Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adelaide Ltd acquired a 100 percent (100%) interest in Figtree Ltd on 1 January 2021. The following information is related to the financial year

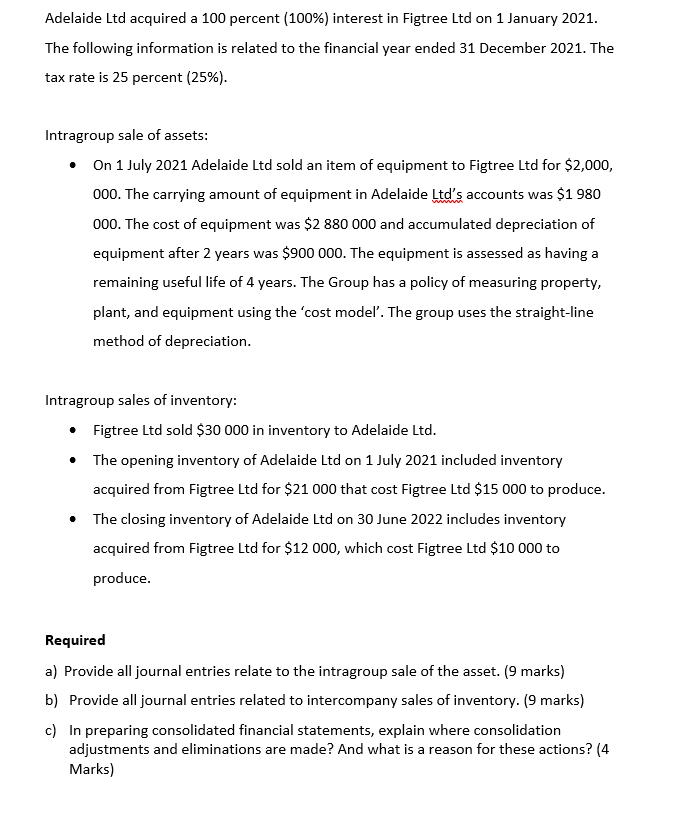

Adelaide Ltd acquired a 100 percent (100%) interest in Figtree Ltd on 1 January 2021. The following information is related to the financial year ended 31 December 2021. The tax rate is 25 percent (25%). Intragroup sale of assets: On 1 July 2021 Adelaide Ltd sold an item of equipment to Figtree Ltd for $2,000, 000. The carrying amount of equipment in Adelaide Ltd's accounts was $1 980 000. The cost of equipment was $2 880 000 and accumulated depreciation of equipment after 2 years was $900 000. The equipment is assessed as having a remaining useful life of 4 years. The Group has a policy of measuring property, plant, and equipment using the 'cost model'. The group uses the straight-line method of depreciation. Intragroup sales of inventory: . Figtree Ltd sold $30 000 in inventory to Adelaide Ltd. The opening inventory of Adelaide Ltd on 1 July 2021 included inventory acquired from Figtree Ltd for $21 000 that cost Figtree Ltd $15 000 to produce. The closing inventory of Adelaide Ltd on 30 June 2022 includes inventory acquired from Figtree Ltd for $12 000, which cost Figtree Ltd $10 000 to produce. Required a) Provide all journal entries relate to the intragroup sale of the asset. (9 marks) b) Provide all journal entries related to intercompany sales of inventory. (9 marks) c) In preparing consolidated financial statements, explain where consolidation adjustments and eliminations are made? And what is a reason for these actions? (4 Marks)

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Profit on sale 20000001980000 20000 Date Account Dr Cr 20211231 Profit on sale of asset 20000 PL a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started