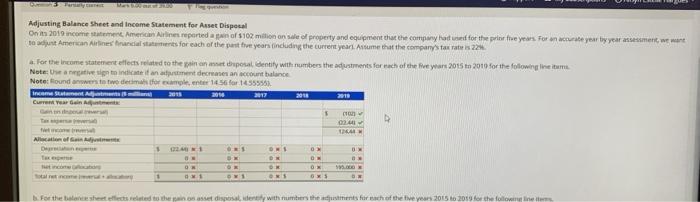

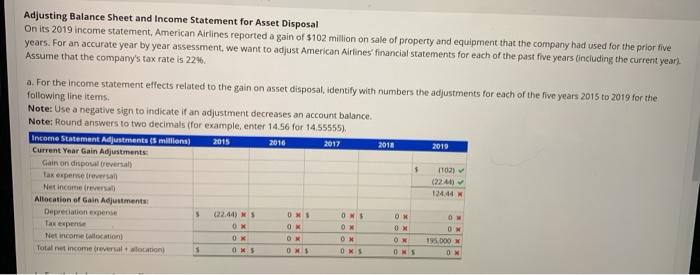

Adjusting Balance Sheet and income Statement for Asset Disposal Onits 2010 comment American Airlines reported of 102 million on sale of property and equipment that the company had ned for the prior fue years for an accurate your tiy year asment, want 10 st American Airlines francial statements for each of the past five years including the current years. Assume that the company's tax rate is 22 For the preome statement effects related to the won n we dupetal dentity with numbers the dirtments for each of the Blue years 2015 to 2010 for the following line tuma Note: Universitaindicatif an entdecanes an account balance Note: Roundwers to decimatforme, en 16 for 1455555 Income Sant All 2011 2018 2012 Current year O. Alication of Saint 1 DHS ON 0 Taxe 15.00 O OM 1 DS OX OS Os For the sheetsed the asset disposade with the fachoftheve years 2015 2059 for the fol Adjusting Balance Sheet and Income Statement for Asset Disposal On its 2019 income statement, American Airlines reported a gain of $102 million on sale of property and equipment that the company had used for the prior five years. For an accurate year by year assessment, we want to adjust American Airlines financial statements for each of the past five years including the current year) Assume that the company's tax rate is 2246. a. For the income statement effects related to the gain an asset disposal, identity with numbers the adjustments for each of the five years 2015 to 2019 for the following line items. Note: Use a negative sign to indicate it an adjustment decreases an account balance. Note: Round answers to two decimals (for example, enter 14.56 for 14.55555) Income Statement Adjustments (5 millions 2016 2018 Current Year Gain Adjustments Gain on disposal breversal Take per te treversan Net income Allocation of Gain Adjustments Depreciation expense 2015 2017 2019 1 ITO) (224) 124.44 5 22.44) KS OX OM OM tax expense Net income location Total income creveral location ONS OK OK OMS OMS OM OX ONS OX ON ON ONS 195 OX OKS 5 ON Adjusting Balance Sheet and income Statement for Asset Disposal Onits 2010 comment American Airlines reported of 102 million on sale of property and equipment that the company had ned for the prior fue years for an accurate your tiy year asment, want 10 st American Airlines francial statements for each of the past five years including the current years. Assume that the company's tax rate is 22 For the preome statement effects related to the won n we dupetal dentity with numbers the dirtments for each of the Blue years 2015 to 2010 for the following line tuma Note: Universitaindicatif an entdecanes an account balance Note: Roundwers to decimatforme, en 16 for 1455555 Income Sant All 2011 2018 2012 Current year O. Alication of Saint 1 DHS ON 0 Taxe 15.00 O OM 1 DS OX OS Os For the sheetsed the asset disposade with the fachoftheve years 2015 2059 for the fol Adjusting Balance Sheet and Income Statement for Asset Disposal On its 2019 income statement, American Airlines reported a gain of $102 million on sale of property and equipment that the company had used for the prior five years. For an accurate year by year assessment, we want to adjust American Airlines financial statements for each of the past five years including the current year) Assume that the company's tax rate is 2246. a. For the income statement effects related to the gain an asset disposal, identity with numbers the adjustments for each of the five years 2015 to 2019 for the following line items. Note: Use a negative sign to indicate it an adjustment decreases an account balance. Note: Round answers to two decimals (for example, enter 14.56 for 14.55555) Income Statement Adjustments (5 millions 2016 2018 Current Year Gain Adjustments Gain on disposal breversal Take per te treversan Net income Allocation of Gain Adjustments Depreciation expense 2015 2017 2019 1 ITO) (224) 124.44 5 22.44) KS OX OM OM tax expense Net income location Total income creveral location ONS OK OK OMS OMS OM OX ONS OX ON ON ONS 195 OX OKS 5 ON