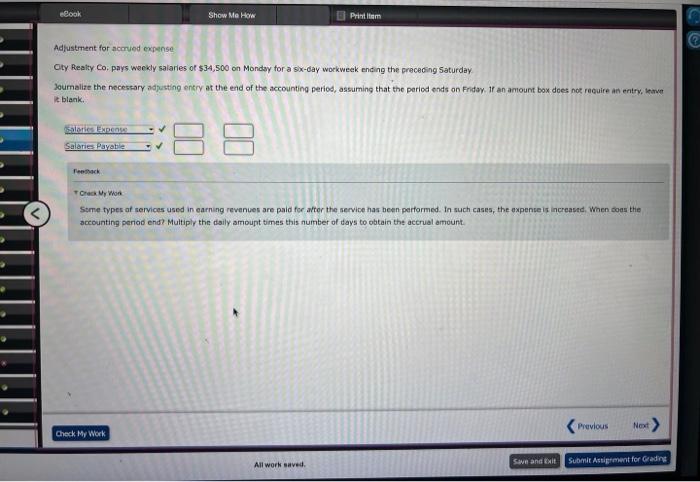

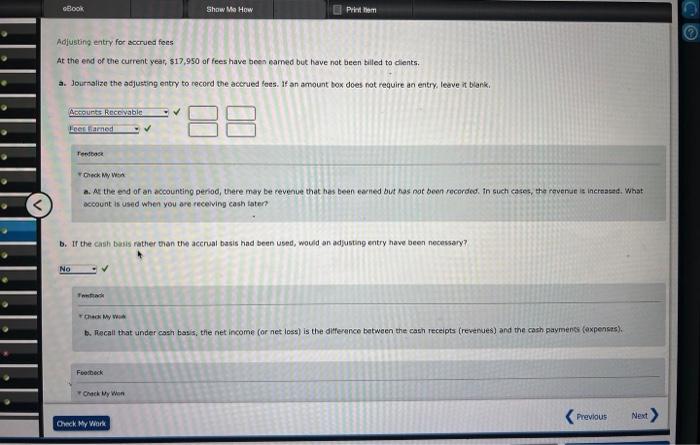

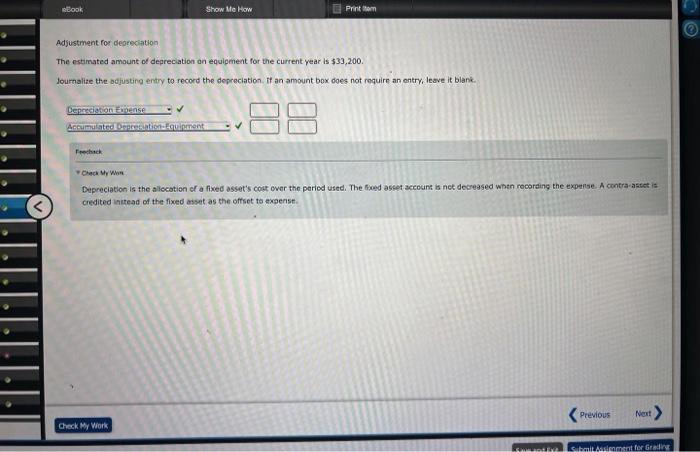

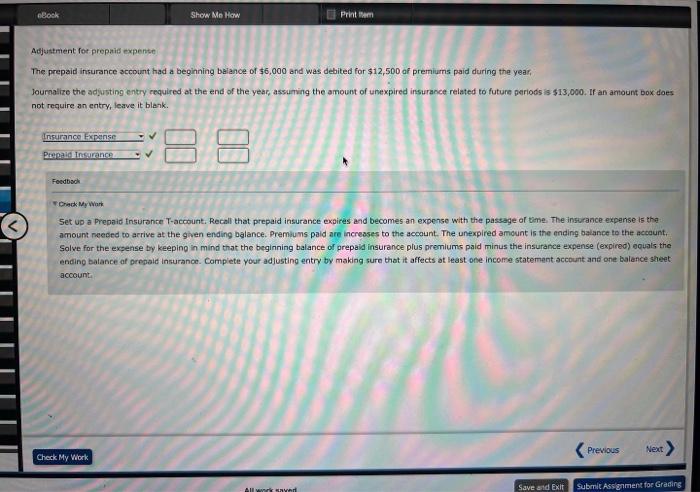

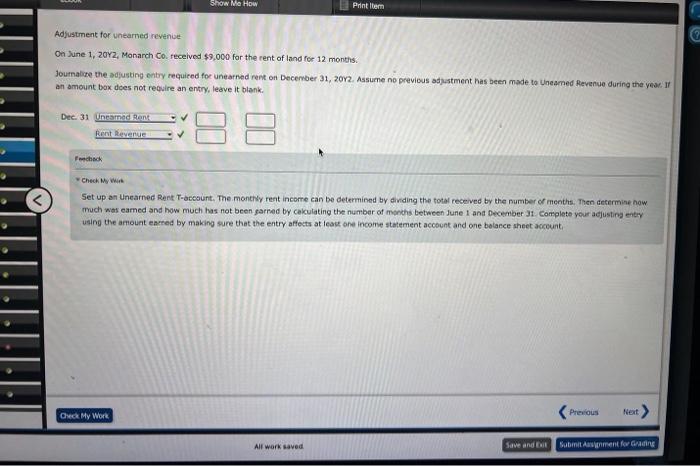

Adfustment for acmyed expense Oty Realty Co: pays werkly salaries of $34,500 on Mondyy for a sx-day workweek ending the preceding 5aturday Joumalize the necessary sdjusting entry at the end of the accounting period, assuming that the period ends on Friday. If an amount box does not require an entry, Iemye thank. fenthack t crack Uy inot acecunting period end? Muitiply the disily amount times this number of days to ebtain the acerval amount. Adjusting entry for accrued fees At the end of the current year, $17,950 of fees have been eamed but have not been tilled to clients. a. Journatize the adjusting entry to record the acerued foes. If an amount box does not require an entry, leave it blark. rorek wy wes a. As the evd of an accounting penod, there may be cevenue that has been earred but has not been recorded, in such cates, the revense is increaset, What account is used when you ore recelving cash fater? b. If the cash basis rather than the accrual basis had been used, would an adjusting entry have been necessary? Inthish thatis My wist b. Fecail that under cash tasis, the net income (or net loss) is the difference between the cash receipts (revenues) and the cash paymenti (expensas). Adjustment for depreciation The estimated amount of depreciation an equipment for the current year is $33,200. Journalize the bejusting entry to record the depreciation. if an amount box does not roquire an ontry, leave it blank. * chech Mr Whe Depreciation is the allecotien of a fixed asset's cost ower the peried used. The foud ascet actount is net decteased when rocording the expense. A contra-astet is credited instead of the fixed asset as the offset to experst. Abjustment for prepais expense The prepaid insurance sccount had a beginning belahce of $6,000 and was debited for $12,500 of premiums paid during the year, Joumalize the adisting entry required at the end of the year, assuming the amount of unexpired insurance reiated to future periods is $13,000. If an amount box does not require an entry, leave it blenk. Fesdbsok Trieck Brywark Set up a Prepaid tnsurente T-account. Recall that prepaid insurance expires and becomes an expense with the passage or vime, The insurance expense is the amount needed to arrive at the given ending balance. Premiums paid are increases to the account. The unexpired amount is the ending balance to the actaunt, Solve for the expense by keeping in mind that the beginning balance of prepaid insurance plus premiums paid minus the insurance expense (expired) egivals the ending balance af prepald insurance. Compiete your adjusting entry by making sure that it affects at least one income statement account ant one balance sheet acoount Adjustment for unearned revenive On June 1, 20Y2, Monarch Co. received $9,000 for the rent of land for 12 months. Journalite the adjusting entry requiced foc unearned rent on December 31,20r2. Assume no previcus adjustment has been made to Uneamed Aeveniue during the yeak. If an omount box does not require an entry, leave it blank. Fretsech * check Wy wis using the amount eacred by making sure that the entry affesta at leake bhe income statement account and one bolaree sheet ascount