Answered step by step

Verified Expert Solution

Question

1 Approved Answer

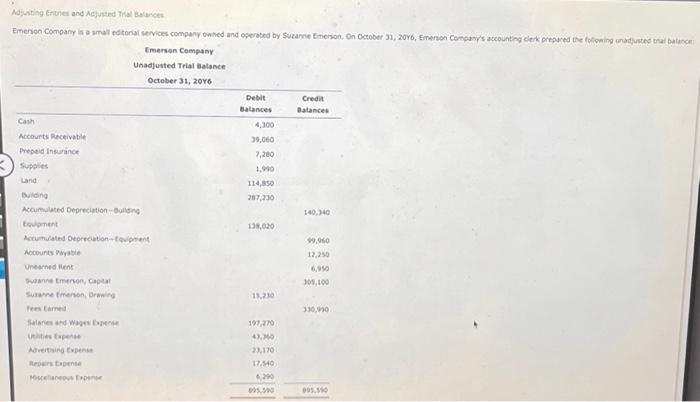

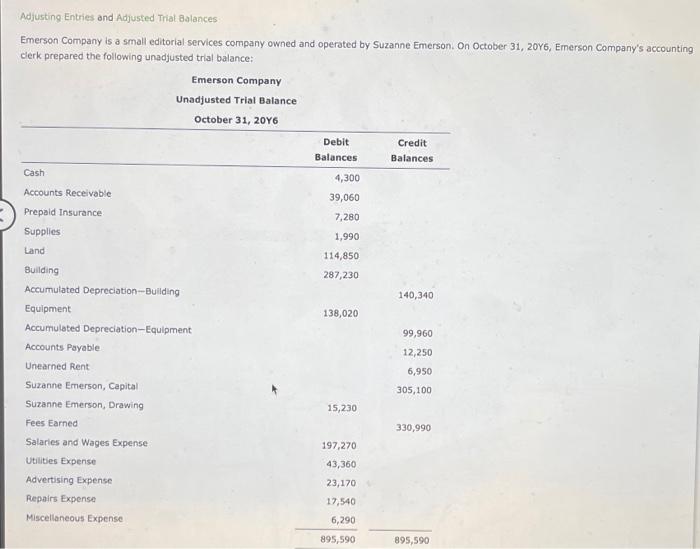

Adjusting Crities and Ajusted To Be Emerson Company is a small editorial services company owned and operated by Suzanne Emerson, on October 31, 2016, Emerson

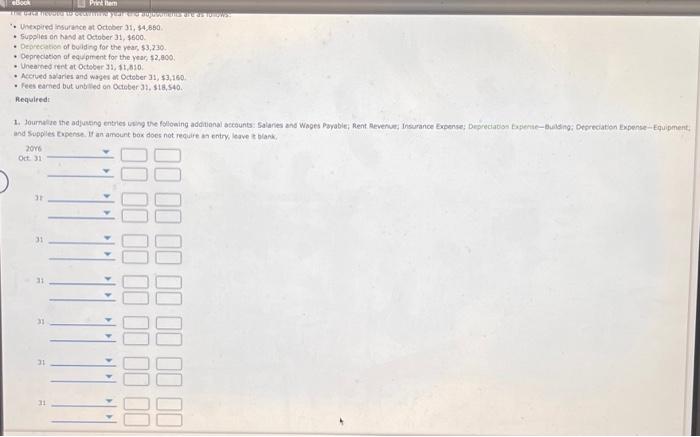

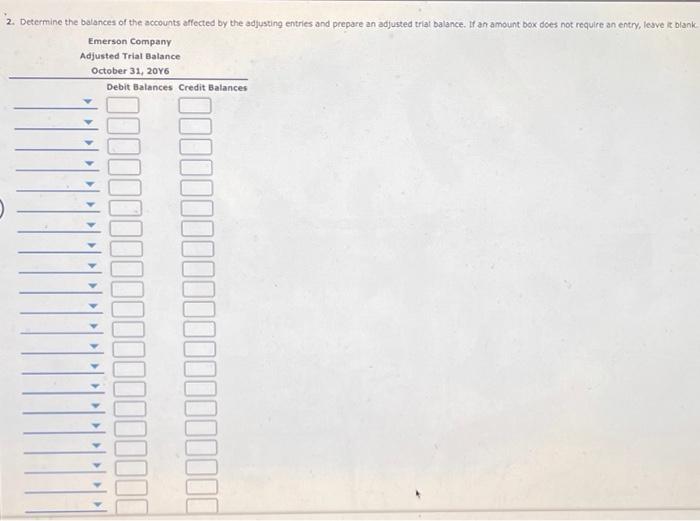

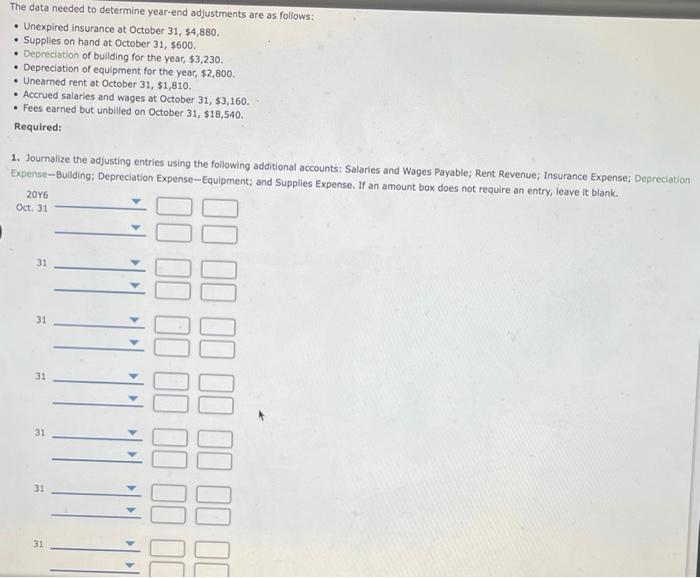

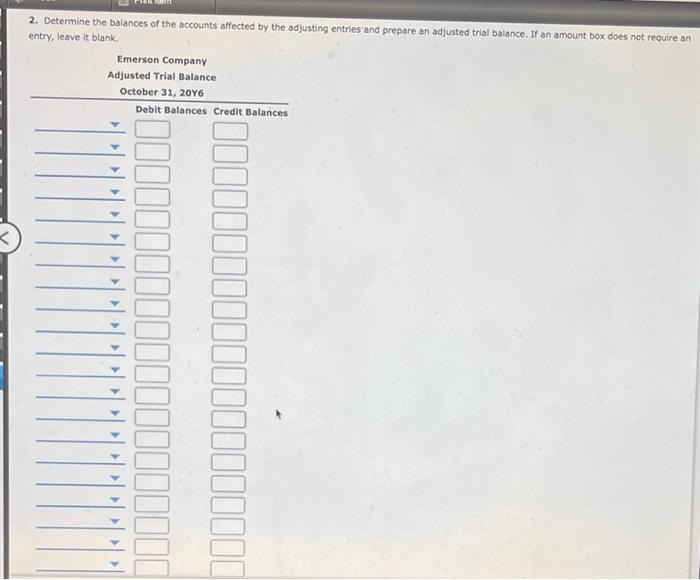

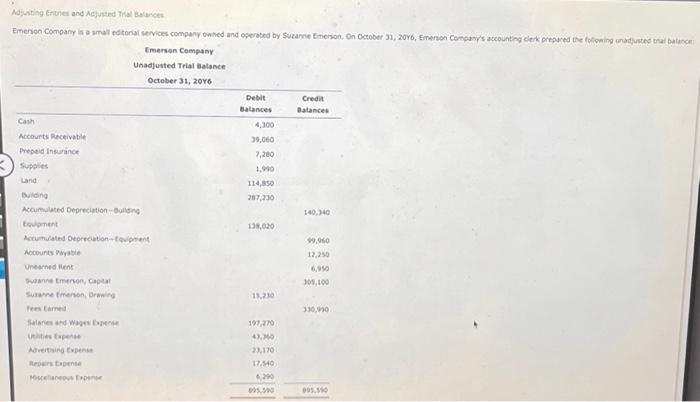

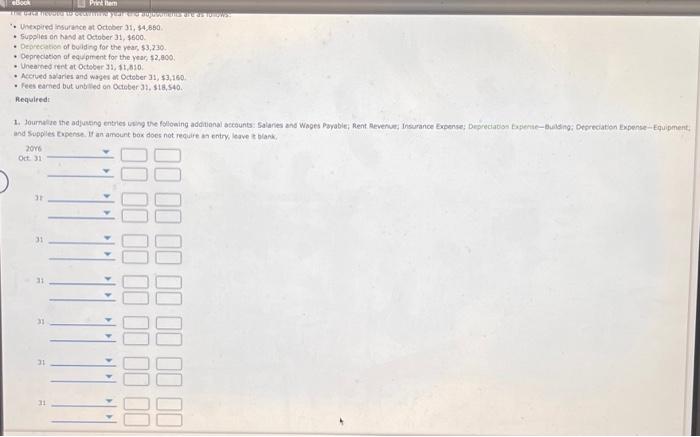

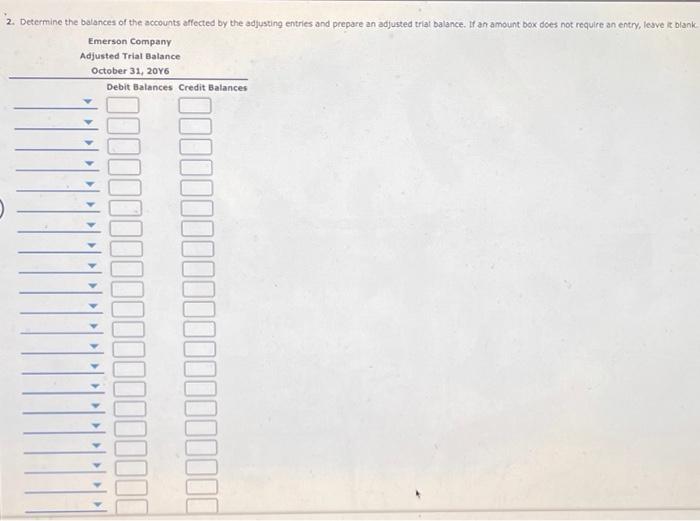

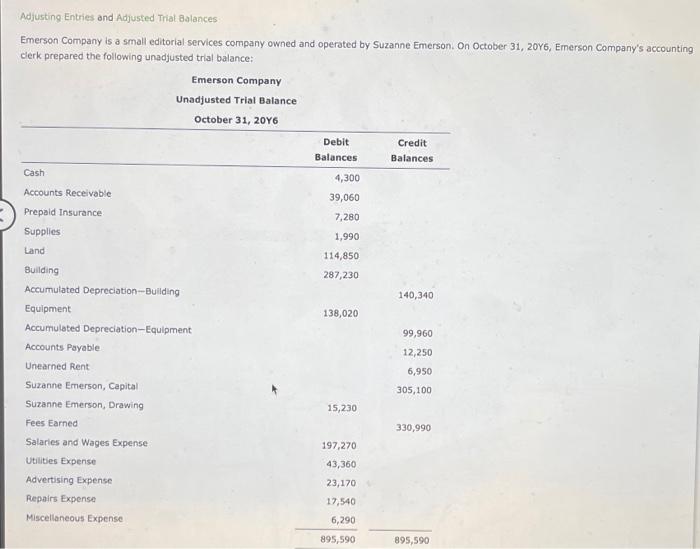

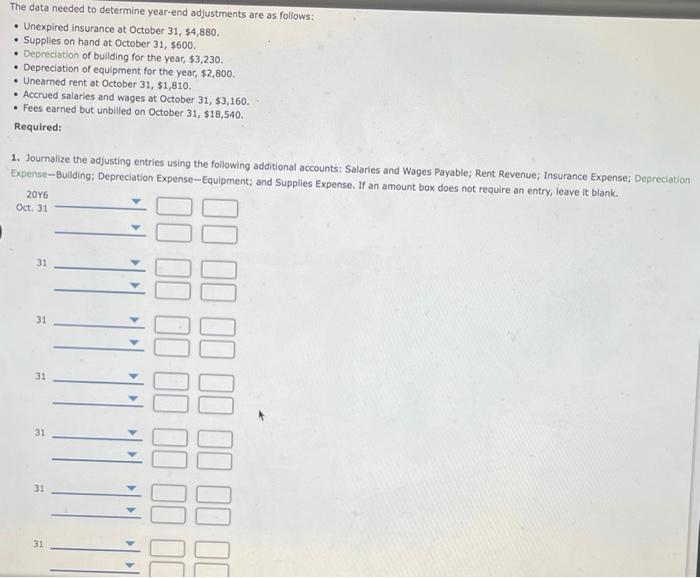

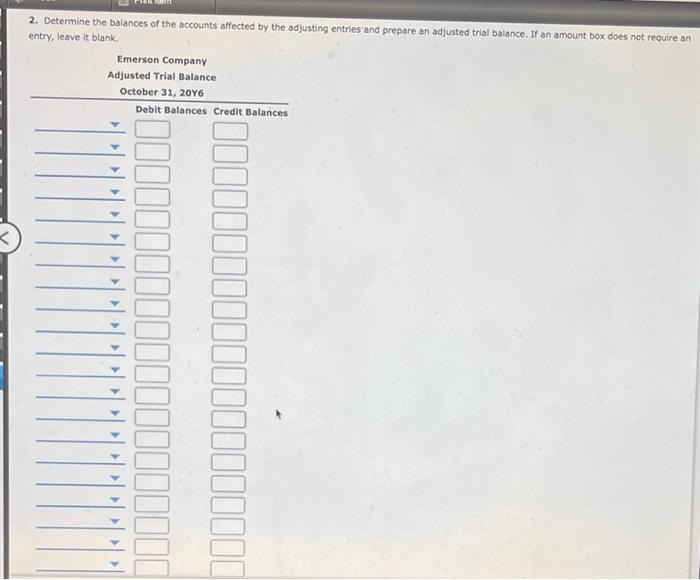

Adjusting Crities and Ajusted To Be Emerson Company is a small editorial services company owned and operated by Suzanne Emerson, on October 31, 2016, Emerson Concany's accounting clerk prepared the following unadjusted brat badanciers Emerson Company Unadjusted Trial Balance October 31, 2016 Credit Balances Cash Accounts Receivable Prepeld Insurance Debit Balances 4,300 39.000 7,200 1.90 124,850 287,230 Land 140.40 138,020 Diding Accumulated Depreciation - Blog oment Accumulated Direction tout Accounts Pwable neredet nemen, Sunnemerson Brown fees are Sales and was 99,00 12,250 6.00 305,100 123 330.00 197,270 430 23.170 17.540 Advertence Nastupne Meno 09.00 SOR Printem TESTIMONI "Unexpired insurance at October 312 34,850 Supplies on October 31, 5600 Deprecation of building for the year. $3,230 Depreciation of equipment for the year, 52,800 Unearted rentat October 3,51.810 Accred Sales and wages at October 31, $3,160 Fees Barned but unbilled on October 31, 518,540 Required: 1. Journalte the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue Insurance perso; Depreciation Experteuilding Depreciation Expense-Equipment and Supplies pense an amount box does not require an entry, have bank 2016 Oct 31 3 . 31 II ID ID II II ID 11 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance. If an amount box does not require an entry, leave it blank Emerson Company Adjusted Trial Balance October 31, 2016 Debit Balances Credit Balances IllIIIII Adjusting Entries and Adjusted Trial Balances Emerson Company is a small editorial services company owned and operated by Suzanne Emerson. On October 31, 2016, Emerson Company's accounting clerk prepared the following unadjusted trial balance: Emerson Company Unadjusted Trial Balance October 31, 2046 Debit Balances Credit Balances Cash Accounts Receivable 4,300 39,060 Prepaid Insurance Supplies 7,280 1,990 Land 114,850 287,230 140,340 138,020 Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Rent Suzanne Emerson, Capital Suzanne Emerson, Drawing Fees Earned Salaries and Wages Expense Utilities Expense Advertising Expense Repairs Expense Miscellaneous Expense 99,960 12,250 6,950 305,100 15,230 330,990 197,270 43,360 23,170 17,540 6,290 895,590 895,590 The data needed to determine year-end adjustments are as follows: Unexpired insurance at October 31, $4,880. Supplies on hand at October 31, $600. Depreciation of building for the year, $3,230. Depreciation of equipment for the year, $2,800 Unearned rent at October 31, $1,810. Accrued salaries and wages at October 31, $3,160. Fees earned but unbilled on October 31, $18,540. Required: 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense-Building; Depreciation Expense-Equipment; and Supplies Expense. If an amount box does not require an entry, leave it blank. 2016 Oct. 31 31 > 31 RE 31 I II II II II II II 31 31 31 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance. If an amount box does not require an entry, leave it blank. Emerson Company Adjusted Trial Balance October 31, 2016 Debit Balances Credit Balances IL

Adjusting Crities and Ajusted To Be Emerson Company is a small editorial services company owned and operated by Suzanne Emerson, on October 31, 2016, Emerson Concany's accounting clerk prepared the following unadjusted brat badanciers Emerson Company Unadjusted Trial Balance October 31, 2016 Credit Balances Cash Accounts Receivable Prepeld Insurance Debit Balances 4,300 39.000 7,200 1.90 124,850 287,230 Land 140.40 138,020 Diding Accumulated Depreciation - Blog oment Accumulated Direction tout Accounts Pwable neredet nemen, Sunnemerson Brown fees are Sales and was 99,00 12,250 6.00 305,100 123 330.00 197,270 430 23.170 17.540 Advertence Nastupne Meno 09.00 SOR Printem TESTIMONI "Unexpired insurance at October 312 34,850 Supplies on October 31, 5600 Deprecation of building for the year. $3,230 Depreciation of equipment for the year, 52,800 Unearted rentat October 3,51.810 Accred Sales and wages at October 31, $3,160 Fees Barned but unbilled on October 31, 518,540 Required: 1. Journalte the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue Insurance perso; Depreciation Experteuilding Depreciation Expense-Equipment and Supplies pense an amount box does not require an entry, have bank 2016 Oct 31 3 . 31 II ID ID II II ID 11 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance. If an amount box does not require an entry, leave it blank Emerson Company Adjusted Trial Balance October 31, 2016 Debit Balances Credit Balances IllIIIII Adjusting Entries and Adjusted Trial Balances Emerson Company is a small editorial services company owned and operated by Suzanne Emerson. On October 31, 2016, Emerson Company's accounting clerk prepared the following unadjusted trial balance: Emerson Company Unadjusted Trial Balance October 31, 2046 Debit Balances Credit Balances Cash Accounts Receivable 4,300 39,060 Prepaid Insurance Supplies 7,280 1,990 Land 114,850 287,230 140,340 138,020 Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Rent Suzanne Emerson, Capital Suzanne Emerson, Drawing Fees Earned Salaries and Wages Expense Utilities Expense Advertising Expense Repairs Expense Miscellaneous Expense 99,960 12,250 6,950 305,100 15,230 330,990 197,270 43,360 23,170 17,540 6,290 895,590 895,590 The data needed to determine year-end adjustments are as follows: Unexpired insurance at October 31, $4,880. Supplies on hand at October 31, $600. Depreciation of building for the year, $3,230. Depreciation of equipment for the year, $2,800 Unearned rent at October 31, $1,810. Accrued salaries and wages at October 31, $3,160. Fees earned but unbilled on October 31, $18,540. Required: 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense-Building; Depreciation Expense-Equipment; and Supplies Expense. If an amount box does not require an entry, leave it blank. 2016 Oct. 31 31 > 31 RE 31 I II II II II II II 31 31 31 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance. If an amount box does not require an entry, leave it blank. Emerson Company Adjusted Trial Balance October 31, 2016 Debit Balances Credit Balances IL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started