Address the questions below with explanation

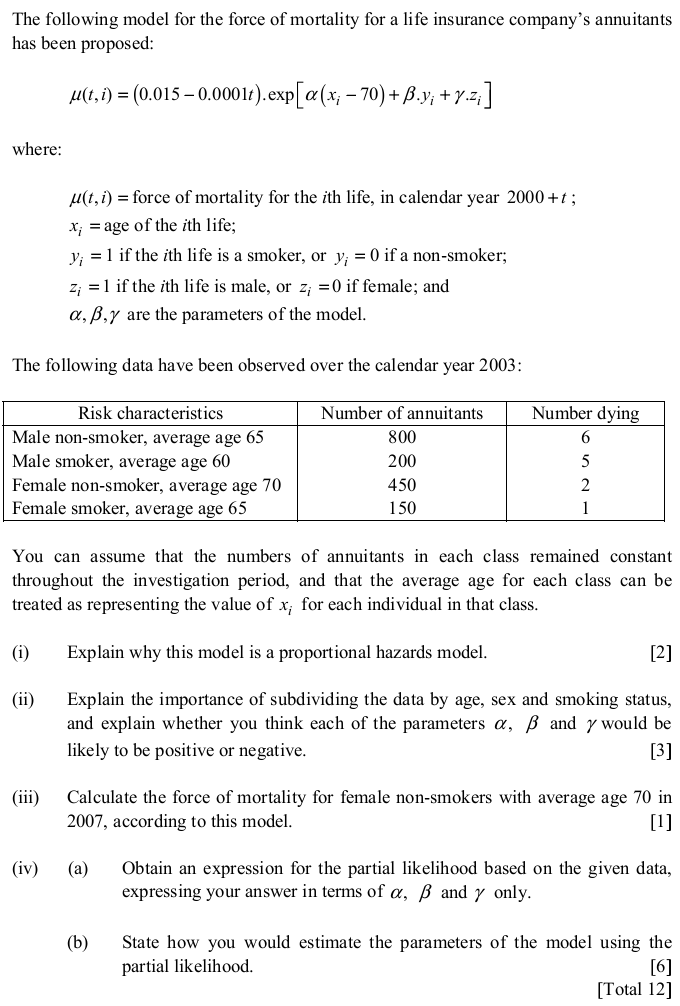

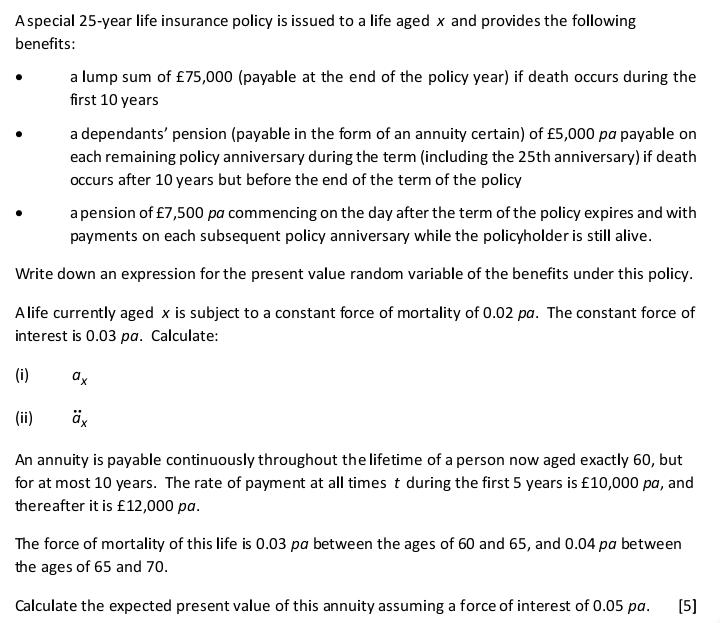

The following model for the force of mortality for a life insurance company's annuitants has been proposed: u(t, i) = (0.015 -0.0001t). expo(x; -70) + B.y; + y.z;] where: u(t, i) = force of mortality for the ith life, in calendar year 2000 +t ; x; = age of the ith life; y; = 1 if the ith life is a smoker, or y; = 0 if a non-smoker; z; =1 if the ith life is male, or z; =0 if female; and a, B, y are the parameters of the model. The following data have been observed over the calendar year 2003: Risk characteristics Number of annuitants Number dying Male non-smoker, average age 65 800 Male smoker, average age 60 200 -NUO Female non-smoker, average age 70 450 Female smoker, average age 65 150 You can assume that the numbers of annuitants in each class remained constant throughout the investigation period, and that the average age for each class can be treated as representing the value of x; for each individual in that class. (i) Explain why this model is a proportional hazards model. [2] (ii) Explain the importance of subdividing the data by age, sex and smoking status, and explain whether you think each of the parameters o, B and y would be likely to be positive or negative. [3] (iii) Calculate the force of mortality for female non-smokers with average age 70 in 2007, according to this model. [1] (iv) (a) Obtain an expression for the partial likelihood based on the given data, expressing your answer in terms of a, B and y only. (b) State how you would estimate the parameters of the model using the partial likelihood. [6] [Total 12]Aspecial 25-year life insurance policy is issued to a life aged x and provides the following benefits: a lump sum of $75,000 (payable at the end of the policy year) if death occurs during the first 10 years a dependants' pension (payable in the form of an annuity certain) of $5,000 pa payable on each remaining policy anniversary during the term (including the 25th anniversary) if death occurs after 10 years but before the end of the term of the policy a pension of f7,500 pa commencing on the day after the term of the policy expires and with payments on each subsequent policy anniversary while the policyholder is still alive. Write down an expression for the present value random variable of the benefits under this policy. Alife currently aged x is subject to a constant force of mortality of 0.02 pa. The constant force of interest is 0.03 pa. Calculate: ax (ii) ax An annuity is payable continuously throughout the lifetime of a person now aged exactly 60, but for at most 10 years. The rate of payment at all times t during the first 5 years is f10,000 pa, and thereafter it is f12,000 pa. The force of mortality of this life is 0.03 pa between the ages of 60 and 65, and 0.04 pa between the ages of 65 and 70. Calculate the expected present value of this annuity assuming a force of interest of 0.05 pa. [5]