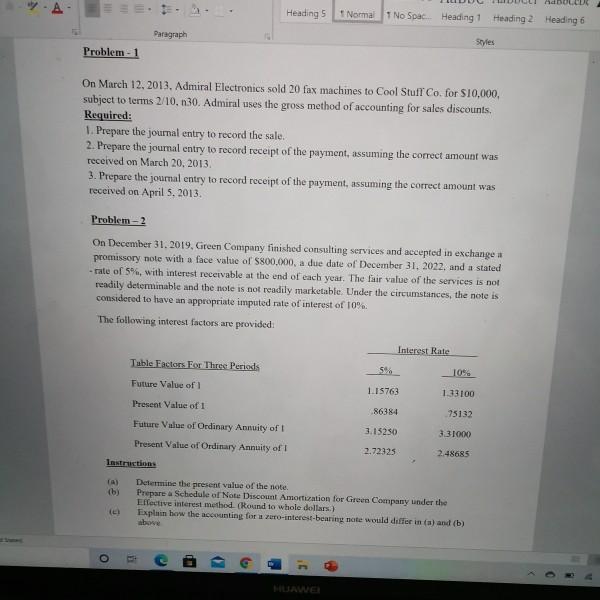

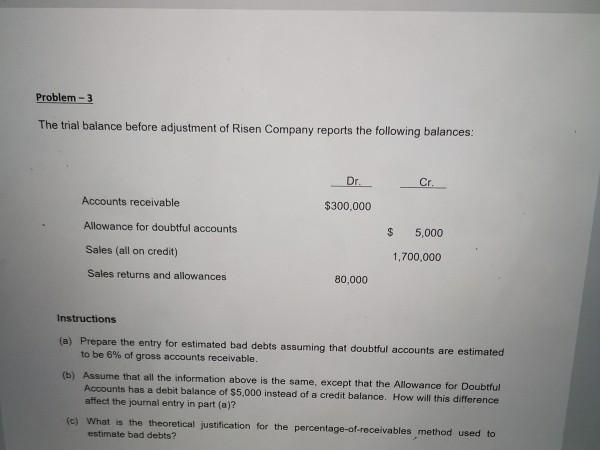

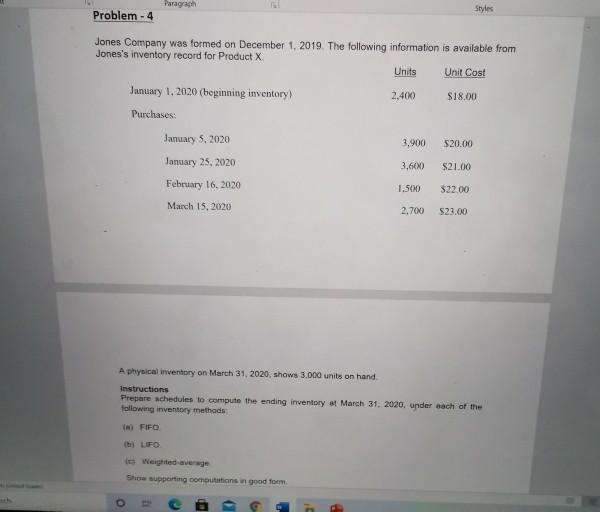

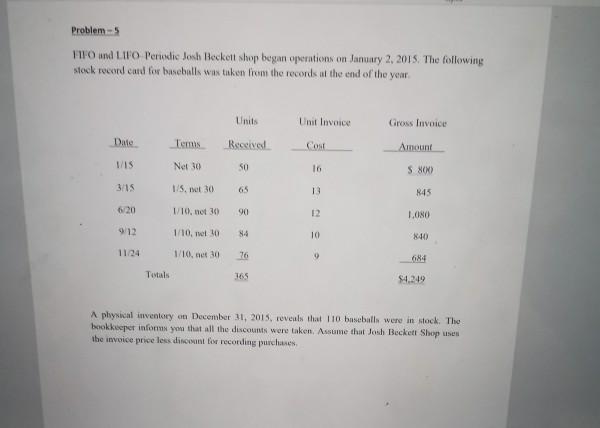

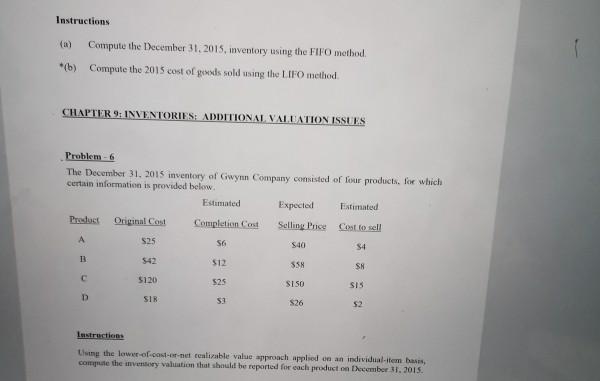

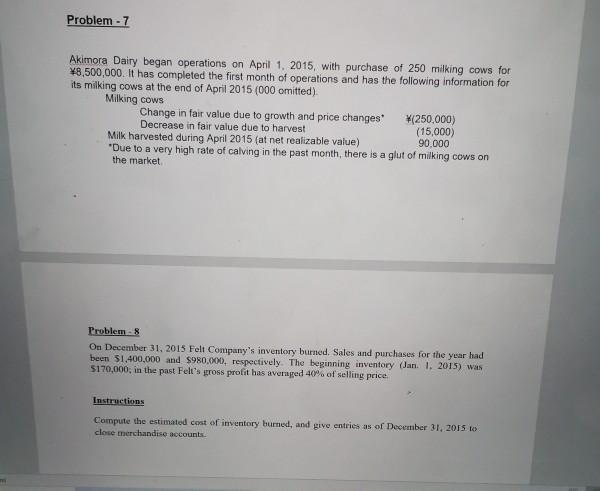

AdDOLLS A Heading 5 Normal 1 No Spac.. Heading 1 Heading 2 Heading 6 Paragraph Problem - 1 On March 12, 2013. Admiral Electronics sold 20 fax machines to Cool Stult Co. for $10,000, subject to terms 2/10,n30. Admiral uses the gross method of accounting for sales discounts. Required: 1. Prepare the journal entry to record the sale. 2. Prepare the journal entry to record receipt of the payment, assuming the correct amount was received on March 20.2013 3. Prepare the journal entry to record receipt of the payment, assuming the correct amount was received on April 5, 2013. Problem - 2 On December 31, 2019. Green Company finished consulting services and accepted in exchange a promissory note with a face value of $800.000, a due date of December 31, 2022. and a stated - rate of 5%, with interest receivable at the end of each year. The fair value of the services is not readily determinable and the note is not readily marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of interest of 10%. The following interest factors are provided Interest Rate Table Factors For Three Periods 5% 10% Future Value of 1 1. 15763 1.33100 Present Value of 1 86384 75132 Future Value of Ordinary Annuity of Present Value of Ordinary Annuity of 3.15250 3.31000 2.72325 2.48685 Instructions (A) Determine the present value of the note Prepare a Schedule of Note Discount Amortization for Green Company under the Effective interest method (Round to whole dollars.) Explain how the accounting for interest-bearing not would differ in ta) and (b) above Problem - 3 The trial balance before adjustment of Risen Company reports the following balances: Cr Accounts receivable $300.000 $ 5,000 Allowance for doubtful accounts Sales (all on credit) Sales returns and allowances 1,700,000 80,000 Instructions (a) Prepare the entry for estimated bad debts assuming that doubtful accounts are estimated to be 6% of gross accounts receivable. (b) Assume that all the information above is the same, except that the Allowance for Doubtful Accounts has a debit balance of $5,000 instead of a credit balance. How will this difference affect the journal entry in part (a)? (c) What is the theoretical justification for the percentage-of-receivables method used to estimate bad debts? Paragraph Styles Problem - 4 Jones Company was formed on December 1, 2019. The following information is available from Jones's inventory record for Product X Units Unit Cost January 1, 2020 (beginning inventory 2.400 $18.00 Purchases: January 5, 2020 3.900 $20.00 3,600 $21.00 January 25, 2020 February 16, 2020 1.500 $22.00 March 15, 2020 2.700 523.00 A physical inventory on March 31, 2020. shows 3.000 units on hand Instructions Prepare schedules to compute the ending inventory at March 31, 2020, under each of the following inventory methods (a) FIFO LIFO Weighted average Show supporting options in good for o 6 Problems FIFO and LIFO Periodic Josh Beckett shop began operations on January 2, 2015. The following stock record card for baseballs was taken from the records at the end of the year Units Umit Invoice Gross Invoice Date Temis Received Cost Amount 1/15 Net 30 So 16 S 800 1/5.30 65 13 845 1/10), not 30 90 12 LONO 912 1/10.10 84 10 840 1/10, net 30 76 Totals 165 $4.249 A physical inventory on December 31, 2015, reveals that 110 baseballs were in stock. The bookkeeper inform you that all the discounts were taken. Assume that Josh Beckett Shop uses the invoice price less discount for recording purchases Instructions Compute the December 31, 2015, inventory using the FIFO method (b) Compute the 2015 cost of gods sold using the LIFO method CHAPTER 9: INVENTORIES: ADDITIONAL VALLATION ISSUES Probleme The December 31, 2015 inventory of Gwynn Company consisted of four products for which certain information is provided below Estimated Expected Estimated Original Cost Completion Cost Selling Price Cost o sell 525 S6 540 54 13 512 SSN SN 5120 525 SISO SIS D SIR S3 $26 52 Lastructions Using the lower-of-cost-e-nut calable value approach applied on an individual-item bass, compute the inventory valuation that should be reported for each product on December 31, 2015 Problem - 7 Akimora Dairy began operations on April 1, 2015, with purchase of 250 milking cows for 48,500,000. It has completed the first month of operations and has the following information for its milking cows at the end of April 2015 (000 omitted) Milking cows Change in fair value due to growth and price changes #(250,000) Decrease in fair value due to harvest (15,000) Milk harvested during April 2015 (at net realizable value) 90.000 "Due to a very high rate of calving in the past month, there is a glut of milking cows on the market Problem - 8 On December 31, 2015 Felt Company's inventory burned. Sales and purchases for the year had been $1,400,000 and $980,000, respectively. The beginning inventory (Jan. 1. 2015) was 5170,000, in the past Felt's gross profit has averaged 40% of selling price Instructions Compute the estimated cost of inventory burned, and give entries as of December 31, 2015 to close merchandise accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started