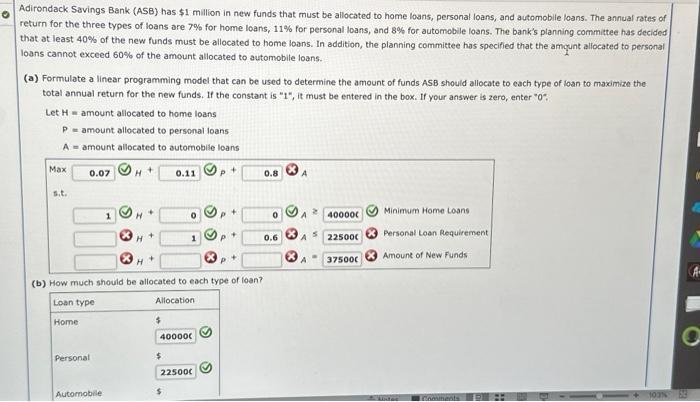

0 Adirondack Savings Bank (ASB) has $1 million in new funds that must be allocated to home loans, personal loans, and automobile loans. The

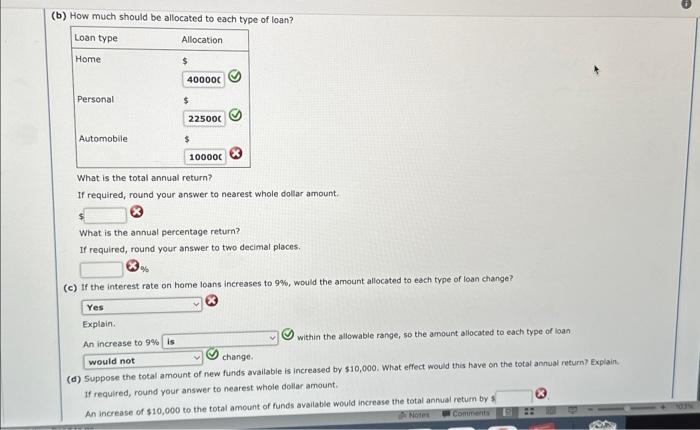

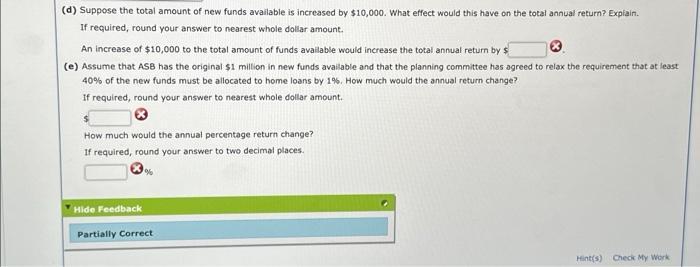

0 Adirondack Savings Bank (ASB) has $1 million in new funds that must be allocated to home loans, personal loans, and automobile loans. The annual rates of return for the three types of loans are 7% for home loans, 11% for personal loans, and 8% for automobile loans. The bank's planning committee has decided that at least 40% of the new funds must be allocated to home loans. In addition, the planning committee has specified that the amqunt allocated to personal loans cannot exceed 60% of the amount allocated to automobile loans. (a) Formulate a linear programming model that can be used to determine the amount of funds ASB should allocate to each type of loan to maximize the total annual return for the new funds. If the constant is "1", it must be entered in the box. If your answer is zero, enter "0". Let H amount allocated to home loans Pamount allocated to personal loans A amount allocated to automobile loans + H H+ Max 0.07 H+ 0.11 p + 0.8 St. 1 0 P + 400000 Minimum Home Loans 1 P + 5 0.6 225000 Personal Loan Requirement H+ P + 375000 Amount of New Funds (b) How much should be allocated to each type of loan? Allocation Loan type Home $ 400000 Personal $ 225000 Automobile 100% Austes Comments (b) How much should be allocated to each type of loan? Loan type Home Allocation $ 400000 Personal 225000 Automobile 100000 What is the total annual return? If required, round your answer to nearest whole dollar amount. What is the annual percentage return? If required, round your answer to two decimal places. (c) If the interest rate on home loans increases to 9%, would the amount allocated to each type of loan change? Yes Explain. An increase to 9% is would not change. within the allowable range, so the amount allocated to each type of loan (d) Suppose the total amount of new funds available is increased by $10,000. What effect would this have on the total annual return? Explain. If required, round your answer to nearest whole dollar amount. An increase of $10,000 to the total amount of funds available would increase the total annual return by s Notes Comments (d) Suppose the total amount of new funds available is increased by $10,000. What effect would this have on the total annual return? Explain. If required, round your answer to nearest whole dollar amount. An increase of $10,000 to the total amount of funds available would increase the total annual return by $ (e) Assume that ASB has the original $1 million in new funds available and that the planning committee has agreed to relax the requirement that at least 40% of the new funds must be allocated to home loans by 1%. How much would the annual return change? If required, round your answer to nearest whole dollar amount. How much would the annual percentage return change? If required, round your answer to two decimal places. % Hide Feedback Partially Correct Hint(s) Check My Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the images provided Ill address each part of the problem Problem Summary Adirondack Savings Bank ASB has 1 million in new funds to allocate t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started