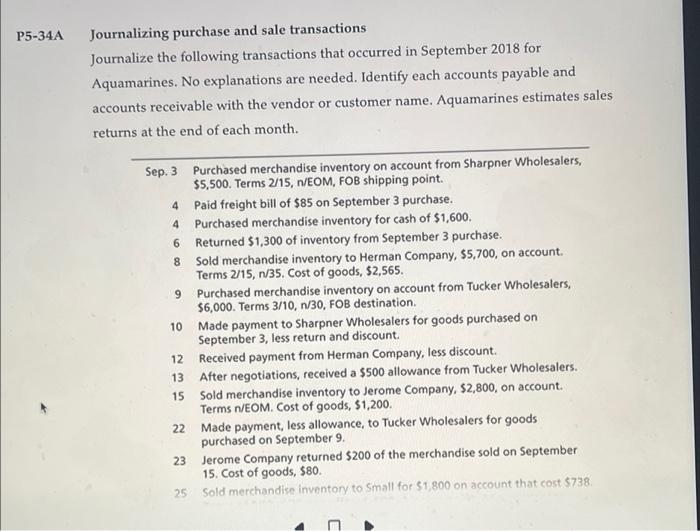

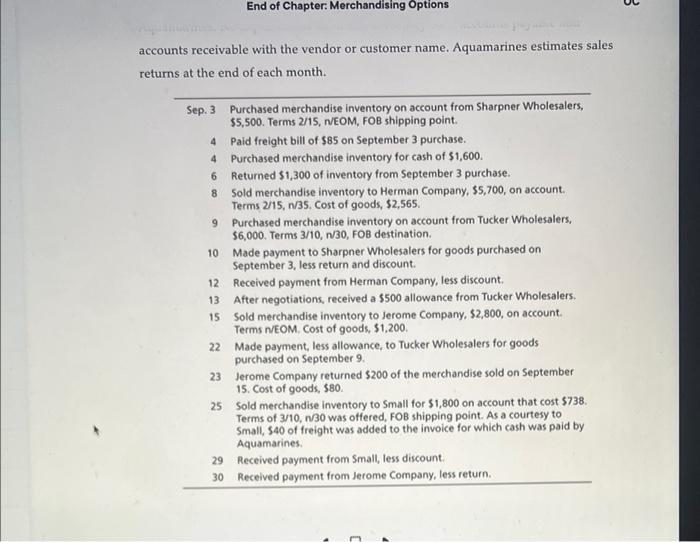

P5-34A Journalizing purchase and sale transactions Journalize the following transactions that occurred in September 2018 for Aquamarines. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Aquamarines estimates sales returns at the end of each month. Sep. 3 Purchased merchandise inventory on account from Sharpner Wholesalers, $5,500. Terms 2/15, n/EOM, FOB shipping point. 4 Paid freight bill of $85 on September 3 purchase. 4 Purchased merchandise inventory for cash of $1,600. 6 Returned $1,300 of inventory from September 3 purchase. 8 Sold merchandise inventory to Herman Company, $5,700, on account. Terms 2/15, n/35. Cost of goods, $2,565. 9 Purchased merchandise inventory on account from Tucker Wholesalers, $6,000. Terms 3/10, n/30, FOB destination. 10 Made payment to Sharpner Wholesalers for goods purchased on September 3, less return and discount. 12 Received payment from Herman Company, less discount. 13 After negotiations, received a $500 allowance from Tucker Wholesalers. 15 Sold merchandise inventory to Jerome Company, $2,800, on account. Terms n/EOM. Cost of goods, $1,200. 22 Made payment, less allowance, to Tucker Wholesalers for goods purchased on September 9. 23 Jerome Company returned $200 of the merchandise sold on September 15. Cost of goods, $80. 25 Sold merchandise inventory to Small for $1,800 on account that cost $738. End of Chapter: Merchandising Options accounts receivable with the vendor or customer name. Aquamarines estimates sales returns at the end of each month. Sep. 3 Purchased merchandise inventory on account from Sharpner Wholesalers, $5,500. Terms 2/15, n/EOM, FOB shipping point. 4 Paid freight bill of $85 on September 3 purchase. 4 Purchased merchandise inventory for cash of $1,600. 6 Returned $1,300 of inventory from September 3 purchase. 8 Sold merchandise inventory to Herman Company, $5,700, on account. Terms 2/15, n/35. Cost of goods, $2,565. 9 Purchased merchandise inventory on account from Tucker Wholesalers, $6,000. Terms 3/10, n/30, FOB destination. 10 Made payment to Sharpner Wholesalers for goods purchased on September 3, less return and discount. 12 Received payment from Herman Company, less discount. 13 After negotiations, received a $500 allowance from Tucker Wholesalers. 15 Sold merchandise inventory to Jerome Company, $2,800, on account. Terms n/EOM. Cost of goods, $1,200. 22 Made payment, less allowance, to Tucker Wholesalers for goods purchased on September 9. 23 Jerome Company returned $200 of the merchandise sold on September 15. Cost of goods, $80. 25 Sold merchandise inventory to Small for $1,800 on account that cost $738. Terms of 3/10, n/30 was offered, FOB shipping point. As a courtesy to Small, $40 of freight was added to the invoice for which cash was paid by Aquamarines. 29 Received payment from Small, less discount. 30 Received payment from Jerome Company, less return. 3