Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adjust the below general ledger with the adjustments from requirement 4 below. General Ledger: Use the below adjustments to update the general ledger above. REQUIREMENT

Adjust the below general ledger with the adjustments from requirement 4 below.

General Ledger:

Use the below adjustments to update the general ledger above.

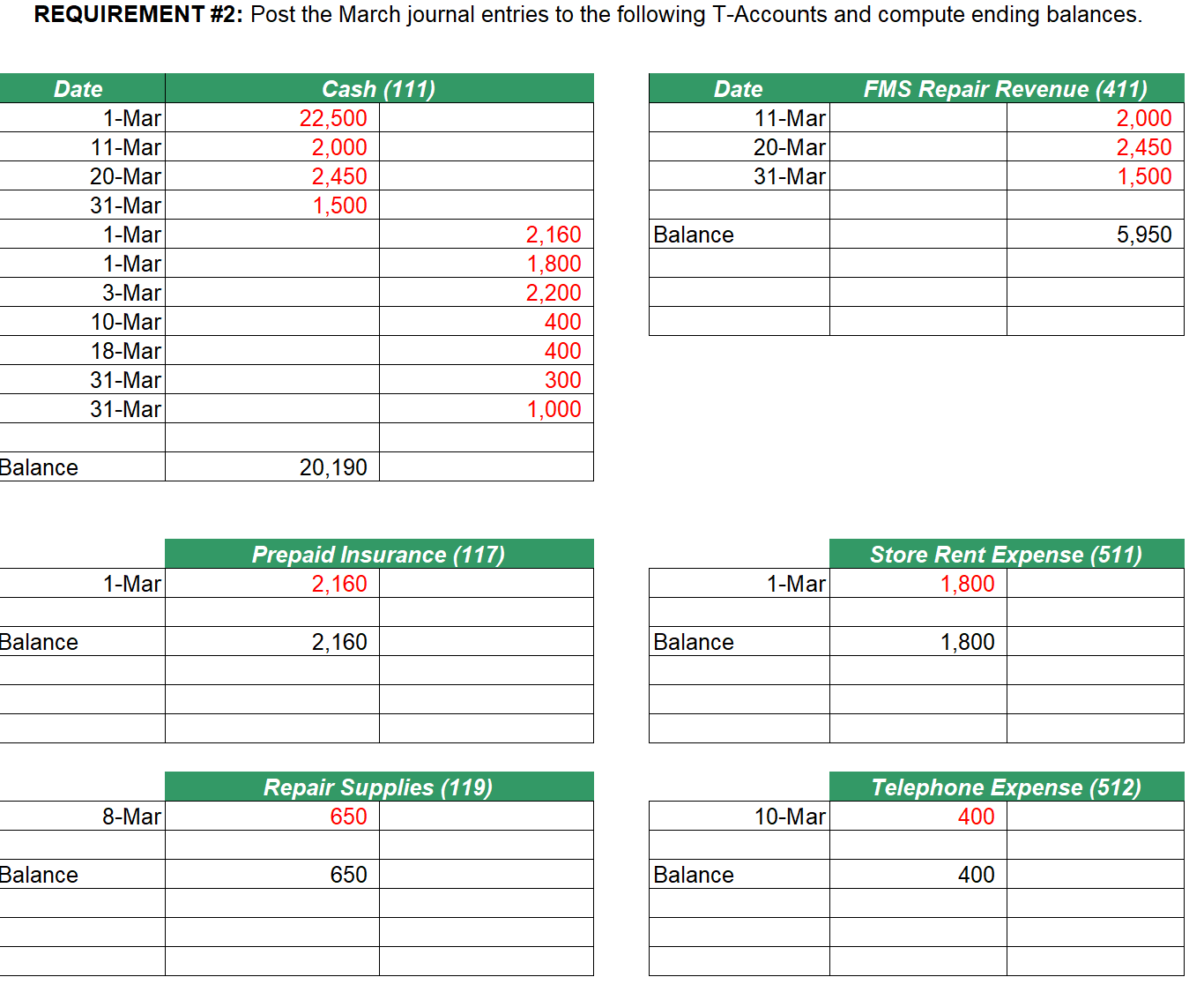

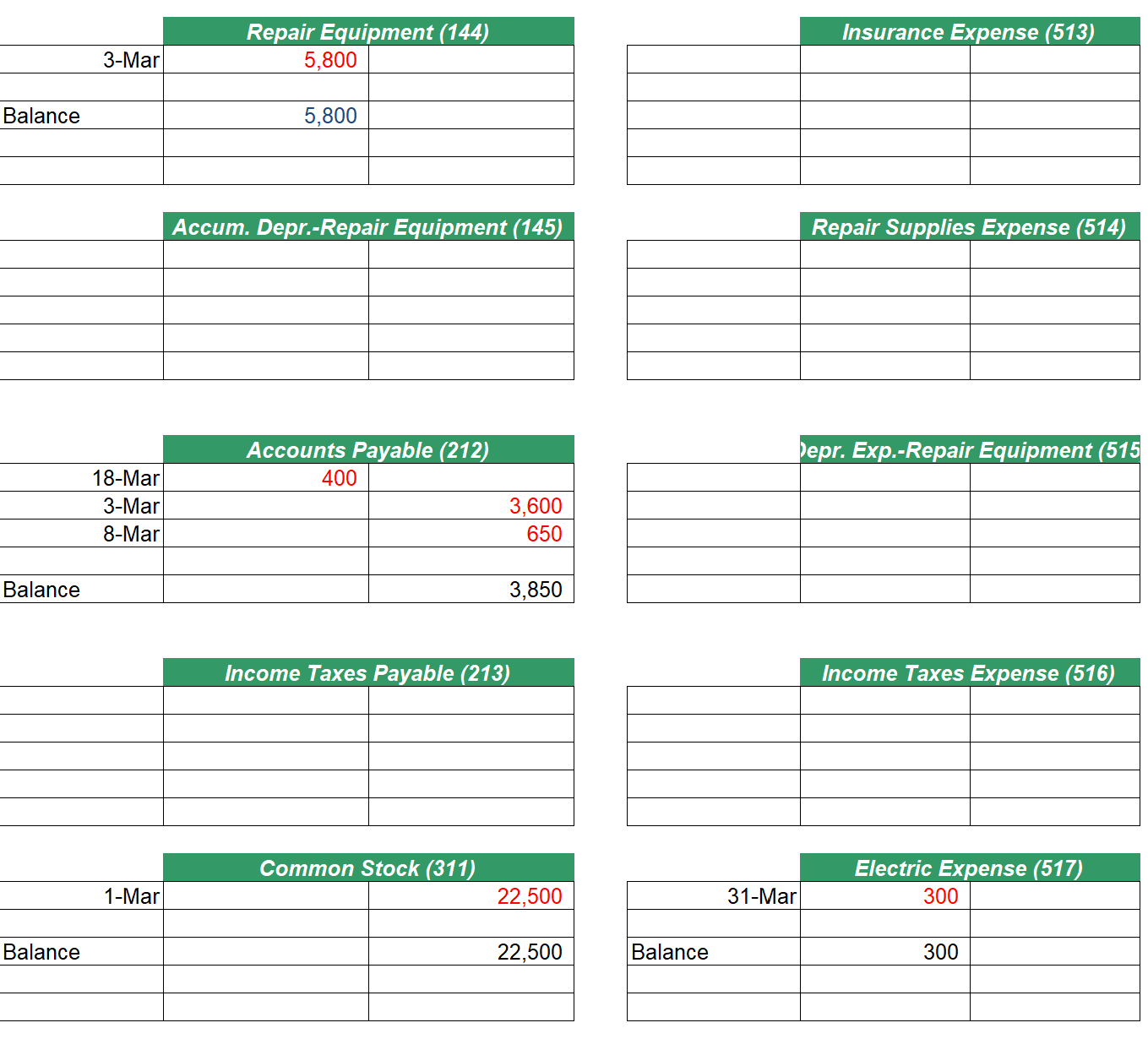

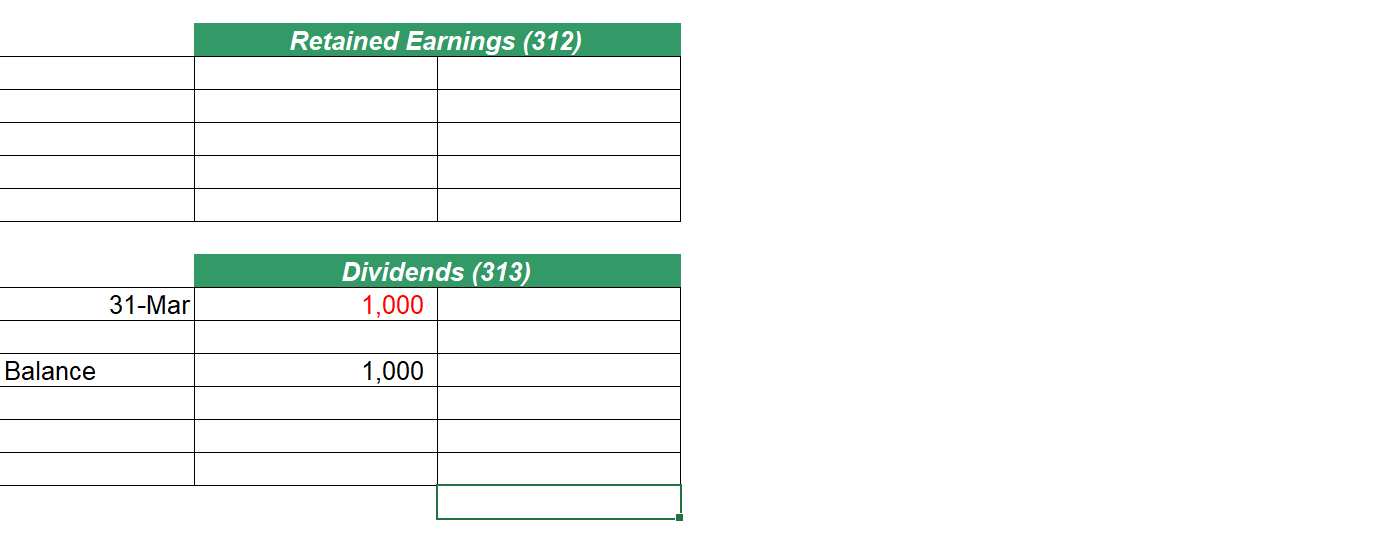

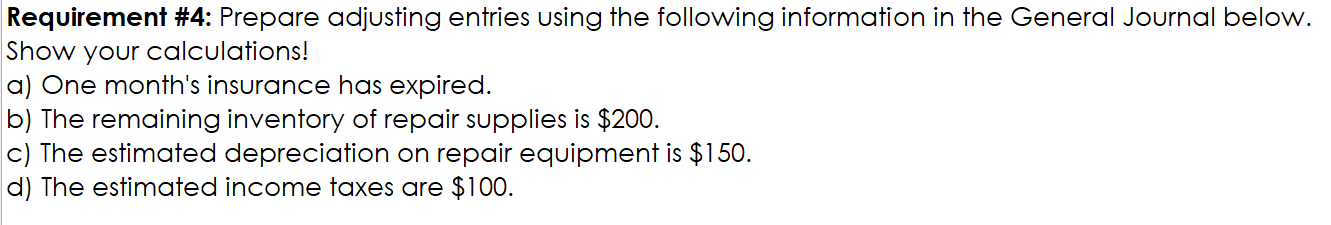

REQUIREMENT \#2: Post the March journal entries to the following T-Accounts and compute ending balances. Requirement \#4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $150. d) The estimated income taxes are $100. \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c|}{ Retained Earnings (312) } \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline & \multicolumn{2}{|c|}{ Dividends (313) } \\ \hline 31-Mar & 1,000 & \\ \hline Balance & 1,000 & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \cline { 2 - 3 } & & \end{tabular} \begin{tabular}{|l|r|l|} & \multicolumn{2}{|c|}{ Repair Equipment (144) } \\ \hline 3-Mar & 5,800 & \\ \hline Balance & 5,800 & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Accum. Depr.-Repair Equipment (145) \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c}{ Accum. Depr.-Repair Equipment (145) } \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} & \multicolumn{2}{|c|}{ Accounts Payable (212) } \\ \hline 18-Mar & 400 & \\ \hline 3-Mar & & 3,600 \\ \hline 8-Mar & & 650 \\ \hline Balance & & 3,850 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Income Taxes Payable (213) } \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \multicolumn{1}{|c|}{} & \multicolumn{2}{|c|}{ Common Stock (311) } \\ \hline 1-Mar & & 22,500 \\ \hline Balance & & 22,500 \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Repair Supplies Expense (514) Depr. Exp.-Repair Equipment (515) \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Income Taxes Expense (516) \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \multicolumn{1}{c|}{} & \multicolumn{2}{c|}{ Electric Expense (517) } \\ \hline 31-Mar & 300 & \\ \hline Balance & & \\ \hline & 300 & \\ \hline & & \\ \hline & & \\ \hline \end{tabular}

REQUIREMENT \#2: Post the March journal entries to the following T-Accounts and compute ending balances. Requirement \#4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $150. d) The estimated income taxes are $100. \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c|}{ Retained Earnings (312) } \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline & \multicolumn{2}{|c|}{ Dividends (313) } \\ \hline 31-Mar & 1,000 & \\ \hline Balance & 1,000 & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \cline { 2 - 3 } & & \end{tabular} \begin{tabular}{|l|r|l|} & \multicolumn{2}{|c|}{ Repair Equipment (144) } \\ \hline 3-Mar & 5,800 & \\ \hline Balance & 5,800 & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Accum. Depr.-Repair Equipment (145) \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c}{ Accum. Depr.-Repair Equipment (145) } \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} & \multicolumn{2}{|c|}{ Accounts Payable (212) } \\ \hline 18-Mar & 400 & \\ \hline 3-Mar & & 3,600 \\ \hline 8-Mar & & 650 \\ \hline Balance & & 3,850 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Income Taxes Payable (213) } \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \multicolumn{1}{|c|}{} & \multicolumn{2}{|c|}{ Common Stock (311) } \\ \hline 1-Mar & & 22,500 \\ \hline Balance & & 22,500 \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Repair Supplies Expense (514) Depr. Exp.-Repair Equipment (515) \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Income Taxes Expense (516) \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \multicolumn{1}{c|}{} & \multicolumn{2}{c|}{ Electric Expense (517) } \\ \hline 31-Mar & 300 & \\ \hline Balance & & \\ \hline & 300 & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started