ADJUSTING ENTRIES

ADJUSTING ENTRIES AND TRIAL BALANCES

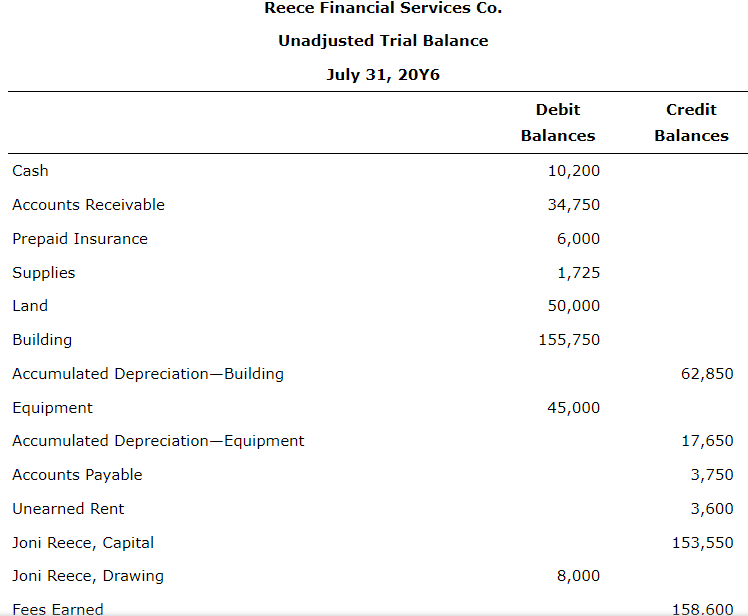

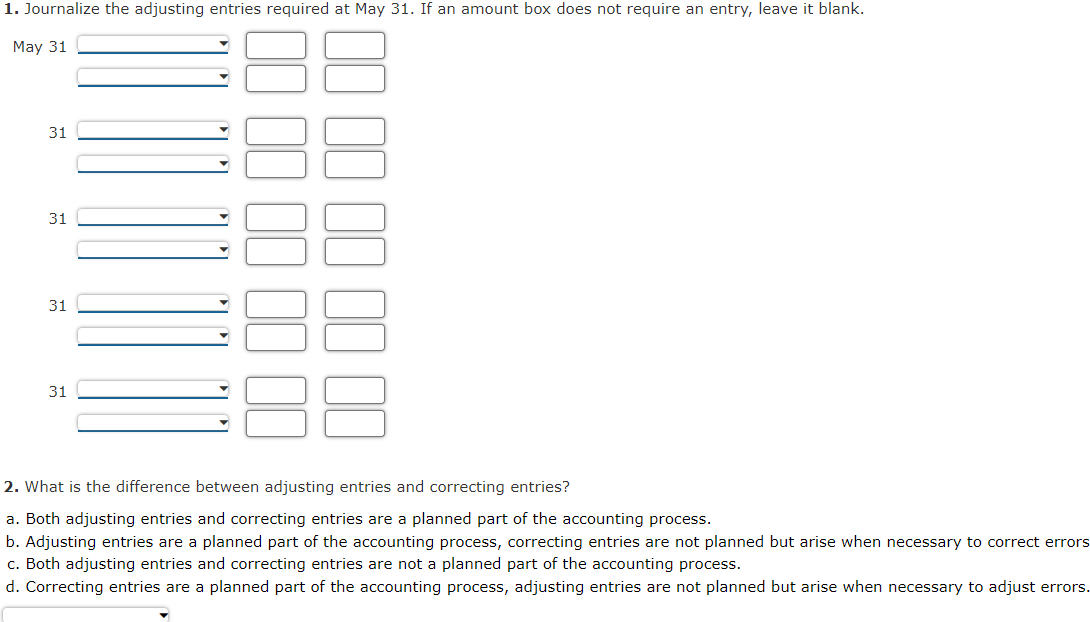

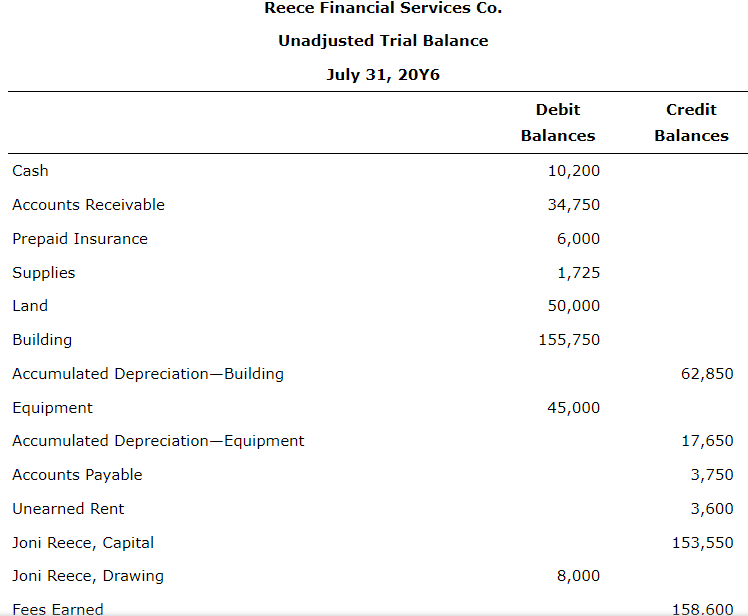

Reece Financial Services Co., which specializes in appliance services, is owned and operated by Joni Reece. Reece Financial Services' accounting clerk prepared the following unadjusted trial balance at July 31, 20Y6:

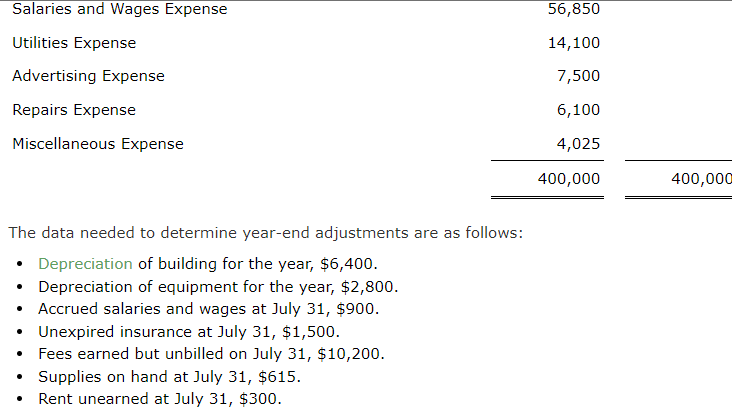

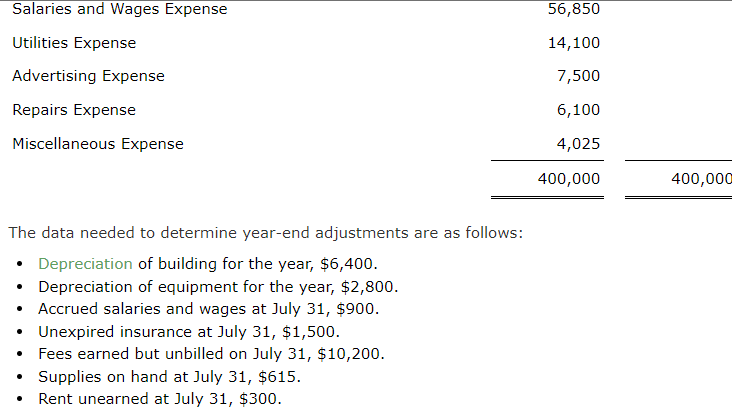

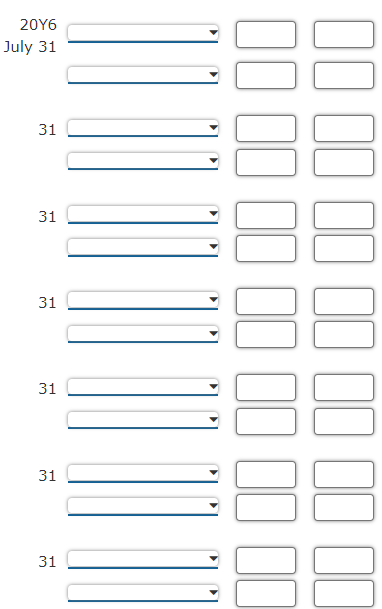

1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expenses, Depreciation Expense - Building, Depreciation Expenses, and Supplies Expense. If an amount box doesn't require an entry, please leave it blank.

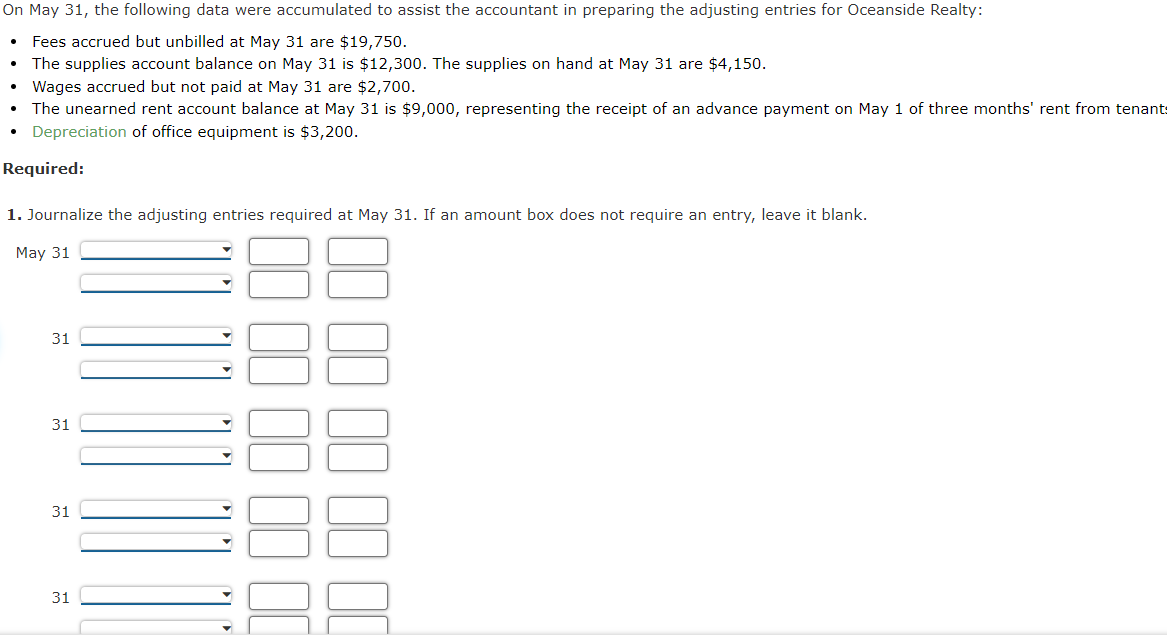

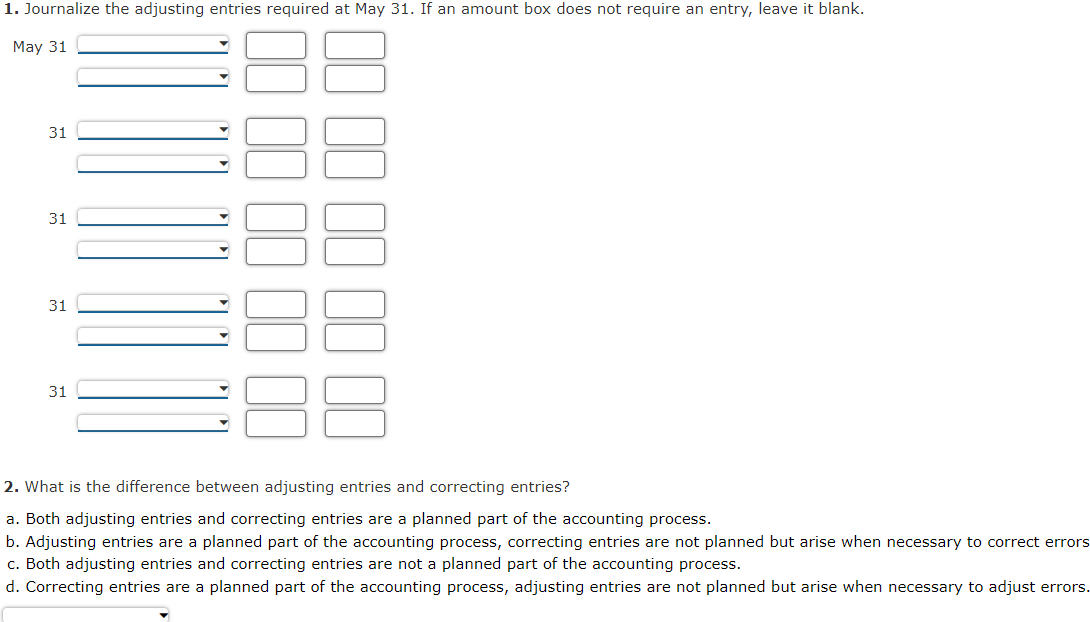

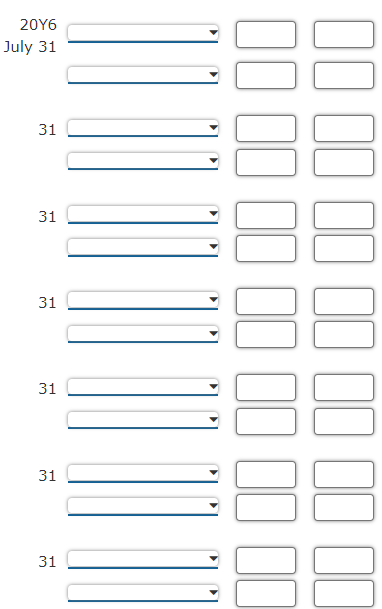

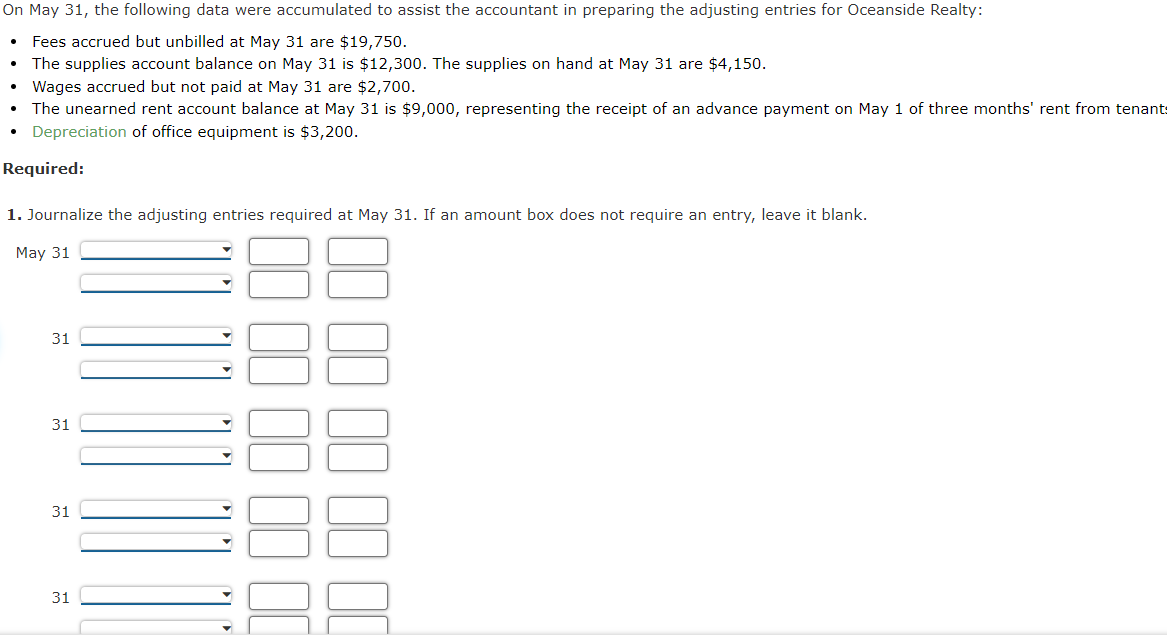

On May 31, the following data were accumulated to assist the accountant in preparing the adjusting entries for Oceanside Realty: Fees accrued but unbilled at May 31 are $19,750. The supplies account balance on May 31 is $12,300. The supplies on hand at May 31 are $4,150. Wages accrued but not paid at May 31 are $2,700. The unearned rent account balance at May 31 is $9,000, representing the receipt of an advance payment on May 1 of three months' rent from tenant Depreciation of office equipment is $3,200. . Required: 1. Journalize the adjusting entries required at May 31. If an amount box does not require an entry, leave it blank. May 31 31 31 31 0 31 1. Journalize the adjusting entries required at May 31. If an amount box does not require an entry, leave it blank. May 31 31 31 II III II II II II I. 31 31 2. What is the difference between adjusting entries and correcting entries? a. Both adjusting entries and correcting entries are a planned part of the accounting process. b. Adjusting entries are a planned part of the accounting process, correcting entries are not planned but arise when necessary to correct errors c. Both adjusting entries and correcting entries are not a planned part of the accounting process. d. Correcting entries are a planned part of the accounting process, adjusting entries are not planned but arise when necessary to adjust errors. Reece Financial Services Co. Unadjusted Trial Balance July 31, 2016 Debit Balances Credit Balances Cash 10,200 Accounts Receivable 34,750 Prepaid Insurance 6,000 Supplies 1,725 Land 50,000 Building 155,750 62,850 45,000 Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Rent 17,650 3,750 3,600 153,550 Joni Reece, Capital Joni Reece, Drawing 8,000 Fees Earned 158.600 Salaries and Wages Expense 56,850 14,100 7,500 Utilities Expense Advertising Expense Repairs Expense Miscellaneous Expense 6,100 4,025 400,000 400,000 The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, $6,400. Depreciation of equipment for the year, $2,800. Accrued salaries and wages at July 31, $900. Unexpired insurance at July 31, $1,500. Fees earned but unbilled on July 31, $10,200. Supplies on hand at July 31, $615. Rent unearned at July 31, $300. 20Y6 July 31 31 31 31 31 31 31