Answered step by step

Verified Expert Solution

Question

1 Approved Answer

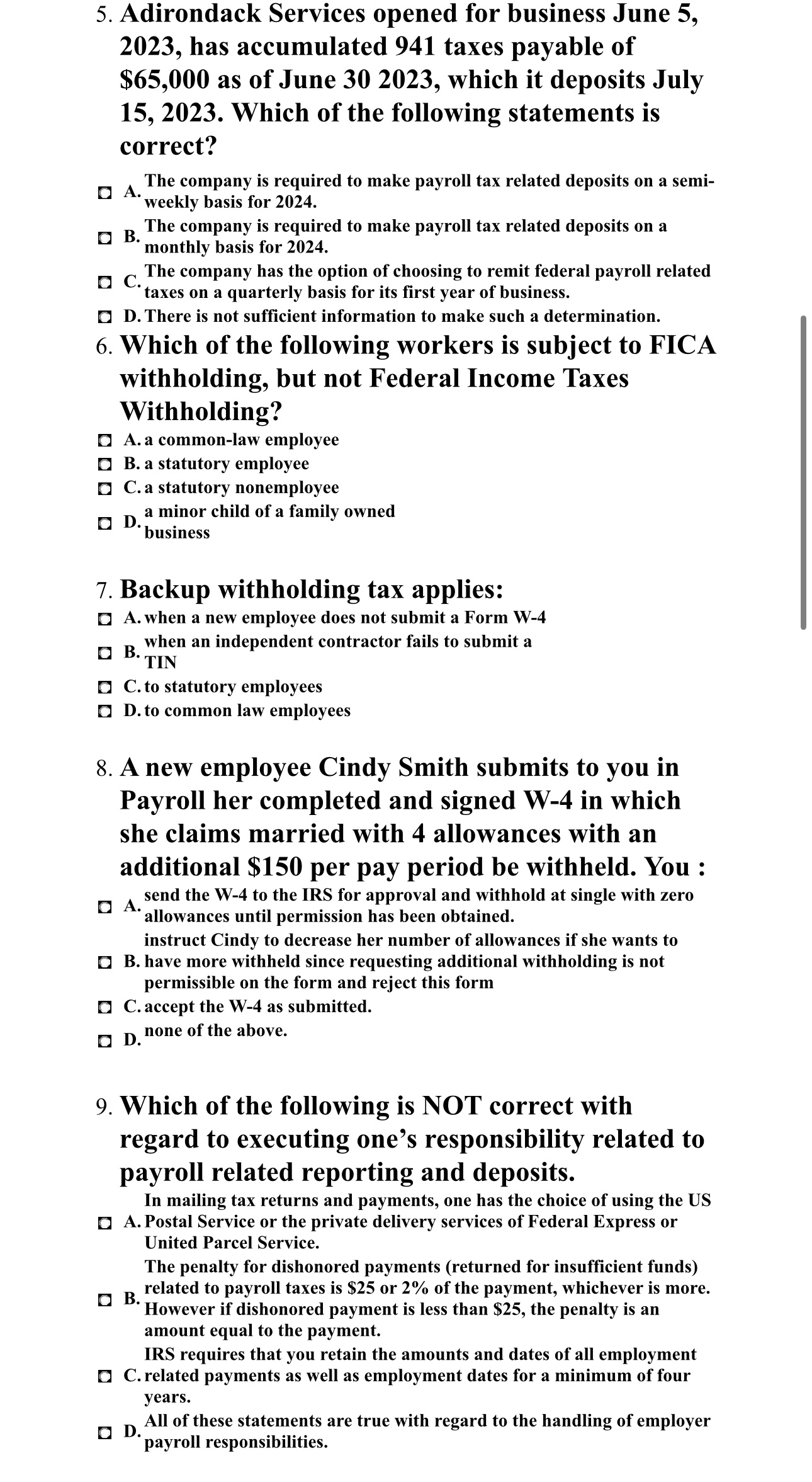

Adirondack Services opened for business June 5 , 2 0 2 3 , has accumulated 9 4 1 taxes payable of $ 6 5 ,

Adirondack Services opened for business June has accumulated taxes payable of $ as of June which it deposits July Which of the following statements is correct?

A The company is required to make payroll tax related deposits on a semiweekly basis for

B The company is required to make payroll tax related deposits on a monthly basis for

C The company has the option of choosing to remit federal payroll related taxes on a quarterly basis for its first year of business.

D There is not sufficient information to make such a determination.

Which of the following workers is subject to FICA withholding, but not Federal Income Taxes Withholding?

A a commonlaw employee

B a statutory employee

C a statutory nonemployee

D a minor child of a family owned

Backup withholding tax applies:

A when a new employee does not submit a Form W

B when an independent contractor fails to submit a TIN

C to statutory employees

D to common law employees

A new employee Cindy Smith submits to you in Payroll her completed and signed in which she claims married with allowances with an additional $ per pay period be withheld. You :

A send the to the IRS for approval and withhold at single with zero allowances until permission has been obtained.

instruct Cindy to decrease her number of allowances if she wants to

B have more withheld since requesting additional withholding is not permissible on the form and reject this form

C accept the as submitted.

D none of the above.

Which of the following is NOT correct with regard to executing one's responsibility related to payroll related reporting and deposits.

In mailing tax returns and payments, one has the choice of using the US

A Postal Service or the private delivery services of Federal Express or United Parcel Service.

The penalty for dishonored payments returned for insufficient funds

B related to payroll taxes is $ or of the payment, whichever is more. However if dishonored payment is less than $ the penalty is an amount equal to the payment.

IRS requires that you retain the amounts and dates of all employment

C related payments as well as employment dates for a minimum of four years.

D All of these statements are true with regard to the handling of employer payroll responsibilities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started