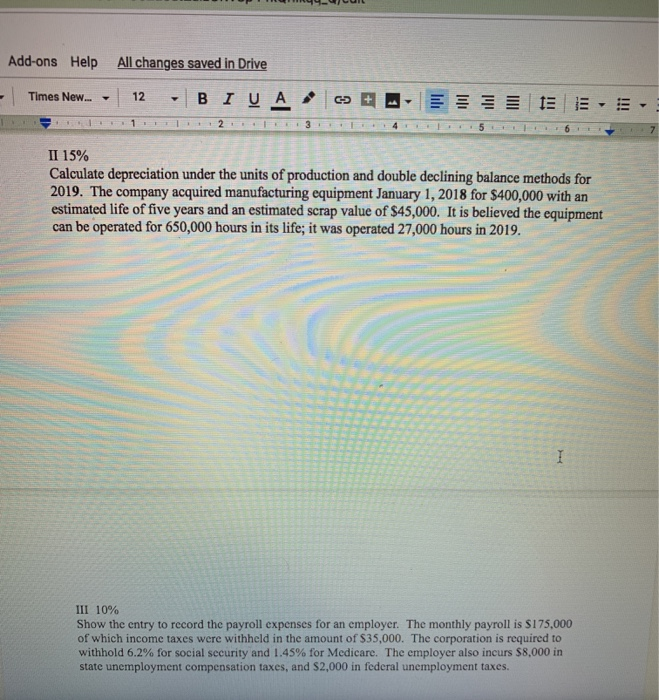

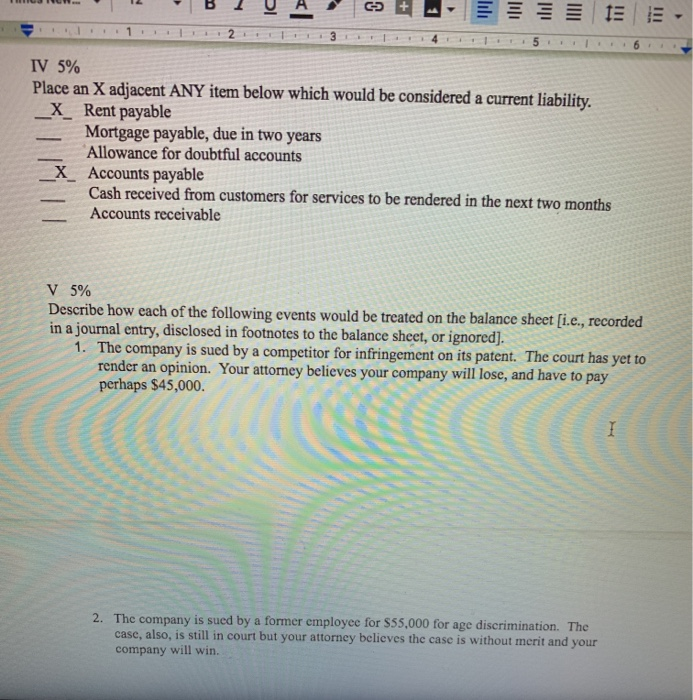

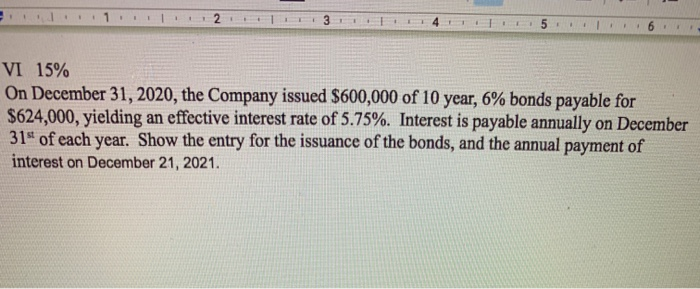

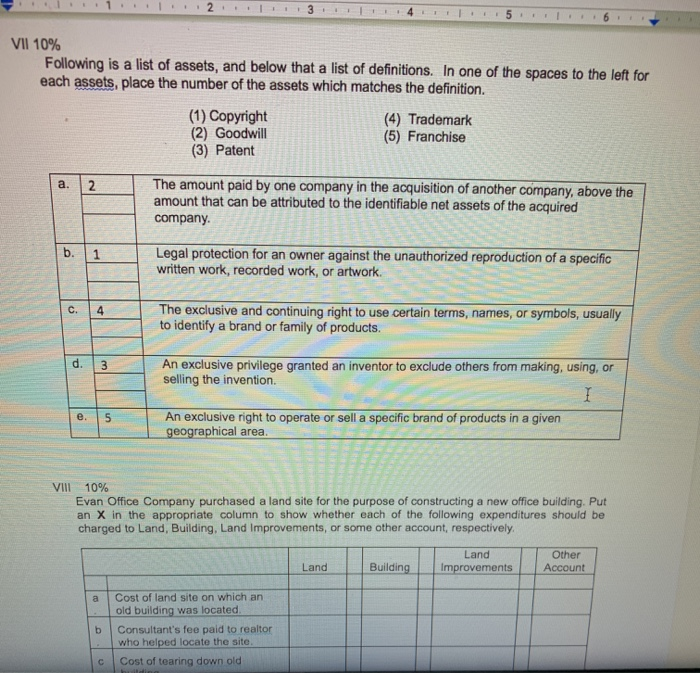

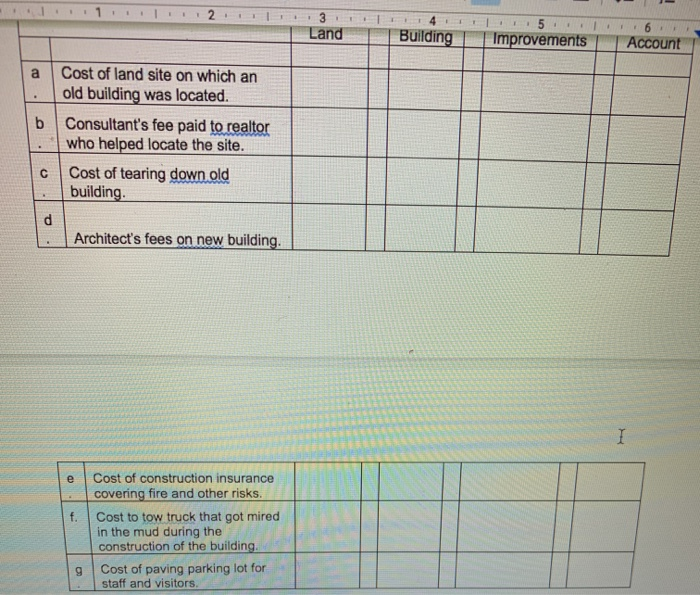

Add-ons Help All changes saved in Drive - Times New... - 12 - BI UA E IEEE 1.2. 134 LFL 56 II 15% Calculate depreciation under the units of production and double declining balance methods for 2019. The company acquired manufacturing equipment January 1, 2018 for $400,000 with an estimated life of five years and an estimated scrap value of $45,000. It is believed the equipment can be operated for 650,000 hours in its life; it was operated 27,000 hours in 2019, III 10% Show the entry to record the payroll expenses for an employer. The monthly payroll is $175,000 of which income taxes were withheld in the amount of $35.000. The corporation is required to withhold 6.2% for social security and 1.45% for Medicare. The employer also incurs $8,000 in state unemployment compensation taxes, and S2,000 in federal unemployment taxes. . .. 1 .2 . 3 4 5 6 IV 5% Place an X adjacent ANY item below which would be considered a current liability. _X_ Rent payable Mortgage payable, due in two years Allowance for doubtful accounts Accounts payable Cash received from customers for services to be rendered in the next two months Accounts receivable V5% Describe how each of the following events would be treated on the balance sheet [i.e., recorded in a journal entry, disclosed in footnotes to the balance sheet, or ignored). 1. The company is sued by a competitor for infringement on its patent. The court has yet to render an opinion. Your attorney believes your company will lose, and have to pay perhaps $45,000. 2. The company is sued by a former employee for $55,000 for age discrimination. The case, also, is still in court but your attorney believes the case is without merit and your company will win. 121 ITTL4L 5 . 6 VI 15% On December 31, 2020, the Company issued $600,000 of 10 year, 6% bonds payable for $624,000, yielding an effective interest rate of 5.75%. Interest is payable annually on December 31 of each year. Show the entry for the issuance of the bonds, and the annual payment of interest on December 21, 2021. VII 10% Following is a list of assets, and below that a list of definitions. In one of the spaces to the left for each assets, place the number of the assets which matches the definition. (1) Copyright (2) Goodwill (3) Patent (4) Trademark (5) Franchise The amount paid by one company in the acquisition of another company, above the amount that can be attributed to the identifiable net assets of the acquired company Legal protection for an owner against the unauthorized reproduction of a specific written work, recorded work, or artwork The exclusive and continuing right to use certain terms, names, or symbols, usually to identify a brand or family of products. An exclusive privilege granted an inventor to exclude others from making, using, or selling the invention. An exclusive right to operate or sell a specific brand of products in a given geographical area. VIII 10% Evan Office Company purchased a land site for the purpose of constructing a new office building. Put an X in the appropriate column to show whether each of the following expenditures should be charged to Land, Building, Land Improvements, or some other account, respectively Land Improvements Building Other Account Land Cost of land site on which an old building was located Consultant's fee paid to realtor who helped locate the site Cost of tearing down old 1 1 2 3 4 Building Land | Improvements Account Cost of land site on which an old building was located. Consultant's fee paid to realtor who helped locate the site. Cost of tearing down old building. Architect's fees on new building. Cost of construction insurance covering fire and other risks. Cost to tow truck that got mired in the mud during the construction of the building. Cost of paving parking lot for staff and visitors. g