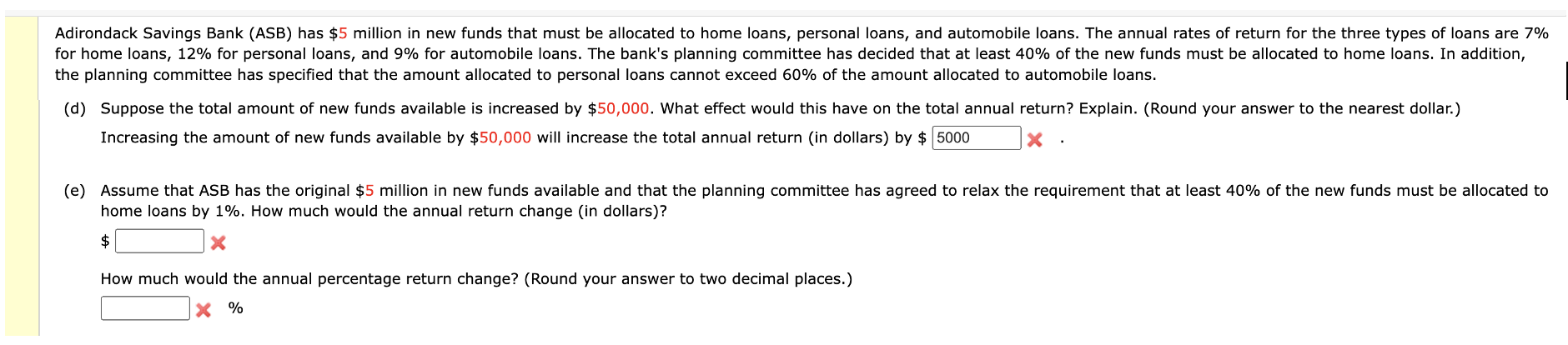

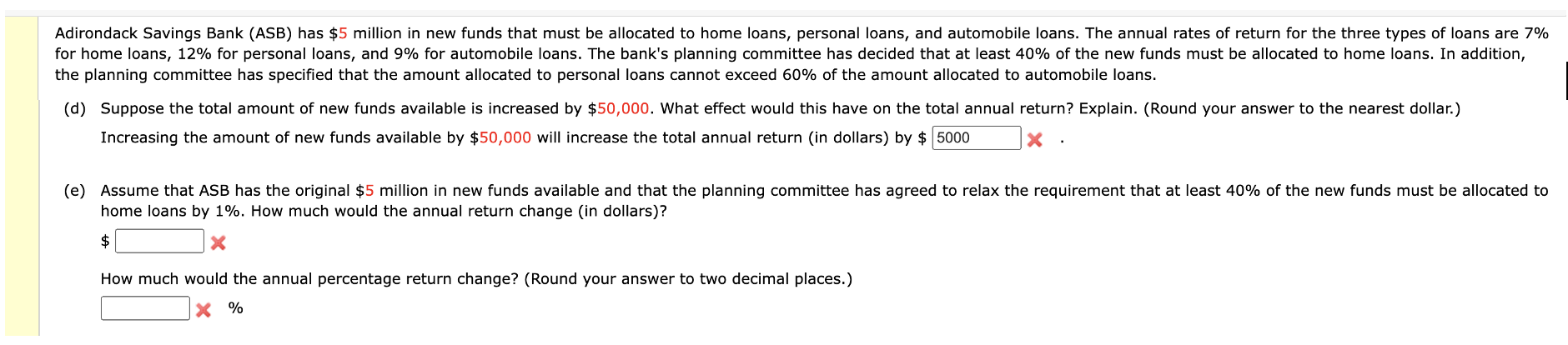

Adirondack Savings Bank (ASB) has $5 million in new funds that must be allocated to home loans, personal loans, and automobile loans. The annual rates of return for the three types of loans are 7% for home loans, 12% for personal loans, and 9% for automobile loans. The bank's planning committee has decided that at least 40% of the new funds must be allocated to home loans. In addition, the planning committee has specified that the amount allocated to personal loans cannot exceed 60% of the amount allocated to automobile loans. (d) Suppose the total amount of new funds available is increased by $50,000. What effect would this have on the total annual return? Explain. (Round your answer to the nearest dollar.) Increasing the amount of new funds available by $50,000 will increase the total annual return (in dollars) by $ 5000 X (e) Assume that ASB has the original $5 million in new funds available and that the planning committee has agreed to relax the requirement that at least 40% of the new funds must be allocated to home loans by 1%. How much would the annual return change in dollars)? $ X How much would the annual percentage return change? (Round your answer to two decimal places.) X % Adirondack Savings Bank (ASB) has $5 million in new funds that must be allocated to home loans, personal loans, and automobile loans. The annual rates of return for the three types of loans are 7% for home loans, 12% for personal loans, and 9% for automobile loans. The bank's planning committee has decided that at least 40% of the new funds must be allocated to home loans. In addition, the planning committee has specified that the amount allocated to personal loans cannot exceed 60% of the amount allocated to automobile loans. (d) Suppose the total amount of new funds available is increased by $50,000. What effect would this have on the total annual return? Explain. (Round your answer to the nearest dollar.) Increasing the amount of new funds available by $50,000 will increase the total annual return (in dollars) by $ 5000 X (e) Assume that ASB has the original $5 million in new funds available and that the planning committee has agreed to relax the requirement that at least 40% of the new funds must be allocated to home loans by 1%. How much would the annual return change in dollars)? $ X How much would the annual percentage return change? (Round your answer to two decimal places.) X %