Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A.Determine whether the Accounts Receivable and Temporary Investments should be sold using the provisions of ITA 85(1). Explain your conclusion and, if you recommend that

A.Determine whether the Accounts Receivable and Temporary Investments should be sold using the provisions of ITA 85(1). Explain your conclusion and, if you recommend that ITA 85(1) should not be used, indicate the appropriate alternative treatment.

B. Without regard to your conclusions in Part A, assume that all of the business properties are sold to the new corporation using the provisions of ITA 85(1). Indicate the minimum elected amounts for each property.

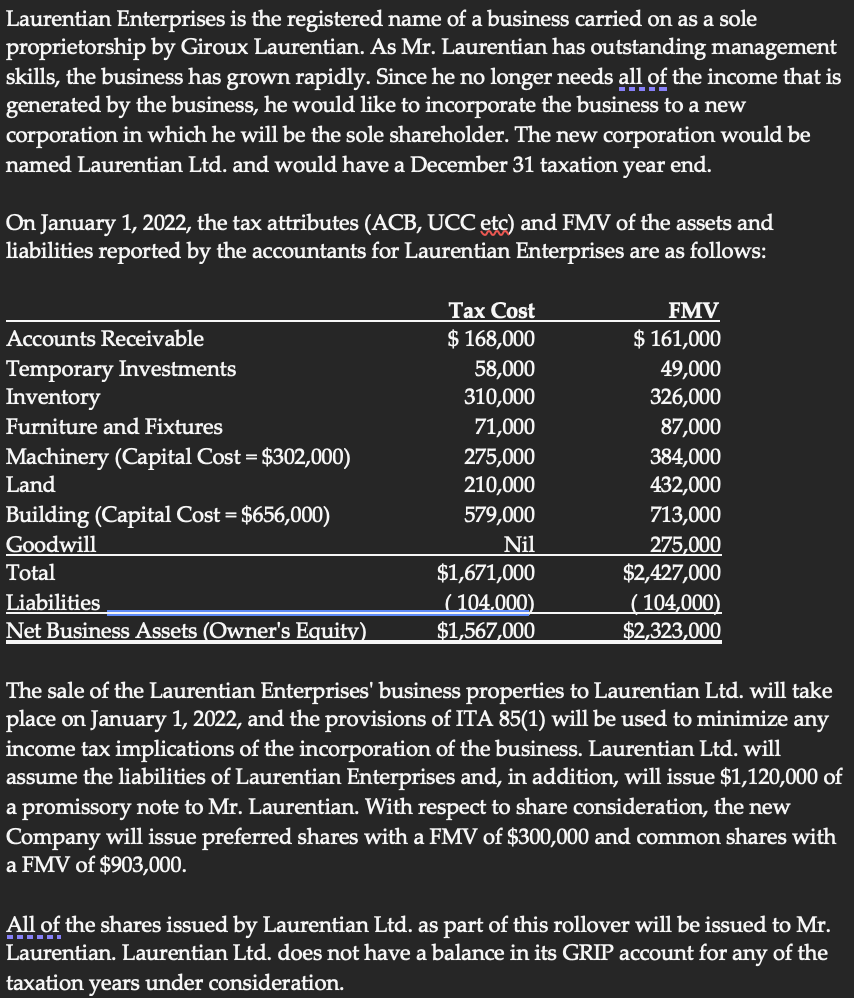

Laurentian Enterprises is the registered name of a business carried on as a sole proprietorship by Giroux Laurentian. As Mr. Laurentian has outstanding management skills, the business has grown rapidly. Since he no longer needs all of the income that is generated by the business, he would like to incorporate the business to a new corporation in which he will be the sole shareholder. The new corporation would be named Laurentian Ltd. and would have a December 31 taxation year end. On January 1, 2022, the tax attributes (ACB, UCC etc) and FMV of the assets and liabilities reported by the accountants for Laurentian Enterprises are as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started