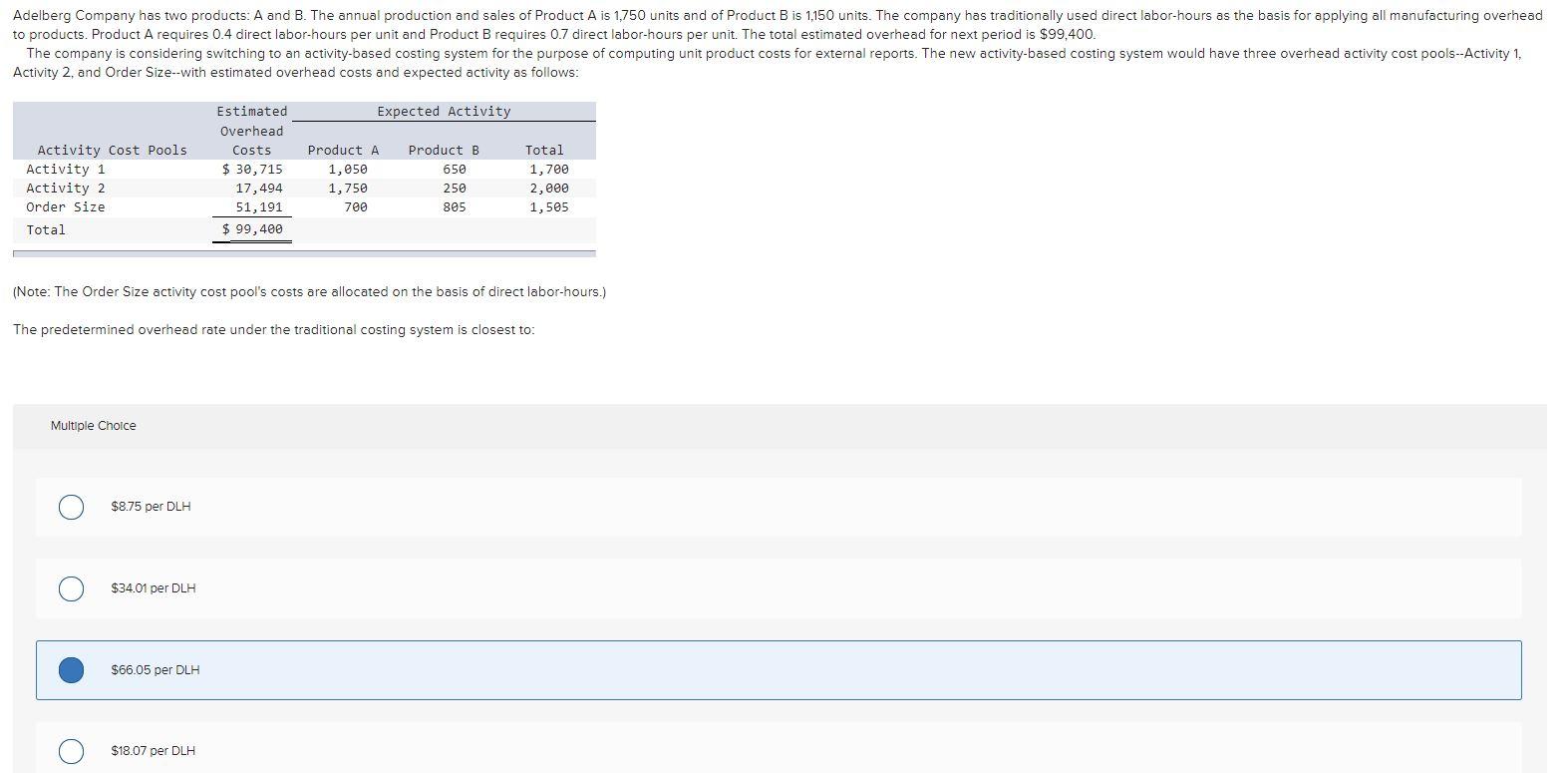

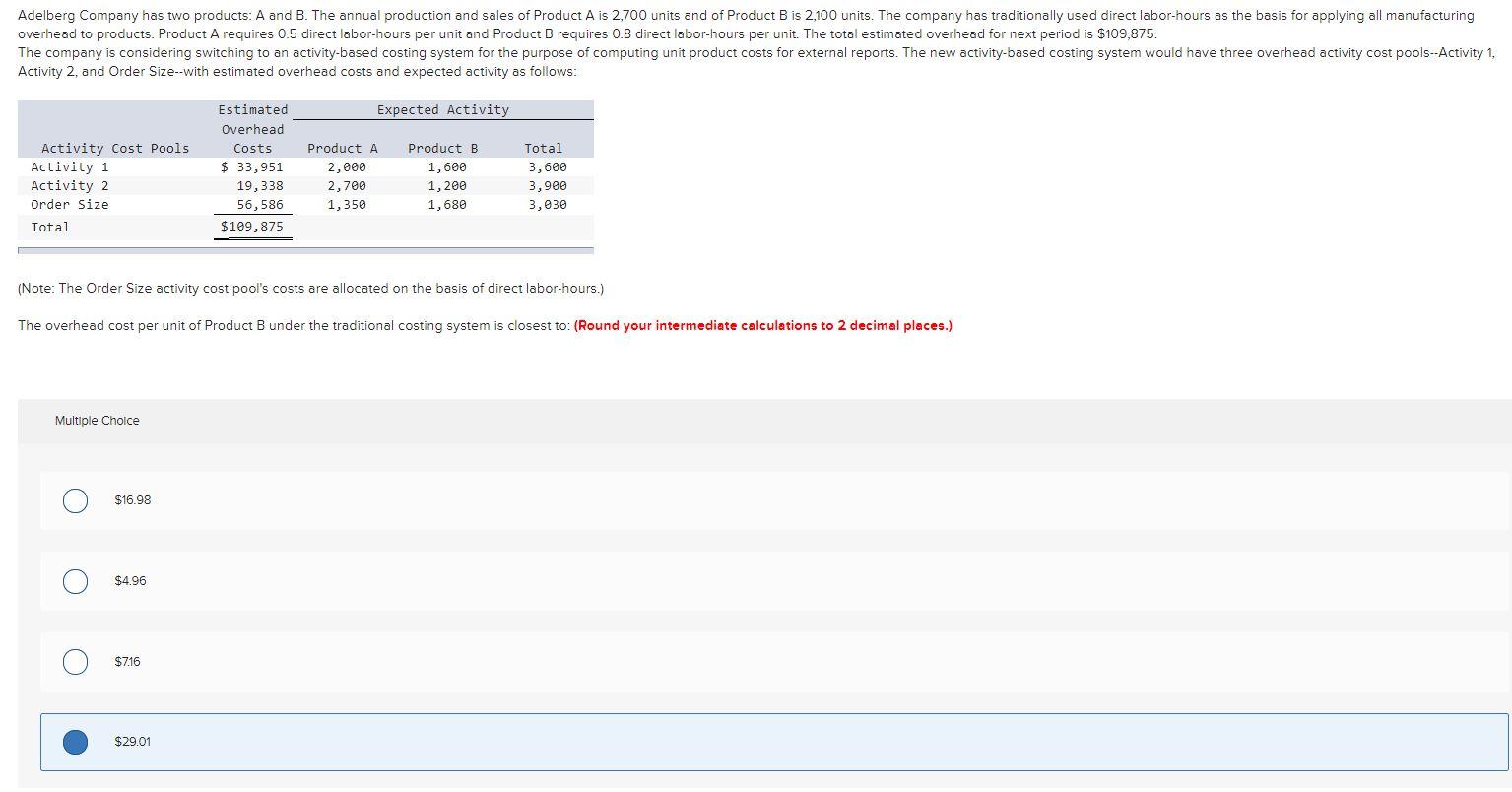

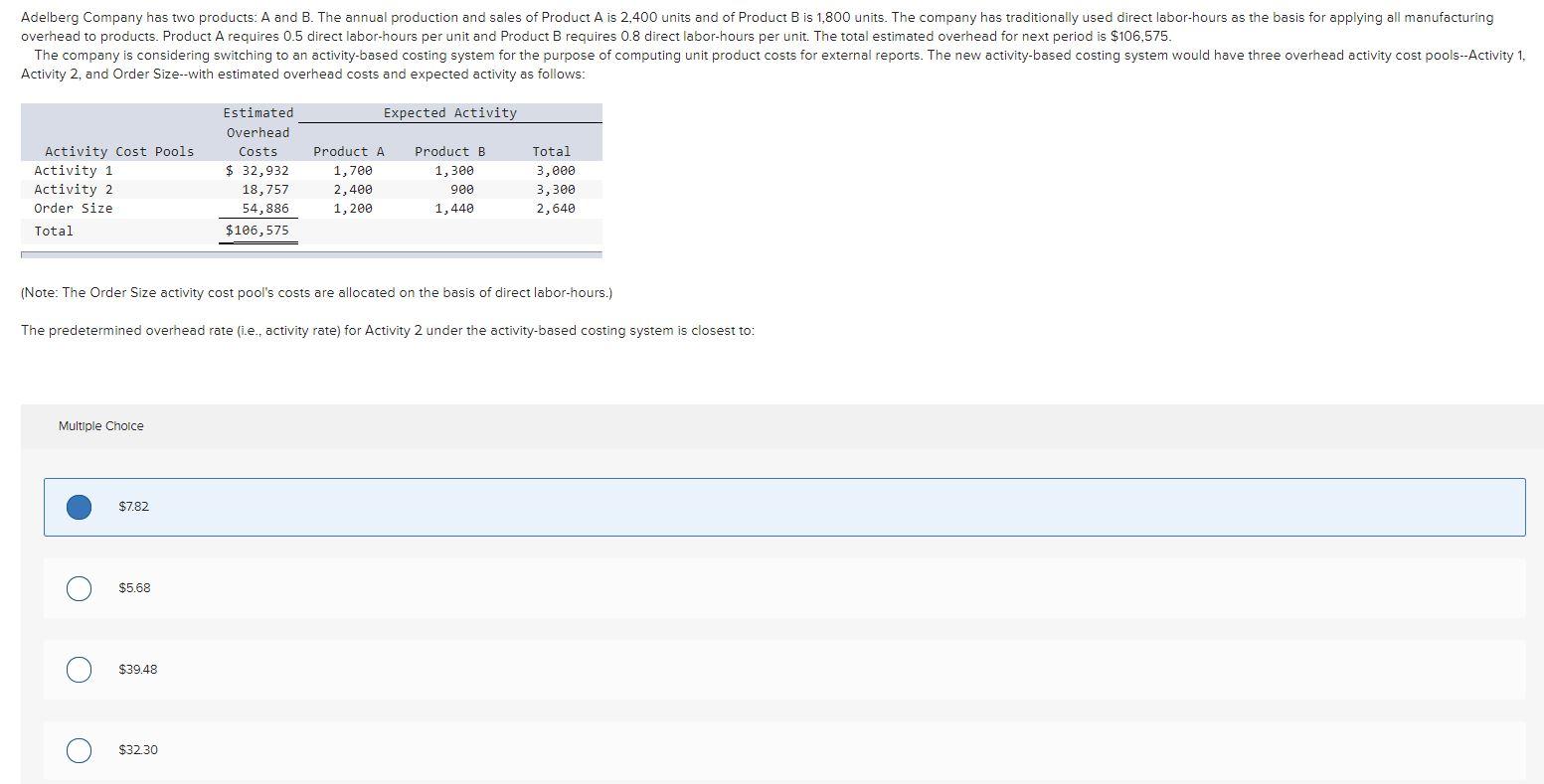

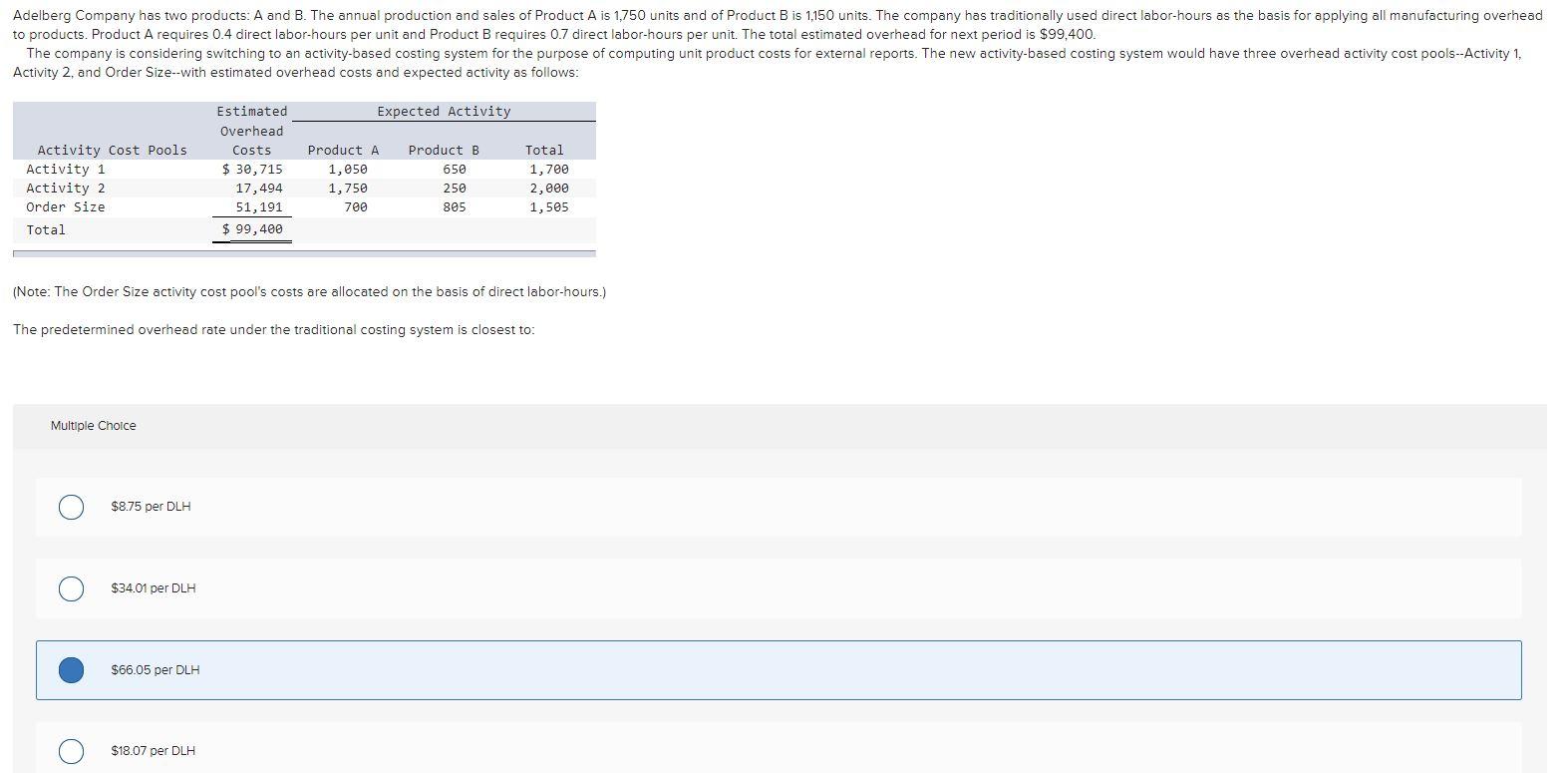

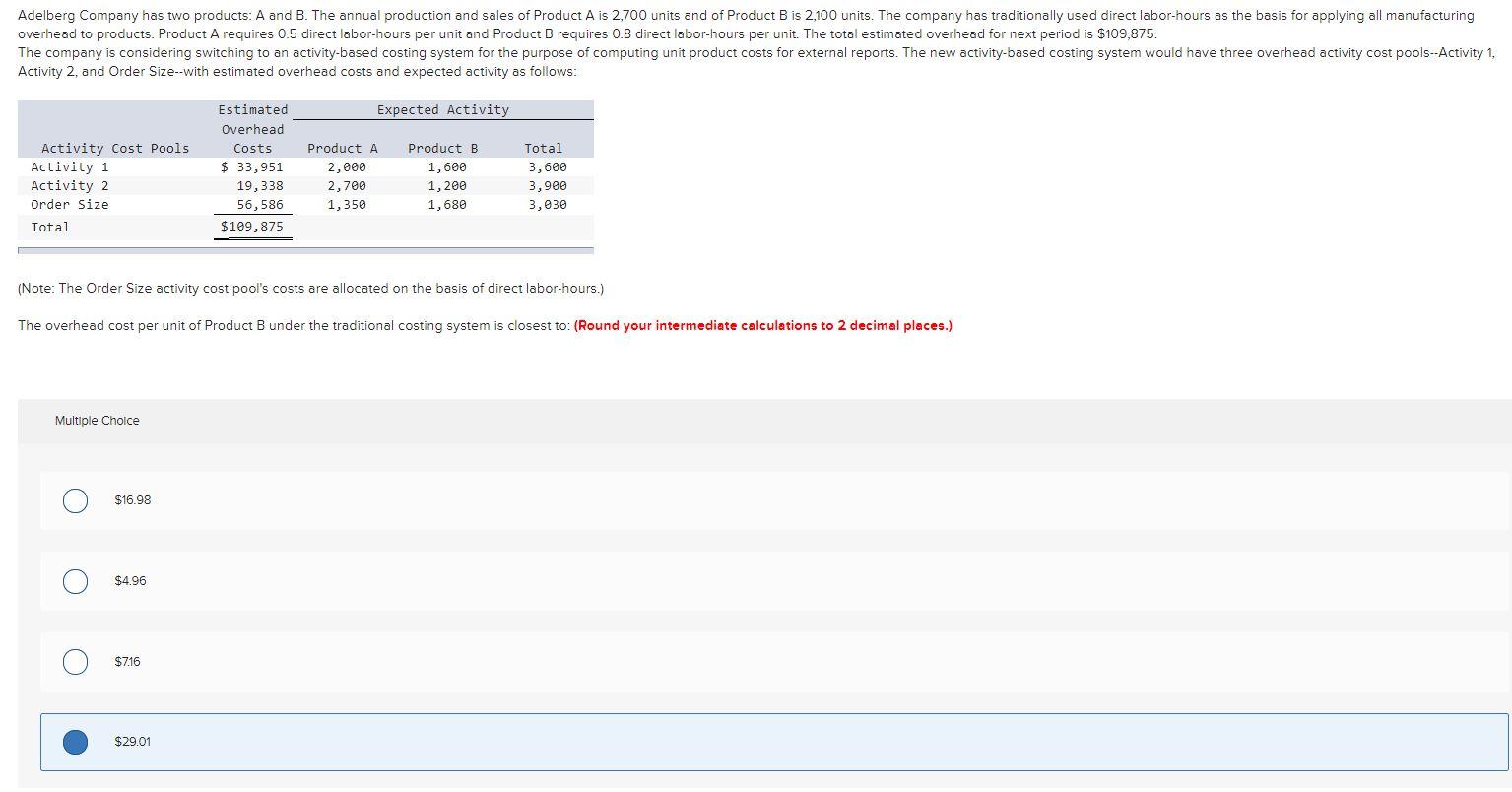

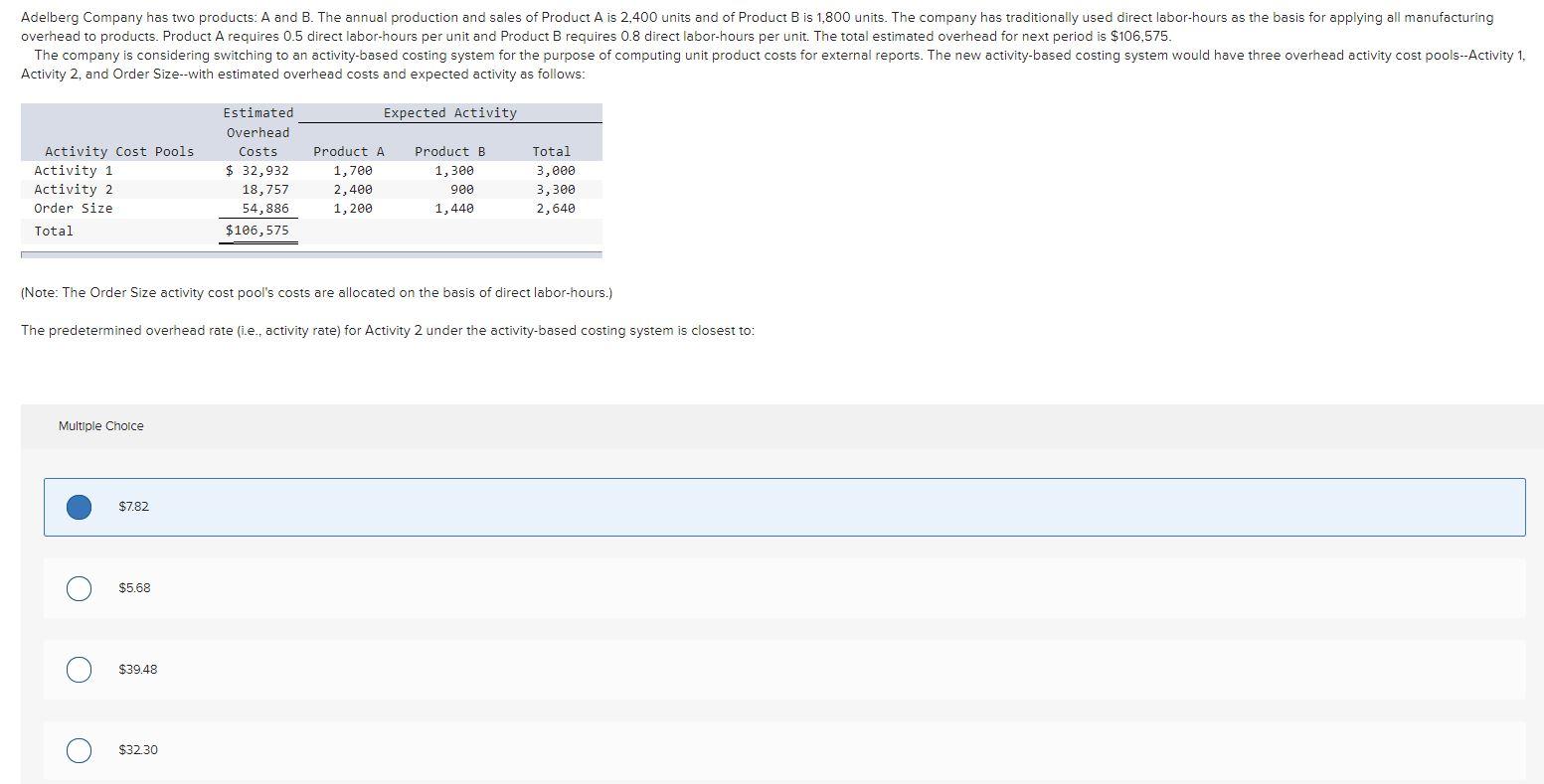

Adelberg Company has two products: A and B. The annual production and sales of Product A is 1,750 units and of Product B is 1,150 units. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.7 direct labor-hours per unit. The total estimated overhead for next period is $99,400. The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and Order Size--with estimated overhead costs and expected activity as follows: Expected Activity Activity Cost Pools Activity 1 Activity 2 Order Size Total Estimated Overhead Costs $ 30,715 17,494 51,191 $ 99,400 Product A 1,050 1,750 700 Product B 650 250 805 Total 1,700 2,eee 1,505 (Note: The Order Size activity cost pool's costs are allocated on the basis of direct labor-hours.) The predetermined overhead rate under the traditional costing system is closest to: Multiple Choice $8.75 per DLH $34.01 per DLH $66.05 per DLH $18.07 per DLH Adelberg Company has two products: A and B. The annual production and sales of Product A is 2,700 units and of Product B is 2,100 units. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.5 direct labor-hours per unit and Product B requires 0.8 direct labor-hours per unit. The total estimated overhead for next period is $109,875. The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and Order Size--with estimated overhead costs and expected activity as follows: Expected Activity Activity Cost Pools Activity 1 Activity 2 Order Size Total Estimated Overhead Costs $ 33,951 19,338 56,586 $109,875 Product A 2,000 2,700 1,350 Product B 1,600 1,200 1,680 Total 3,600 3,900 3,030 (Note: The Order Size activity cost pool's costs are allocated on the basis of direct labor-hours.) The overhead cost per unit of Product B under the traditional costing system is closest to: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $16.98 O $4.96 O $7.16 $29.01 Adelberg Company has two products: A and B. The annual production and sales of Product A is 2,400 units and of Product B is 1,800 units. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.5 direct labor-hours per unit and Product B requires 0.8 direct labor-hours per unit. The total estimated overhead for next period is $106,575. The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and Order Size--with estimated overhead costs and expected activity as follows: Expected Activity Product B Estimated Overhead Costs $ 32,932 18,757 54,886 $106,575 Activity Cost Pools Activity 1 Activity 2 Order Size Total 1,300 Product A 1,700 2,400 1,200 Total 3,000 3,300 900 1,440 2,640 (Note: The Order Size activity cost pool's costs are allocated on the basis of direct labor-hours.) The predetermined overhead rate (i.e., activity rate) for Activity 2 under the activity-based costing system is closest to: Multiple Choice $7.82 $5.68 $39.48 $32.30